K1 Form 2019

What is the K1 Form

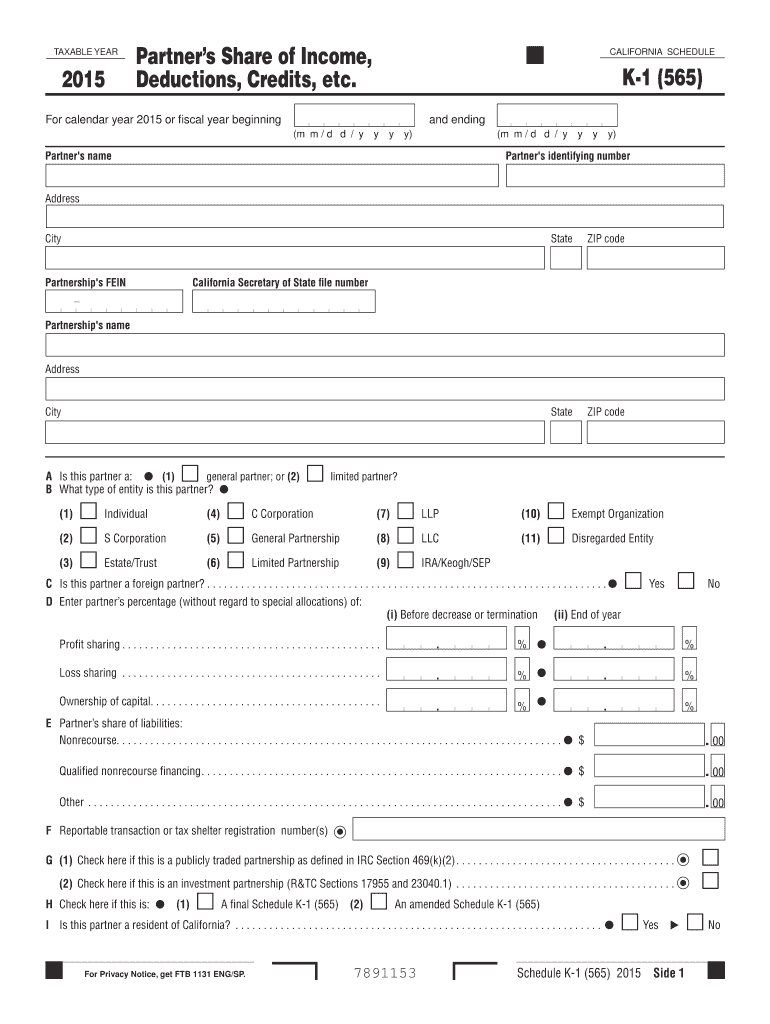

The K1 Form, officially known as Schedule K-1, is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it provides detailed information needed to accurately report their share of the income on their personal tax returns. The K1 Form helps ensure that all partners or shareholders are taxed appropriately based on their share of the entity's earnings.

How to use the K1 Form

Using the K1 Form involves several steps to ensure accurate reporting of income. First, recipients must receive the form from the partnership or S corporation, which outlines their share of profits, losses, and other tax attributes. Once received, individuals should carefully review the information for accuracy. The data reported on the K1 Form must then be transferred to the appropriate sections of the individual’s tax return, typically on Form 1040. It's important to consult IRS guidelines or a tax professional to ensure proper usage and compliance.

Steps to complete the K1 Form

Completing the K1 Form requires careful attention to detail. Here are the steps involved:

- Gather necessary financial documents, including partnership agreements and prior tax returns.

- Fill out the entity information section, including the name, address, and Employer Identification Number (EIN).

- Report the partner's or shareholder's information accurately, including their name, address, and tax identification number.

- Detail the income, deductions, and credits allocated to the partner or shareholder, ensuring all amounts are correct.

- Review the completed form for accuracy before submitting it to the IRS and providing copies to the partners or shareholders.

Legal use of the K1 Form

The K1 Form is legally binding when it is accurately completed and submitted according to IRS regulations. It serves as a formal declaration of income and tax obligations for individuals involved in partnerships or S corporations. To ensure legal compliance, it is crucial to adhere to all filing deadlines and provide accurate information. Failure to do so may result in penalties or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the K1 Form are critical for compliance. Generally, partnerships and S corporations must provide K1 Forms to their partners or shareholders by March 15 of each year. Recipients of the K1 Form must then report the information on their tax returns by the April 15 deadline. It is essential to keep track of these dates to avoid penalties and ensure timely tax reporting.

Who Issues the Form

The K1 Form is issued by partnerships and S corporations to their partners and shareholders. Each entity is responsible for preparing and distributing the form, ensuring that all required information is accurately reported. It is important for recipients to confirm receipt of their K1 Forms, as this document is necessary for completing their individual tax returns.

Quick guide on how to complete 2015 k1 form

Finish K1 Form effortlessly on any gadget

Online document management has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle K1 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to modify and electronically sign K1 Form without hassle

- Obtain K1 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any gadget you prefer. Adjust and electronically sign K1 Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 k1 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 k1 form

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a K1 Form and why is it important?

A K1 Form is a key document used in partnership taxation, providing essential details about income, deductions, and credits that partners must report on their tax returns. It's crucial for ensuring accurate income reporting, and using airSlate SignNow can streamline the process of distributing and signing these documents.

-

How does airSlate SignNow help with managing K1 Forms?

AirSlate SignNow simplifies the management of K1 Forms by allowing users to electronically sign and send documents securely. This enhances efficiency and ensures compliance, making the tax process less stressful for both individuals and businesses.

-

What features does airSlate SignNow offer for K1 Form management?

AirSlate SignNow offers features such as template creation, automated workflows, and real-time tracking of K1 Forms. These tools signNowly reduce the time spent on administrative tasks, allowing users to focus more on their core business activities.

-

Are there any integrations available for K1 Form processing with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting software and CRMs, making it easy to incorporate K1 Form management into your existing workflows. Integrations help improve data accuracy and enhance collaboration between teams.

-

What pricing options are available for using airSlate SignNow to handle K1 Forms?

AirSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes looking to manage K1 Forms efficiently. Each plan includes essential features, allowing you to choose the option that best fits your needs and budget.

-

Is it safe to eSign K1 Forms with airSlate SignNow?

Absolutely! AirSlate SignNow employs top-notch security measures, including encryption and secure storage, to ensure that your K1 Forms and sensitive data remain protected. You can eSign with confidence knowing that your documents are safe.

-

Can I track the status of my K1 Forms in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your K1 Forms in real-time. You will receive notifications when documents are opened, signed, or completed, giving you peace of mind and better control over your document management process.

Get more for K1 Form

Find out other K1 Form

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure