Instructions for Form 6385, Tax Attributes Carryovers Alaska 2019

What is the Instructions For Form 6385, Tax Attributes Carryovers Alaska

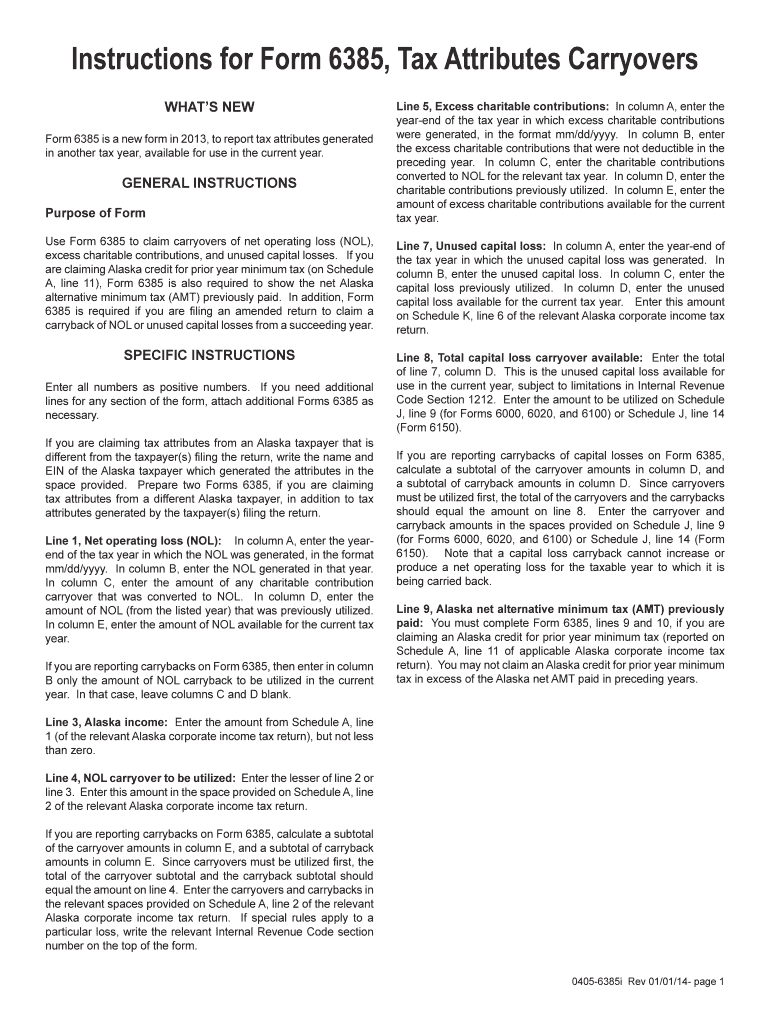

The Instructions for Form 6385, Tax Attributes Carryovers Alaska, provide essential guidance for taxpayers in Alaska regarding the carryover of tax attributes. This form is primarily used to report certain tax attributes that may be carried forward or back to other tax years. Understanding these instructions is crucial for ensuring compliance with federal tax regulations and accurately reflecting any carryover amounts on tax returns.

Steps to complete the Instructions For Form 6385, Tax Attributes Carryovers Alaska

Completing Form 6385 involves several key steps:

- Gather necessary documentation, including prior year tax returns and any relevant financial statements.

- Review the instructions carefully to understand the specific tax attributes applicable to your situation.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check your entries for accuracy and completeness before submission.

- Submit the form electronically or via mail, as per the guidelines provided in the instructions.

Legal use of the Instructions For Form 6385, Tax Attributes Carryovers Alaska

The legal use of the Instructions for Form 6385 is grounded in compliance with IRS regulations. When filled out correctly, this form serves as a legally binding document that can affect your tax liabilities. It is essential to ensure that all information is accurate and supported by appropriate documentation to avoid potential legal issues or penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 6385 are typically aligned with the standard tax return deadlines. Taxpayers should be aware of the following important dates:

- The annual tax return filing deadline, usually April 15, unless extended.

- Any specific deadlines related to the carryover of tax attributes, as outlined in the IRS guidelines.

Key elements of the Instructions For Form 6385, Tax Attributes Carryovers Alaska

Key elements of the Instructions for Form 6385 include:

- Detailed explanations of various tax attributes that can be carried over.

- Guidelines for calculating carryover amounts accurately.

- Specific instructions for reporting these amounts on your tax return.

- Information on how to handle any adjustments or corrections to previously reported attributes.

Examples of using the Instructions For Form 6385, Tax Attributes Carryovers Alaska

Examples of using the Instructions for Form 6385 can help clarify its application. For instance, a taxpayer who has a net operating loss in one tax year may use the instructions to determine how much of that loss can be carried forward to offset income in future years. Additionally, taxpayers may reference examples provided in the instructions to understand how to report specific carryover amounts accurately.

Quick guide on how to complete instructions for form 6385 tax attributes carryovers alaska

Complete Instructions For Form 6385, Tax Attributes Carryovers Alaska effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Instructions For Form 6385, Tax Attributes Carryovers Alaska on any platform using airSlate SignNow Android or iOS applications and simplify your document-based processes today.

How to modify and electronically sign Instructions For Form 6385, Tax Attributes Carryovers Alaska with ease

- Find Instructions For Form 6385, Tax Attributes Carryovers Alaska and click Get Form to get started.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Instructions For Form 6385, Tax Attributes Carryovers Alaska while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 6385 tax attributes carryovers alaska

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 6385 tax attributes carryovers alaska

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What are the Instructions For Form 6385, Tax Attributes Carryovers Alaska?

The Instructions For Form 6385, Tax Attributes Carryovers Alaska, are guidelines provided by the IRS specifically for taxpayers in Alaska who need to report carryovers of tax attributes. These instructions help ensure that taxpayers accurately calculate and report any tax benefits from previous years. Understanding these instructions is vital for compliance and maximizing tax credits.

-

How can airSlate SignNow assist with completing Form 6385?

airSlate SignNow simplifies the process of completing Form 6385 by providing easy-to-use document management tools, ensuring you can fill out and sign the form electronically. Our platform allows you to organize financial documents securely and collaborate with tax professionals seamlessly. Using airSlate SignNow means less hassle and more efficient completion of the Instructions For Form 6385, Tax Attributes Carryovers Alaska.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, electronic signatures, and cloud storage, all aimed at enhancing your document management experience. With our platform, you can easily create and share documents, ensuring you adhere to the Instructions For Form 6385, Tax Attributes Carryovers Alaska. Additionally, our features help in reducing paper usage and streamlining the workflow.

-

Is airSlate SignNow cost-effective for small businesses filing Form 6385?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses needing assistance with documents like Form 6385. Our pricing plans are competitive, making it accessible for businesses of all sizes. By utilizing our platform, small businesses can reduce costs associated with traditional document processes while ensuring compliance with the Instructions For Form 6385, Tax Attributes Carryovers Alaska.

-

Can I integrate airSlate SignNow with other software for better workflow?

Absolutely! airSlate SignNow can integrate with various software applications to enhance your document processing workflow. Whether you're using accounting software or project management tools, we offer seamless integrations to ensure everything works together efficiently. This interoperability supports users in handling the Instructions For Form 6385, Tax Attributes Carryovers Alaska smoothly.

-

What benefits can I expect from using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation provides numerous benefits, including increased efficiency, reduced errors, and improved collaboration. Our platform allows for fast electronic signatures and easy document sharing, which signNowly speeds up the filing process. This efficiency is especially valuable when adhering to the Instructions For Form 6385, Tax Attributes Carryovers Alaska.

-

How secure is my information when using airSlate SignNow?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards to protect your sensitive information. We understand the importance of confidentiality, especially when dealing with documents like Form 6385. You can trust that your data remains secure while you follow the Instructions For Form 6385, Tax Attributes Carryovers Alaska.

Get more for Instructions For Form 6385, Tax Attributes Carryovers Alaska

Find out other Instructions For Form 6385, Tax Attributes Carryovers Alaska

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form