Form 100 California Franchise Tax Board 2019

What is the Form 100 California Franchise Tax Board

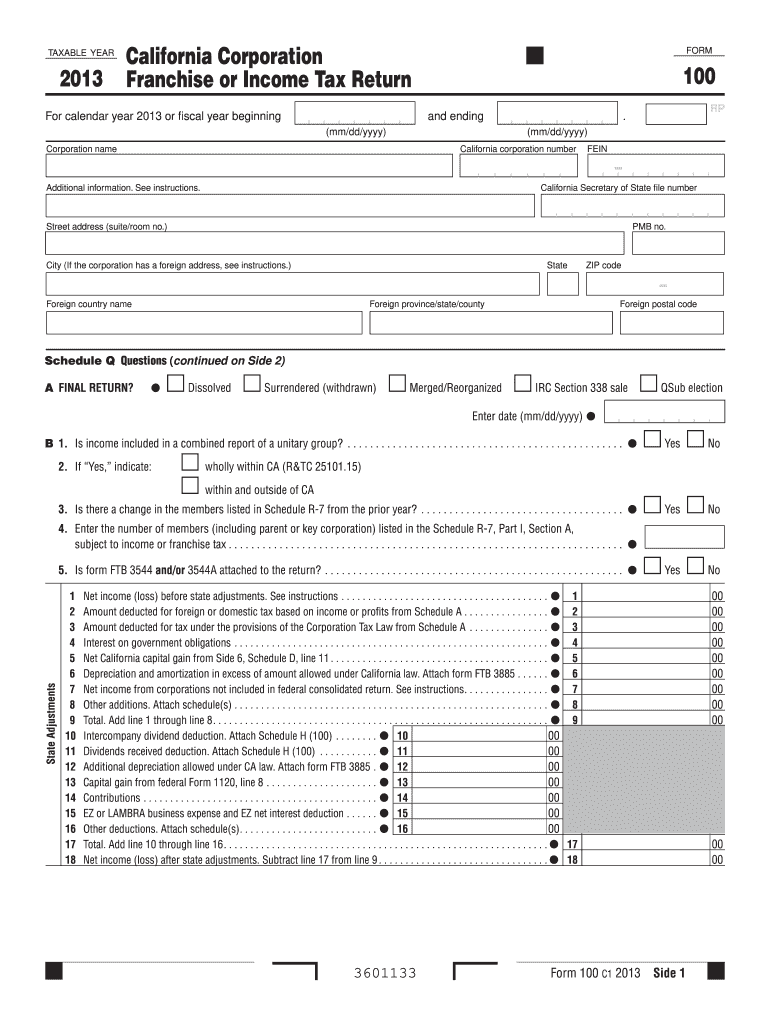

The Form 100 is a crucial document required by the California Franchise Tax Board (FTB) for corporations operating in California. This form is used to report income, calculate taxes owed, and ensure compliance with state tax laws. It is specifically designed for C corporations, which are taxed separately from their owners. Completing this form accurately is essential for maintaining good standing with the state and avoiding penalties.

Steps to complete the Form 100 California Franchise Tax Board

Completing the Form 100 involves several steps to ensure accurate reporting of your corporation's financial information. First, gather all necessary financial documents, including income statements, balance sheets, and any applicable deductions. Next, fill out the form with detailed information about your corporation's income, expenses, and tax credits. Be sure to double-check all entries for accuracy before submitting. Finally, sign and date the form, as an unsigned form may be considered invalid.

Filing Deadlines / Important Dates

Corporations must file the Form 100 by the 15th day of the third month after the close of their fiscal year. For most corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It's important to be aware of these dates to avoid late penalties and ensure timely compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 100 can be submitted through various methods to accommodate different preferences. Corporations may file the form electronically through the California Franchise Tax Board's online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate FTB address, ensuring it is postmarked by the deadline. For those who prefer in-person submissions, visiting a local FTB office is also an option, though appointments may be necessary.

Legal use of the Form 100 California Franchise Tax Board

The Form 100 serves as a legal document that must be completed and submitted in accordance with California tax laws. It is essential for corporations to understand that the information provided on this form can be subject to audits and reviews by the FTB. Therefore, accuracy and honesty in reporting are paramount to avoid legal repercussions. Utilizing reliable methods, such as e-signatures, can enhance the legal standing of the submitted form.

Key elements of the Form 100 California Franchise Tax Board

Several key elements must be included in the Form 100 to ensure it is complete and compliant. These include the corporation's name, address, and federal employer identification number (FEIN). Additionally, corporations must report total income, deductions, and tax credits. Understanding these elements is crucial for accurately calculating the tax liability and ensuring compliance with state regulations.

Required Documents

When filing the Form 100, corporations must provide supporting documentation to substantiate the information reported. This includes financial statements, receipts for deductions, and any relevant schedules that detail income sources. Having these documents ready can facilitate a smoother filing process and help ensure that the form is complete and accurate, reducing the risk of audits or penalties.

Quick guide on how to complete 2013 form 100 california franchise tax board

Prepare Form 100 California Franchise Tax Board effortlessly on any device

Online document administration has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Form 100 California Franchise Tax Board on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 100 California Franchise Tax Board without hassle

- Locate Form 100 California Franchise Tax Board and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 100 California Franchise Tax Board and guarantee clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 100 california franchise tax board

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 100 california franchise tax board

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Form 100 California Franchise Tax Board?

The Form 100 is the California Corporation Franchise or Income Tax Return, which must be filed by corporations doing business in California. This form is crucial for reporting a corporation's income, deductions, and credits to the California Franchise Tax Board. Proper submission is essential to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the Form 100 California Franchise Tax Board?

AirSlate SignNow streamlines the process of preparing and submitting the Form 100 California Franchise Tax Board by providing an easy-to-use platform for electronic signatures and document management. Businesses can easily create, share, and eSign their forms, ensuring a smooth and efficient filing process. This signNowly reduces paperwork and enhances compliance.

-

What are the pricing options for airSlate SignNow for Form 100 California Franchise Tax Board users?

AirSlate SignNow offers various pricing plans suitable for different business sizes and needs. Our plans are designed to be cost-effective while providing essential features for eSigning your Form 100 California Franchise Tax Board. You can choose from monthly or annual subscriptions, and we also offer a free trial to get started.

-

What features does airSlate SignNow offer for managing Form 100 California Franchise Tax Board submissions?

AirSlate SignNow provides several features that facilitate the management of your Form 100 California Franchise Tax Board submissions. These include customizable templates, secure electronic signatures, document tracking, and cloud storage. These tools enhance convenience and security, ensuring your documents are always accessible and compliant.

-

Is airSlate SignNow secure for submitting Form 100 California Franchise Tax Board documents?

Yes, airSlate SignNow prioritizes security and compliance when it comes to submitting the Form 100 California Franchise Tax Board. Our platform uses advanced encryption protocols, ensuring that your sensitive data is protected throughout the signing process. You can trust that your documents remain confidential and secure.

-

Can airSlate SignNow integrate with other software for Form 100 California Franchise Tax Board filings?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software that enhances your Form 100 California Franchise Tax Board filing process. This integration allows for smooth data transfer, reducing manual entry errors and saving time. Popular integrations include platforms like QuickBooks and Salesforce.

-

What are the benefits of using airSlate SignNow for Form 100 California Franchise Tax Board filings?

Using airSlate SignNow to file your Form 100 California Franchise Tax Board offers numerous benefits, including increased efficiency and reduced paperwork. The electronic signing process shortens the time it takes to obtain necessary signatures, while our document tracking feature keeps you informed of your submission status. Overall, it simplifies tax compliance for your business.

Get more for Form 100 California Franchise Tax Board

- English chest 3 student book pdf form

- Job safety analysis example form

- Birds job application form

- Mat 1 form

- Snap benefits application pdf form

- Bank guarantee renewal request letter format word

- The body project script peer leader universal 2 session version bodyprojectsupport form

- Desinfektionsplan fr kosmetik promed form

Find out other Form 100 California Franchise Tax Board

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure