Oregon Form 41 2020

What is the Oregon Form 41

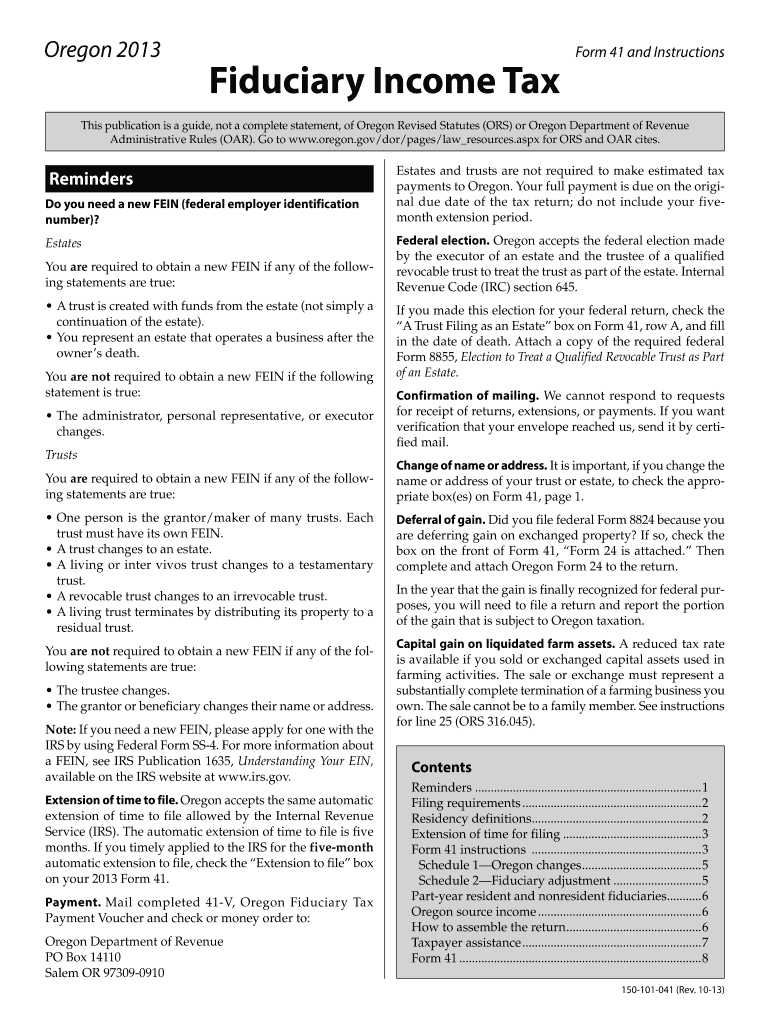

The Oregon Form 41 is a tax return form specifically designed for corporations operating within the state of Oregon. This form is utilized by both C corporations and S corporations to report their income, deductions, and tax liability to the Oregon Department of Revenue. It is essential for maintaining compliance with state tax regulations and ensuring accurate reporting of corporate financial activities.

How to use the Oregon Form 41

Using the Oregon Form 41 involves several steps to ensure that the information provided is accurate and complete. Corporations must gather their financial data, including income statements and expense reports, before filling out the form. The form requires detailed information about the corporation's revenue, deductions, and any applicable credits. Once completed, the form must be filed with the Oregon Department of Revenue by the designated deadline to avoid penalties.

Steps to complete the Oregon Form 41

Completing the Oregon Form 41 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the corporation's identifying information, including the name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions accurately.

- Calculate the corporation's taxable income and applicable tax credits.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the Oregon Department of Revenue.

Legal use of the Oregon Form 41

The Oregon Form 41 is legally binding and must be completed in accordance with state tax laws. Corporations are required to file this form annually, and failure to do so can result in penalties and interest on unpaid taxes. It is crucial for corporations to ensure that all information is accurate and submitted by the deadline to maintain compliance with Oregon tax regulations.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines associated with the Oregon Form 41. The standard due date for filing is typically the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by April 15. Extensions may be available, but they must be requested in advance to avoid penalties.

Required Documents

To successfully complete the Oregon Form 41, corporations need to gather several key documents, including:

- Income statements detailing all sources of revenue.

- Expense reports outlining deductible business expenses.

- Prior year tax returns for reference.

- Any relevant documentation supporting tax credits claimed.

Form Submission Methods (Online / Mail / In-Person)

The Oregon Form 41 can be submitted through various methods. Corporations have the option to file the form electronically via the Oregon Department of Revenue's online portal, which is often the quickest method. Alternatively, the form can be printed and mailed to the appropriate address provided by the department. In-person submissions are generally not recommended due to potential delays and the convenience of electronic filing.

Quick guide on how to complete oregon form 41 2013

Effortlessly Prepare Oregon Form 41 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Oregon Form 41 on any device with airSlate SignNow mobile apps for Android or iOS and enhance any document-related process today.

How to Edit and eSign Oregon Form 41 with Ease

- Find Oregon Form 41 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the anxiety of lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Oregon Form 41 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon form 41 2013

Create this form in 5 minutes!

How to create an eSignature for the oregon form 41 2013

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Oregon Form 41 and why do I need it?

The Oregon Form 41 is a crucial tax return form for partnerships in Oregon, allowing businesses to report their income, deductions, and tax liabilities. Utilizing airSlate SignNow can simplify the process of preparing and submitting your Oregon Form 41, ensuring compliance and accuracy.

-

How does airSlate SignNow help with filing the Oregon Form 41?

airSlate SignNow provides a user-friendly platform for securely signing and managing documents, including the Oregon Form 41. With its eSignature capabilities, you can easily gather necessary approvals from partners, streamlining the filing process.

-

Is airSlate SignNow cost-effective for small businesses handling the Oregon Form 41?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses needing to file the Oregon Form 41. The platform ensures that you save both time and money when managing your tax documentation.

-

Can I integrate airSlate SignNow with other software for handling the Oregon Form 41?

Absolutely! airSlate SignNow seamlessly integrates with various tools and platforms, allowing you to efficiently manage workflows related to the Oregon Form 41. This enables better collaboration and document management for your business.

-

What features does airSlate SignNow offer for managing my Oregon Form 41?

airSlate SignNow provides essential features like eSigning, secure document storage, and template management that prove invaluable when dealing with the Oregon Form 41. These tools make it easier to prepare and submit your tax forms accurately.

-

How long does it take to complete the Oregon Form 41 using airSlate SignNow?

The time to complete the Oregon Form 41 using airSlate SignNow can vary depending on your business's complexity. However, with its intuitive interface and efficient tools, you can typically prepare and process the form quicker than traditional methods.

-

Are there any security measures in place when using airSlate SignNow for Oregon Form 41?

Yes, airSlate SignNow prioritizes security with features like end-to-end encryption and secure document storage, ensuring your Oregon Form 41 and sensitive data are protected. You can trust that your information is kept confidential.

Get more for Oregon Form 41

Find out other Oregon Form 41

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast