740 V 2020

What is the 740 V

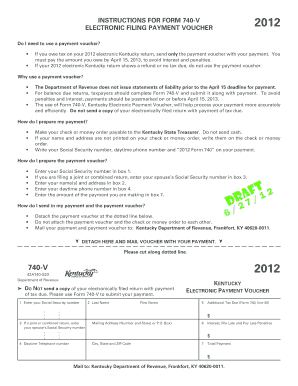

The 740 V is a specific tax form used in Kentucky for individuals seeking a refund of overpaid income tax. This form allows taxpayers to claim a refund based on their tax liability and is particularly relevant for those who have made estimated tax payments or had excess withholding. Understanding the purpose of the 740 V is essential for ensuring accurate tax filings and maximizing potential refunds.

How to use the 740 V

To effectively use the 740 V, taxpayers must first determine their eligibility for a refund. This involves reviewing their income tax payments and any applicable deductions. Once eligibility is confirmed, the form can be filled out with necessary personal information, including name, address, and Social Security number. It is crucial to provide accurate figures for income and tax payments to avoid delays in processing.

Steps to complete the 740 V

Completing the 740 V involves several key steps:

- Gather all relevant financial documents, including W-2s and 1099s.

- Calculate total income and any deductions or credits applicable to your situation.

- Fill out the 740 V form with accurate information, ensuring all entries are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate Kentucky state tax authority, either electronically or by mail.

Legal use of the 740 V

The 740 V is legally binding when filled out and submitted according to Kentucky tax law. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or delays in processing. Utilizing a reliable eSignature platform can enhance the legal validity of the form, ensuring compliance with relevant eSignature regulations.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the 740 V to avoid penalties. Generally, the form must be submitted by April 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended. Staying informed about these dates is crucial for timely submissions and securing potential refunds.

Required Documents

When completing the 740 V, several documents are necessary to ensure accurate filing. These include:

- W-2 forms from employers showing income and tax withheld.

- 1099 forms for any additional income sources.

- Records of estimated tax payments made throughout the year.

- Any relevant documentation for deductions or credits claimed.

Form Submission Methods

The 740 V can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Kentucky Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Quick guide on how to complete 740 v 6155198

Complete 740 V effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to obtain the appropriate form and securely maintain it online. airSlate SignNow provides you with all the resources required to create, adjust, and eSign your documents promptly without complications. Manage 740 V on any platform via airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to adjust and eSign 740 V with minimal effort

- Locate 740 V and then click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize crucial sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to preserve your modifications.

- Choose how you'd like to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form hunting, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Adjust and eSign 740 V to ensure outstanding communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 740 v 6155198

Create this form in 5 minutes!

How to create an eSignature for the 740 v 6155198

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the pricing structure for airSlate SignNow regarding the 740 v. feature?

The pricing for airSlate SignNow starts at a competitive rate, tailored to fit businesses of all sizes. All plans provide access to the 740 v. feature, ensuring efficient document signing without breaking the budget. Our subscription model allows you to choose the right plan based on your business needs.

-

How does the 740 v. feature enhance document signing?

The 740 v. feature is designed to streamline the document signing process by allowing users to eSign documents quickly and securely. This feature also offers audit trails and compliance measures to ensure all transactions are verified. By utilizing the 740 v. functionality, businesses can increase productivity and reduce turnaround times.

-

Can I integrate airSlate SignNow with other applications for the 740 v. feature?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing the usability of the 740 v. feature. Popular integrations include CRM systems, cloud storage services, and project management tools, allowing for more efficient document workflows. This connectivity helps you leverage the full potential of the 740 v. capabilities.

-

What are the benefits of using the 740 v. feature in my business?

Utilizing the 740 v. feature provides numerous benefits, including reduced paperwork and faster document processing times. This leads to improved customer satisfaction as clients can quickly review and sign documents online. Additionally, the 740 v. functionality emphasizes security, ensuring sensitive information is protected.

-

Is training available for businesses to effectively use the 740 v. feature?

Absolutely! airSlate SignNow provides comprehensive training resources for businesses to maximize their use of the 740 v. feature. This includes tutorials, webinars, and customer support, ensuring users feel confident in navigating the platform. We believe that proper training leads to successful implementation of the 740 v. advantages.

-

Can I customize the 740 v. feature according to my company's branding?

Yes, the 740 v. feature allows for customization to align with your company's branding. This includes options to add your logo, colors, and personalized messages in your documents. Customizing the experience not only elevates your brand but also increases trust with clients during the signing process.

-

Is there a limit to the number of documents I can send using the 740 v. feature?

No, with airSlate SignNow's 740 v. feature, there is no limit to the number of documents you can send for signing. Our plans are designed to support high-volume businesses, allowing you to send as many documents as needed without extra charges. This enhances your operational efficiency and supports your growth.

Get more for 740 V

Find out other 740 V

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure