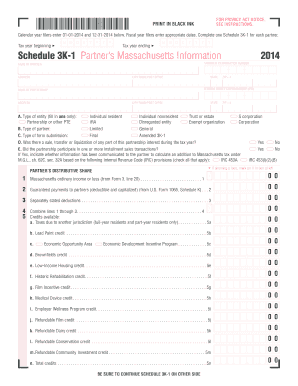

Fiscal Year Filers Enter Appropriate Dates Mass 2020

What is the Fiscal Year Filers Enter Appropriate Dates Mass

The Fiscal Year Filers Enter Appropriate Dates Mass form is a critical document used by businesses and organizations that operate on a fiscal year basis rather than a calendar year. This form allows entities to report their financial activities and ensure compliance with IRS regulations. It is essential for accurately reflecting the financial status of a business during its specified fiscal year, which may differ from the traditional January to December calendar year.

How to use the Fiscal Year Filers Enter Appropriate Dates Mass

To utilize the Fiscal Year Filers Enter Appropriate Dates Mass form effectively, filers must first gather all necessary financial data pertinent to their fiscal year. This includes income statements, balance sheets, and other financial documents. Once the information is compiled, the form can be filled out electronically or on paper. When completing the form, ensure all dates correspond to the fiscal year being reported, as accuracy is vital for compliance and audit purposes.

Steps to complete the Fiscal Year Filers Enter Appropriate Dates Mass

Completing the Fiscal Year Filers Enter Appropriate Dates Mass form involves several key steps:

- Gather necessary financial documents related to the fiscal year.

- Access the form through a reliable platform, such as signNow, for electronic completion.

- Fill out the form, ensuring all entries reflect the correct fiscal year dates.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, following the specific submission guidelines.

Legal use of the Fiscal Year Filers Enter Appropriate Dates Mass

The legal validity of the Fiscal Year Filers Enter Appropriate Dates Mass form hinges on compliance with established regulations. When completed electronically, it must adhere to the standards set forth by the ESIGN Act and UETA, ensuring that electronic signatures are recognized as legally binding. Utilizing a secure platform for eSigning helps maintain the integrity of the document and protects sensitive information.

Filing Deadlines / Important Dates

Filing deadlines for the Fiscal Year Filers Enter Appropriate Dates Mass form vary based on the fiscal year end. Generally, businesses must submit the form within a specific timeframe after the close of their fiscal year. It is crucial to be aware of these deadlines to avoid penalties and ensure timely compliance with IRS requirements. Keeping a calendar with important dates can aid in maintaining adherence to these deadlines.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Fiscal Year Filers Enter Appropriate Dates Mass form. These guidelines outline the necessary information to be included, acceptable filing methods, and the implications of non-compliance. Familiarizing oneself with these guidelines is essential for accurate reporting and avoiding potential issues with the IRS.

Quick guide on how to complete fiscal year filers enter appropriate dates mass

Effortlessly prepare Fiscal Year Filers Enter Appropriate Dates Mass on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct template and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Fiscal Year Filers Enter Appropriate Dates Mass on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Fiscal Year Filers Enter Appropriate Dates Mass effortlessly

- Find Fiscal Year Filers Enter Appropriate Dates Mass and then select Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Fiscal Year Filers Enter Appropriate Dates Mass and guarantee strong communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiscal year filers enter appropriate dates mass

Create this form in 5 minutes!

How to create an eSignature for the fiscal year filers enter appropriate dates mass

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What features does airSlate SignNow offer for fiscal year filers to ensure they enter appropriate dates in Mass.?

airSlate SignNow provides a comprehensive suite of features that simplify document management for fiscal year filers. Our platform allows users to easily customize templates, set reminders for important dates, and ensure compliance with state regulations. By doing so, fiscal year filers can effectively enter appropriate dates for their documents and maintain accuracy.

-

How does airSlate SignNow help fiscal year filers maintain compliance with date regulations in Mass.?

Compliance is crucial for fiscal year filers in Mass., and airSlate SignNow helps by enabling users to track and manage deadlines efficiently. The platform includes features like automated reminders and audit trails that keep all parties informed of necessary dates. This ensures that fiscal year filers can enter appropriate dates within compliance constraints seamlessly.

-

Is airSlate SignNow a cost-effective solution for businesses that need to enter appropriate dates for fiscal year filings in Mass.?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses, especially fiscal year filers in Mass. Our pricing plans are competitive and offer a variety of options depending on the size and needs of your organization. This affordability allows fiscal year filers to efficiently enter appropriate dates without straining their budgets.

-

Can airSlate SignNow integrate with other tools for fiscal year filers to manage their document dates in Mass.?

Absolutely! airSlate SignNow offers seamless integrations with popular tools like Google Drive, Salesforce, and other document management systems. This allows fiscal year filers to streamline their workflows and easily access the documents they need to input appropriate dates in Mass., enhancing productivity and collaboration.

-

What benefits does airSlate SignNow provide for fiscal year filers when managing their documents?

One of the main benefits of using airSlate SignNow for fiscal year filers is the ability to eSign documents quickly and securely. This digital approach not only saves time but also reduces the risk of errors when entering appropriate dates. Additionally, our platform ensures all documents are stored securely, making it easy for fiscal year filers to retrieve them whenever necessary.

-

How user-friendly is airSlate SignNow for fiscal year filers entering appropriate dates in Mass.?

airSlate SignNow is designed with user experience in mind, making it incredibly user-friendly for fiscal year filers. The intuitive interface allows users to navigate the platform easily, ensuring that even those with limited tech skills can effectively manage their documents and enter appropriate dates in Mass. with confidence.

-

What types of documents can fiscal year filers create and manage using airSlate SignNow?

Fiscal year filers can utilize airSlate SignNow to create and manage a wide range of documents, including contracts, tax forms, and agreements. Our platform is versatile, allowing users to customize documents to fit their specific needs. This flexibility facilitates the accurate entry of appropriate dates for all types of fiscal year filings in Mass.

Get more for Fiscal Year Filers Enter Appropriate Dates Mass

Find out other Fiscal Year Filers Enter Appropriate Dates Mass

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document