Online Ftb State of Ca Schedule K 1 for S Corp Form 2019

What is the Online Ftb State Of Ca Schedule K 1 For S Corp Form

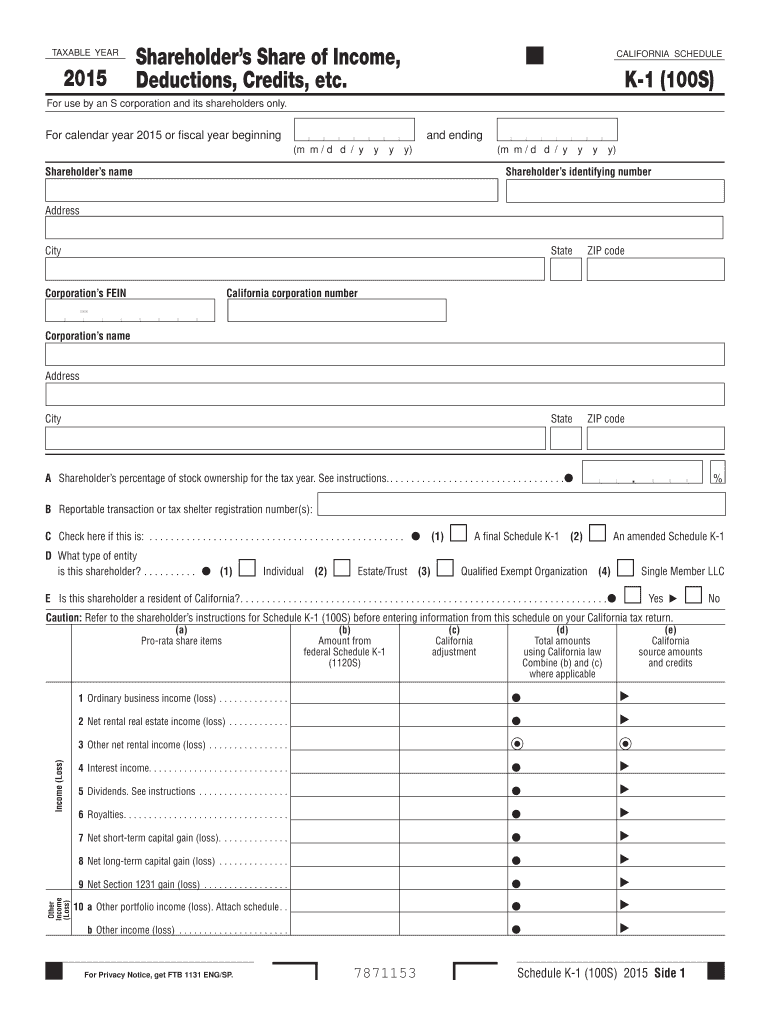

The Online Ftb State Of Ca Schedule K-1 for S Corporation is a tax form used in California to report income, deductions, and credits for shareholders of S Corporations. This form provides detailed information about each shareholder's share of the corporation's income or loss, which is essential for individual tax returns. The Schedule K-1 is crucial for ensuring that shareholders accurately report their earnings and comply with state tax regulations.

How to use the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Using the Online Ftb State Of Ca Schedule K-1 for S Corporation involves several steps. First, shareholders need to access the form through the California Franchise Tax Board's website. Once the form is opened, shareholders should fill in their personal information, including their name, address, and taxpayer identification number. Next, they must enter the specific amounts related to their share of the S Corporation's income, deductions, and credits as provided by the corporation. After completing the form, shareholders can submit it electronically or print it for their records.

Steps to complete the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Completing the Online Ftb State Of Ca Schedule K-1 for S Corporation involves the following steps:

- Access the form on the California Franchise Tax Board website.

- Enter your personal information, including name and address.

- Fill in your taxpayer identification number.

- Input the income, deductions, and credits as reported by the S Corporation.

- Review the information for accuracy.

- Submit the form electronically or print it for your records.

Legal use of the Online Ftb State Of Ca Schedule K 1 For S Corp Form

The Online Ftb State Of Ca Schedule K-1 for S Corporation is legally binding when completed accurately and submitted in accordance with California tax laws. It is essential for shareholders to ensure that the information reported is correct to avoid potential penalties or legal issues. The form must be filed with the California Franchise Tax Board and is used by shareholders to report income on their personal tax returns. Compliance with the relevant tax regulations is critical for maintaining the legal validity of the form.

Key elements of the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Key elements of the Online Ftb State Of Ca Schedule K-1 for S Corporation include:

- Shareholder's name and address.

- Shareholder's taxpayer identification number.

- Details of the S Corporation's income, deductions, and credits.

- Percentage of ownership in the corporation.

- Signature of an authorized representative of the S Corporation.

Filing Deadlines / Important Dates

Filing deadlines for the Online Ftb State Of Ca Schedule K-1 for S Corporation are typically aligned with the tax return deadlines for S Corporations. Generally, S Corporations must file their tax returns by the fifteenth day of the third month after the end of their fiscal year. For most corporations operating on a calendar year, this means the deadline is March 15. Shareholders should receive their Schedule K-1 forms by this date to ensure timely filing of their personal tax returns.

Quick guide on how to complete online ftb state of ca schedule k 1 for s corp 2015 form

Complete Online Ftb State Of Ca Schedule K 1 For S Corp Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without interruptions. Handle Online Ftb State Of Ca Schedule K 1 For S Corp Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The simplest way to modify and eSign Online Ftb State Of Ca Schedule K 1 For S Corp Form with ease

- Locate Online Ftb State Of Ca Schedule K 1 For S Corp Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your adjustments.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Online Ftb State Of Ca Schedule K 1 For S Corp Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct online ftb state of ca schedule k 1 for s corp 2015 form

Create this form in 5 minutes!

How to create an eSignature for the online ftb state of ca schedule k 1 for s corp 2015 form

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

The Online Ftb State Of Ca Schedule K 1 For S Corp Form is a tax document that S Corporations in California must file to report income, deductions, and credits to their shareholders. This form provides essential information needed for shareholders to complete their personal tax returns. By using airSlate SignNow, you can easily create, send, and eSign this important document efficiently.

-

How can I fill out the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Filling out the Online Ftb State Of Ca Schedule K 1 For S Corp Form is simple with airSlate SignNow. Our platform allows you to input the required data directly into the digital form, making the process quick and straightforward. Once completed, you can eSign and send the form to your shareholders directly from the platform.

-

Is airSlate SignNow cost-effective for managing the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Online Ftb State Of Ca Schedule K 1 For S Corp Form. With flexible pricing plans, you can choose a subscription that fits your budget while benefiting from an array of features designed to streamline your document handling processes. Save time and reduce costs with our easy-to-use platform.

-

What features does airSlate SignNow offer for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

airSlate SignNow offers a variety of features to assist with the Online Ftb State Of Ca Schedule K 1 For S Corp Form, including customizable templates, cloud storage, and secure eSignature capabilities. These features ensure that your document handling process is efficient and secure while allowing you to manage multiple forms effortlessly. You can also track the status of your documents in real time.

-

Can I integrate airSlate SignNow with my existing software for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various software applications, enhancing your workflow for managing the Online Ftb State Of Ca Schedule K 1 For S Corp Form. By integrating with your existing tools, you can streamline document management and ensure a cohesive process across your operations.

-

What are the benefits of using airSlate SignNow for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Using airSlate SignNow for the Online Ftb State Of Ca Schedule K 1 For S Corp Form presents numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our solution allows for quick sharing and eSigning, which accelerates the completion of your tax requirements. Additionally, it helps maintain compliance with state regulations.

-

How secure is airSlate SignNow when handling the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Security is a top priority at airSlate SignNow. When handling the Online Ftb State Of Ca Schedule K 1 For S Corp Form, your documents are protected with encryption and multiple security measures to ensure data integrity and privacy. You can confidently manage sensitive tax documents knowing they are safeguarded against unauthorized access.

Get more for Online Ftb State Of Ca Schedule K 1 For S Corp Form

Find out other Online Ftb State Of Ca Schedule K 1 For S Corp Form

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement