Gr 1040nr 2020

What is the GR 1040NR?

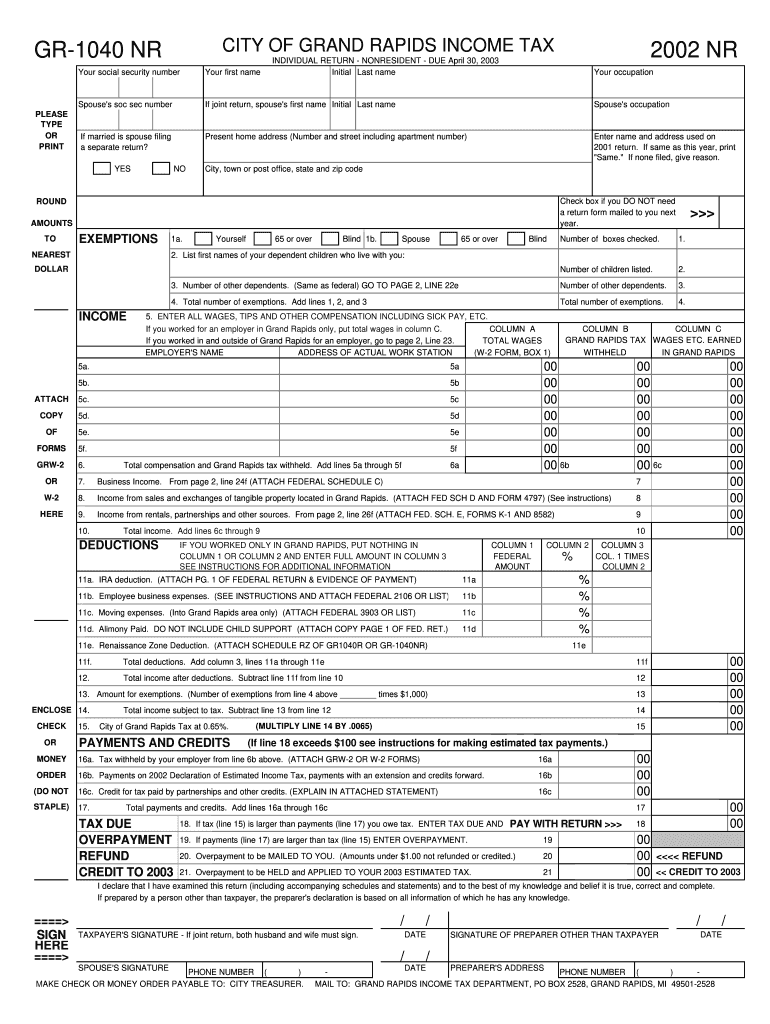

The GR 1040NR is a tax form specifically designed for non-resident aliens in the United States. This form allows individuals who do not meet the criteria for residency to report their income effectively to the Internal Revenue Service (IRS). Non-resident aliens must use this form to ensure compliance with U.S. tax laws when they earn income from U.S. sources. Understanding the GR 1040NR is essential for non-residents to fulfill their tax obligations while avoiding potential penalties.

How to Use the GR 1040NR

Using the GR 1040NR involves several steps to ensure accurate reporting of income. First, gather all necessary documentation, including income statements and any relevant tax treaties that may apply. Next, complete the form by providing personal information, such as your name, address, and taxpayer identification number. It is crucial to report all income earned from U.S. sources accurately. After filling out the form, review it for accuracy before submitting it to the IRS. Utilizing digital tools can simplify this process, ensuring that the form is filled out correctly and securely.

Steps to Complete the GR 1040NR

Completing the GR 1040NR requires careful attention to detail. Follow these steps for a successful submission:

- Gather all required documents, including W-2 forms and 1099s.

- Determine your filing status and the income you need to report.

- Fill out the personal information section accurately.

- Report all applicable income, including wages, interest, and dividends.

- Claim any deductions or credits for which you are eligible.

- Review the completed form for errors or omissions.

- Submit the GR 1040NR electronically or by mail, following IRS guidelines.

Legal Use of the GR 1040NR

The legal use of the GR 1040NR is governed by U.S. tax laws, which require non-resident aliens to report their income accurately. To ensure that the form is legally binding, it is essential to comply with the IRS regulations regarding eSignatures and digital submissions. Using a reliable eSignature platform can provide the necessary legal framework to validate the submission of the GR 1040NR, ensuring that it meets the requirements set forth by the IRS and other regulatory bodies.

Filing Deadlines / Important Dates

Filing deadlines for the GR 1040NR are critical for compliance. Generally, non-resident aliens must submit their tax returns by April fifteenth of the year following the tax year in question. If you are unable to file by this deadline, you may request an extension, which typically allows an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these dates is essential for successful tax filing.

Form Submission Methods (Online / Mail / In-Person)

The GR 1040NR can be submitted through various methods, providing flexibility for non-resident aliens. The form can be filed electronically using approved e-filing software, which simplifies the submission process and ensures accuracy. Alternatively, you can mail a paper version of the form to the appropriate IRS address. In-person submissions are less common but may be available at certain IRS offices. Each method has its advantages, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete gr 1040nr

Effortlessly Prepare Gr 1040nr on Any Gadget

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle Gr 1040nr on any device with airSlate SignNow’s applications for Android or iOS and enhance any document-related workflow today.

How to Edit and Electronically Sign Gr 1040nr with Ease

- Locate Gr 1040nr and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Gr 1040nr to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gr 1040nr

Create this form in 5 minutes!

How to create an eSignature for the gr 1040nr

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the gr 1040nr form and who needs to file it?

The gr 1040nr form is a tax return specifically for non-resident aliens in the United States. Individuals who have income from U.S. sources and meet certain other conditions are required to file this form. Understanding the requirements of the gr 1040nr helps ensure compliance and avoid penalties.

-

How does airSlate SignNow assist with the gr 1040nr preparation process?

AirSlate SignNow streamlines the gr 1040nr preparation process by providing an intuitive platform for sending and eSigning documents. This ensures that all necessary forms, including the gr 1040nr, are completed accurately and efficiently. Our solution simplifies the workflow, making tax season less stressful.

-

What are the pricing options for airSlate SignNow regarding the gr 1040nr service?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring that filing the gr 1040nr is cost-effective. Customers can choose from various subscription levels depending on the volume of documents they need to manage. This way, you can access essential tools without overspending.

-

What features make airSlate SignNow ideal for managing the gr 1040nr process?

AirSlate SignNow provides features such as templates, automated workflows, and secure storage, all of which are vital for managing the gr 1040nr process. The ability to track document status in real-time ensures that important tax documents are not lost or delayed. These functionalities enhance the overall efficiency of tax management.

-

Are there integration options available for airSlate SignNow in relation to the gr 1040nr?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing the process of preparing the gr 1040nr. This integration helps automate data transfer, reducing the risk of errors typically associated with manual entry. Such compatibility streamlines your document management and filing processes.

-

What benefits can businesses expect using airSlate SignNow for the gr 1040nr?

By using airSlate SignNow for the gr 1040nr, businesses can expect increased efficiency and reduced turnaround times. The platform's user-friendly interface allows for easy document handling, ensuring that tax obligations are met on time. Additionally, the enhanced security features protect sensitive information effectively.

-

Is there customer support available for airSlate SignNow users dealing with the gr 1040nr?

Absolutely, airSlate SignNow offers dedicated customer support for users requiring assistance with the gr 1040nr. Our knowledgeable team is readily available to provide guidance and answer any inquiries. This support ensures that users can navigate the tax preparation process confidently.

Get more for Gr 1040nr

Find out other Gr 1040nr

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online