Form it 205 TAllocation of Estimated Tax Payments to 2020

What is the Form IT 205 TAllocation Of Estimated Tax Payments To

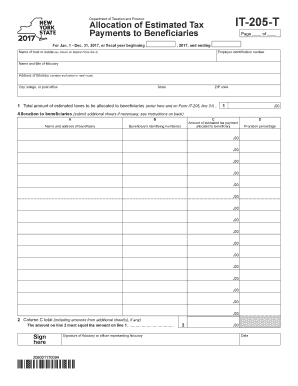

The Form IT 205 T is a tax form used in the United States for allocating estimated tax payments to specific tax years. This form is particularly relevant for individuals and businesses who need to report their estimated tax payments to the appropriate tax authorities. It ensures that the payments are properly credited against the taxpayer's liabilities for the designated years, helping to avoid any discrepancies during tax filing.

How to use the Form IT 205 TAllocation Of Estimated Tax Payments To

Using the Form IT 205 T involves several steps to ensure accurate completion and submission. First, gather all necessary financial information, including income sources and previous tax payments. Next, fill out the form by indicating the total estimated tax payments made and specifying the tax years to which these payments should be allocated. It is crucial to double-check the entries for accuracy before submission to avoid potential issues with the tax authorities.

Steps to complete the Form IT 205 TAllocation Of Estimated Tax Payments To

Completing the Form IT 205 T requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the relevant tax authority.

- Fill in your personal information, including your name, address, and Social Security number.

- List the total estimated tax payments made during the tax year.

- Allocate these payments to the appropriate tax years as needed.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Form IT 205 TAllocation Of Estimated Tax Payments To

The Form IT 205 T is legally recognized for allocating estimated tax payments, provided it is completed and submitted in accordance with tax regulations. Compliance with federal and state tax laws is essential to ensure that the form is valid. This includes accurate reporting of payment amounts and adherence to deadlines. Using a reliable eSignature solution can further enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 205 T are crucial to avoid penalties. Typically, the form must be submitted by the same deadlines as the estimated tax payments it reports. Taxpayers should keep track of quarterly deadlines to ensure timely filing. It is advisable to consult the tax authority's guidelines for specific dates, as these may vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 205 T can be submitted through various methods, including online, by mail, or in person. Online submission is often the fastest and most efficient method, allowing for immediate processing. For those who prefer traditional methods, mailing the completed form to the appropriate tax office is an option. In-person submissions may be available at designated tax offices, providing an opportunity for direct assistance if needed.

Quick guide on how to complete form it 205 t2017allocation of estimated tax payments to

Complete Form IT 205 TAllocation Of Estimated Tax Payments To effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and without complications. Manage Form IT 205 TAllocation Of Estimated Tax Payments To on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The most effective way to edit and eSign Form IT 205 TAllocation Of Estimated Tax Payments To with ease

- Locate Form IT 205 TAllocation Of Estimated Tax Payments To and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether it's via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of missing or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs within a few clicks from any device you choose. Edit and eSign Form IT 205 TAllocation Of Estimated Tax Payments To to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 t2017allocation of estimated tax payments to

Create this form in 5 minutes!

How to create an eSignature for the form it 205 t2017allocation of estimated tax payments to

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is Form IT 205 TAllocation Of Estimated Tax Payments To?

Form IT 205 TAllocation Of Estimated Tax Payments To is a tax form used in New York that allows individuals to allocate their estimated tax payments toward their tax liabilities. This form is essential for ensuring that taxpayers are properly distributing their estimated payments between various tax accounts, such as personal income tax and corporate tax.

-

How can airSlate SignNow help with Form IT 205 TAllocation Of Estimated Tax Payments To?

airSlate SignNow simplifies the process of preparing and signing Form IT 205 TAllocation Of Estimated Tax Payments To by providing an easy-to-use eSignature solution. With our platform, you can quickly fill out, sign, and send the form electronically, ensuring compliance and saving time.

-

Is there a cost associated with using airSlate SignNow for Form IT 205 TAllocation Of Estimated Tax Payments To?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a subscription that best fits your requirements, allowing you to efficiently manage the Form IT 205 TAllocation Of Estimated Tax Payments To and other document workflows without breaking the bank.

-

Can I integrate airSlate SignNow with other software to assist with Form IT 205 TAllocation Of Estimated Tax Payments To?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of software applications, enhancing your workflow when dealing with Form IT 205 TAllocation Of Estimated Tax Payments To. This means you can connect with tools like CRM systems, document storage services, and more for streamlined operations.

-

What features does airSlate SignNow offer for handling Form IT 205 TAllocation Of Estimated Tax Payments To?

airSlate SignNow includes various features such as document templates, automated reminders, and advanced security measures to protect your sensitive information. These tools are particularly useful when managing Form IT 205 TAllocation Of Estimated Tax Payments To, ensuring you stay organized and compliant.

-

How secure is my information when using airSlate SignNow for Form IT 205 TAllocation Of Estimated Tax Payments To?

Security is a top priority at airSlate SignNow. When working with Form IT 205 TAllocation Of Estimated Tax Payments To, your data is protected by high-level encryption and secure access controls, giving you peace of mind about your sensitive tax information.

-

Can I access Form IT 205 TAllocation Of Estimated Tax Payments To on my mobile device through airSlate SignNow?

Yes! airSlate SignNow is mobile-friendly, allowing you to access and manage Form IT 205 TAllocation Of Estimated Tax Payments To from your smartphone or tablet. This flexibility means you can handle your tax documents on-the-go, keeping your business running smoothly.

Get more for Form IT 205 TAllocation Of Estimated Tax Payments To

Find out other Form IT 205 TAllocation Of Estimated Tax Payments To

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA