10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return is Due April 15, Michigan 2020

What is the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan

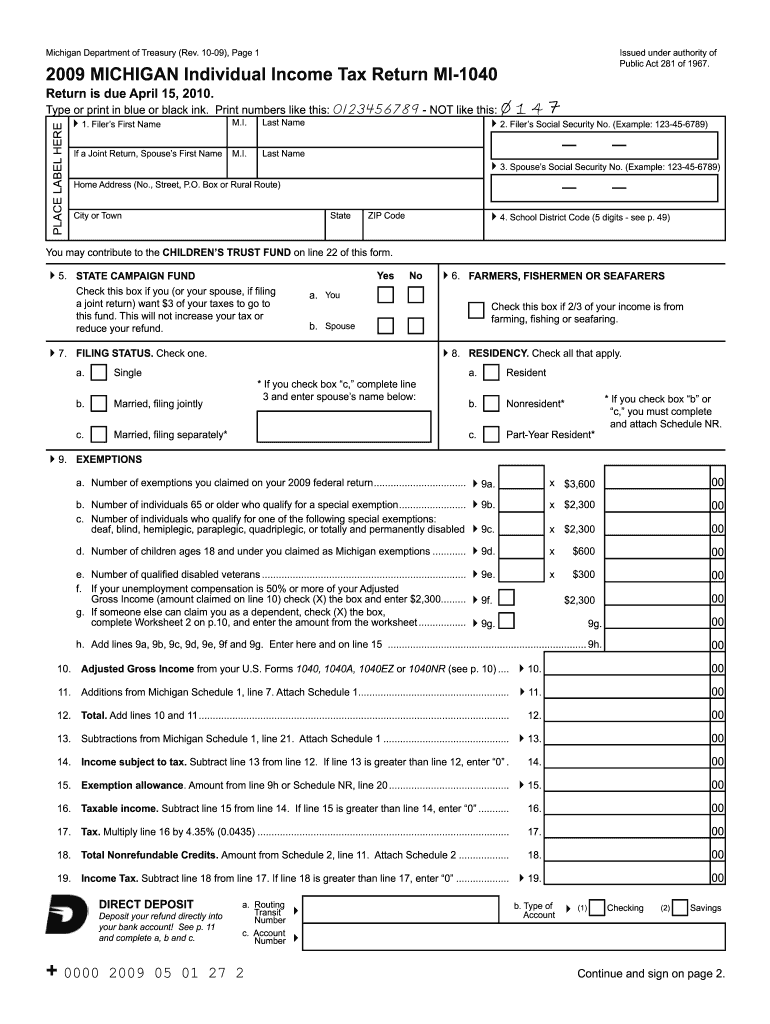

The 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 is a state-specific tax form used by residents of Michigan to report their individual income for the tax year. This form is essential for calculating the amount of state income tax owed or the refund due to the taxpayer. It is important to note that the return is due on April 15, aligning with the federal tax filing deadline. Understanding this form is crucial for compliance with Michigan tax laws and ensuring that all income is accurately reported.

Steps to complete the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan

Completing the 10 09, Page 1 MICHIGAN Individual Income Tax Return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, dividends, and any other sources of income.

- Calculate your deductions and credits to determine your taxable income.

- Compute the tax owed or refund due based on the state tax tables.

- Sign and date the form, ensuring that all information is accurate.

Legal use of the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan

The legal use of the 10 09, Page 1 MICHIGAN Individual Income Tax Return is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the April 15 deadline. E-signatures are accepted, provided they comply with Michigan's eSignature laws. This ensures that the form is legally binding and can be used in any legal proceedings if necessary. It is important for taxpayers to retain a copy of the submitted form for their records.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the 10 09, Page 1 MICHIGAN Individual Income Tax Return. The primary deadline for filing the return is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should note that extensions for filing may be available, but any taxes owed must still be paid by the original due date to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The 10 09, Page 1 MICHIGAN Individual Income Tax Return can be submitted through various methods:

- Online: Taxpayers can e-file the form using approved tax software or through the Michigan Department of Treasury's website.

- Mail: Completed forms can be sent to the appropriate address provided by the Michigan Department of Treasury.

- In-Person: Taxpayers may also submit their forms at designated state tax offices, though this option may vary by location.

Key elements of the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan

Key elements of the 10 09, Page 1 MICHIGAN Individual Income Tax Return include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources.

- Deductions: Standard or itemized deductions that reduce taxable income.

- Tax Calculation: The application of tax rates to determine the amount owed.

- Signature: Required for the form to be valid.

Quick guide on how to complete 10 09 page 1 2009 michigan individual income tax return mi 1040 return is due april 15 2010 michigan

Complete 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan without hassle

- Obtain 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 10 09 page 1 2009 michigan individual income tax return mi 1040 return is due april 15 2010 michigan

Create this form in 5 minutes!

How to create an eSignature for the 10 09 page 1 2009 michigan individual income tax return mi 1040 return is due april 15 2010 michigan

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return?

The 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return is the official form that Michigan residents must complete to report their income and calculate their tax liability for the year. It is crucial to fill this form accurately to comply with state tax laws and ensure timely filing.

-

When is the due date for the MI 1040 Return?

The MI 1040 Return is due on April 15 each year, which is the same deadline as the federal tax return. Make sure to submit your 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return on or before this date to avoid penalties and interest.

-

How can airSlate SignNow help with the MI 1040 Return process?

airSlate SignNow streamlines the process of sending and eSigning your 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return. With our easy-to-use platform, you can quickly prepare, send, and securely sign your tax documents within minutes, ensuring a hassle-free tax filing experience.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers cost-effective pricing plans tailored to fit different business needs. Our flexible subscription options ensure that you get access to the tools necessary for managing your 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return efficiently and affordably.

-

Are there any features that specifically support tax document handling?

Yes, airSlate SignNow provides features specifically designed for tax documents, including templates, reminders, and secure storage. These tools are particularly useful for handling documents like the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return, making your tax filing seamless and organized.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow offers robust integrations with various accounting and tax software, which can enhance your experience while preparing the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return. This allows you to import and export data seamlessly, ensuring accuracy and efficiency.

-

Is it possible to track the status of my 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return using airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your sent documents, including the 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return. Our platform provides notifications when documents are viewed and signed, keeping you updated throughout the process.

Get more for 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan

Find out other 10 09, Page 1 MICHIGAN Individual Income Tax Return MI 1040 Return Is Due April 15, Michigan

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement