Rct 101 Form 2019

What is the Rct 101 Form

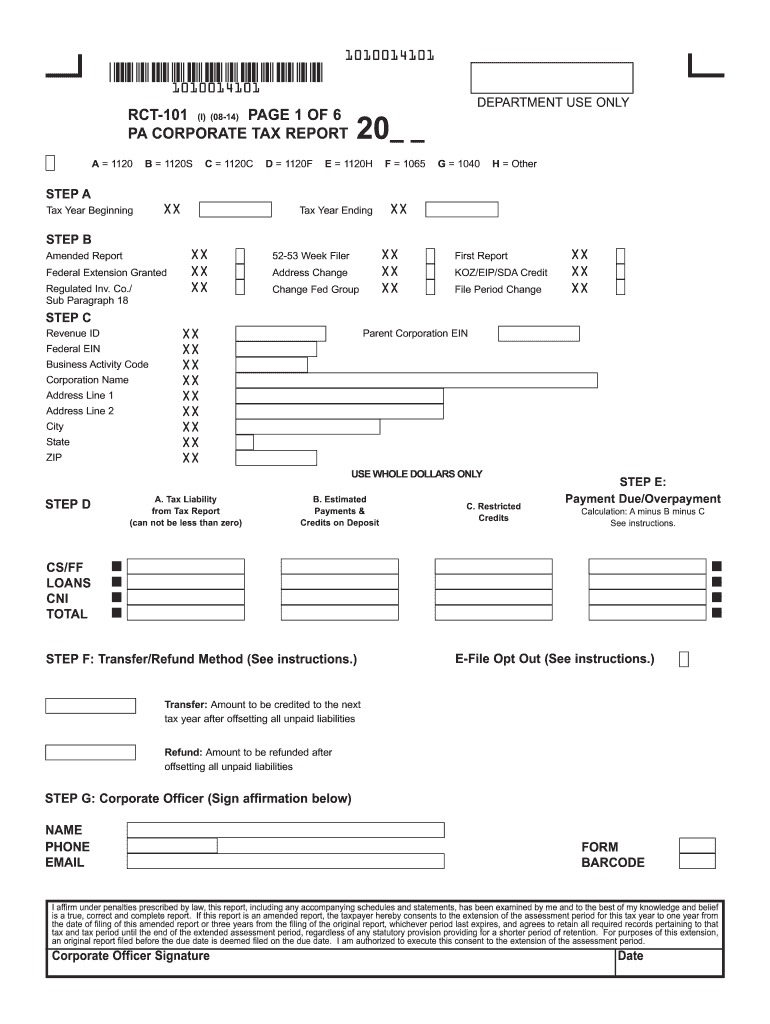

The Rct 101 Form is a tax document used primarily in the United States for reporting specific financial information to state tax authorities. This form is essential for businesses and individuals who need to declare their income, expenses, and other relevant financial activities. It serves as a formal declaration that helps ensure compliance with state tax laws and regulations. Understanding the purpose and requirements of the Rct 101 Form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Rct 101 Form

Using the Rct 101 Form involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, expense receipts, and any other relevant records. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay close attention to details, as inaccuracies can lead to delays or penalties. Once the form is completed, review it for any errors before submission. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Steps to complete the Rct 101 Form

Completing the Rct 101 Form involves a systematic approach to ensure all required information is accurately reported. Follow these steps:

- Gather Documentation: Collect all financial records, including income, expenses, and deductions.

- Fill Out the Form: Enter the required information, ensuring accuracy in all fields.

- Review for Errors: Double-check all entries for potential mistakes or omissions.

- Submit the Form: Send the completed form to the appropriate tax authority by the deadline.

Legal use of the Rct 101 Form

The Rct 101 Form is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions, including fines or audits. Adhering to the legal guidelines surrounding the use of this form helps maintain compliance with tax laws and protects individuals and businesses from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Rct 101 Form can vary based on state regulations and the type of entity submitting the form. It is crucial to be aware of these deadlines to avoid penalties. Typically, the form must be submitted annually, with specific due dates often falling on the same date each year. Marking these important dates on your calendar can help ensure timely submission and compliance with tax obligations.

Required Documents

To complete the Rct 101 Form, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s

- Receipts for business expenses

- Records of any deductions claimed

- Previous year’s tax returns for reference

Having these documents readily available can streamline the completion process and help ensure accuracy in reporting.

Who Issues the Form

The Rct 101 Form is issued by state tax authorities, which are responsible for collecting taxes and enforcing tax laws within their jurisdiction. Each state may have its own version of the form, tailored to meet specific regulatory requirements. It is important to obtain the correct version of the form from the appropriate state agency to ensure compliance with local tax regulations.

Quick guide on how to complete 2014 rct 101 form

Complete Rct 101 Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it on the internet. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without any delays. Handle Rct 101 Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Rct 101 Form without hassle

- Obtain Rct 101 Form and click Get Form to begin.

- Make use of the tools at your disposal to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details carefully and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it directly to your computer.

Stop worrying about lost or misplaced documents, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Rct 101 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 rct 101 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 rct 101 form

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Rct 101 Form used for?

The Rct 101 Form is a crucial document for businesses that need to report various tax-related information. It serves as a tool for submitting specific revenue details to tax authorities, streamlining your accounting process. Using airSlate SignNow, you can easily prepare and eSign the Rct 101 Form.

-

How does airSlate SignNow simplify the Rct 101 Form process?

airSlate SignNow simplifies the Rct 101 Form process by allowing users to create, send, and sign documents electronically. This eliminates the need for paper forms and enhances efficiency in managing and filing tax documents. With our platform, you can quickly access templates for the Rct 101 Form to expedite the process.

-

What are the pricing options for using airSlate SignNow to handle the Rct 101 Form?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. Each plan provides features tailored for efficient handling of the Rct 101 Form and other documents. You can choose from monthly or annual subscriptions to best fit your budget while keeping your document management costs low.

-

Are there any integration options available for the Rct 101 Form with airSlate SignNow?

Yes, airSlate SignNow provides numerous integration options that allow you to connect with popular business tools and platforms. This smooth integration helps automate the workflow surrounding the Rct 101 Form, ensuring that your tax documentation is handled within your existing systems. Our API capabilities further enhance these integrations.

-

Can I track changes made to the Rct 101 Form in airSlate SignNow?

Absolutely! airSlate SignNow offers a comprehensive tracking feature that monitors every change made to the Rct 101 Form. You’ll receive real-time notifications about document status, who signed, and when changes were executed, giving you full visibility into your document management process.

-

How secure is the management of the Rct 101 Form in airSlate SignNow?

airSlate SignNow prioritizes document security, especially for sensitive forms like the Rct 101 Form. We utilize advanced encryption methods and secure storage solutions to protect your information. Additionally, our platform complies with industry-standard security regulations to further safeguard your data.

-

What are the key benefits of using airSlate SignNow for the Rct 101 Form?

Using airSlate SignNow for the Rct 101 Form offers multiple benefits including rapid turnaround times, enhanced efficiency, and reduced manual errors. The electronic signing process accelerates approvals while offering a user-friendly experience. You can also centralize all your document management activities, aiding in better organization and compliance.

Get more for Rct 101 Form

- Scholastic credit card form

- Sett framework template form

- Ford reimbursement request form

- Pihkal traduit franais pdf form

- Bluecareplusotc com form

- City of rowlett building inspection form

- Texas voter registration application prescribed by the office of the secretary of state for official use only vr17 co cameron tx form

- Summons 20 day corporate service a general forms summons 20 day corporate service clkct 314

Find out other Rct 101 Form

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online