Pennsylvania Income Tax Return PA 40 Revenue Pa Gov 2019

What is the Pennsylvania Income Tax Return PA 40 Revenue pa gov

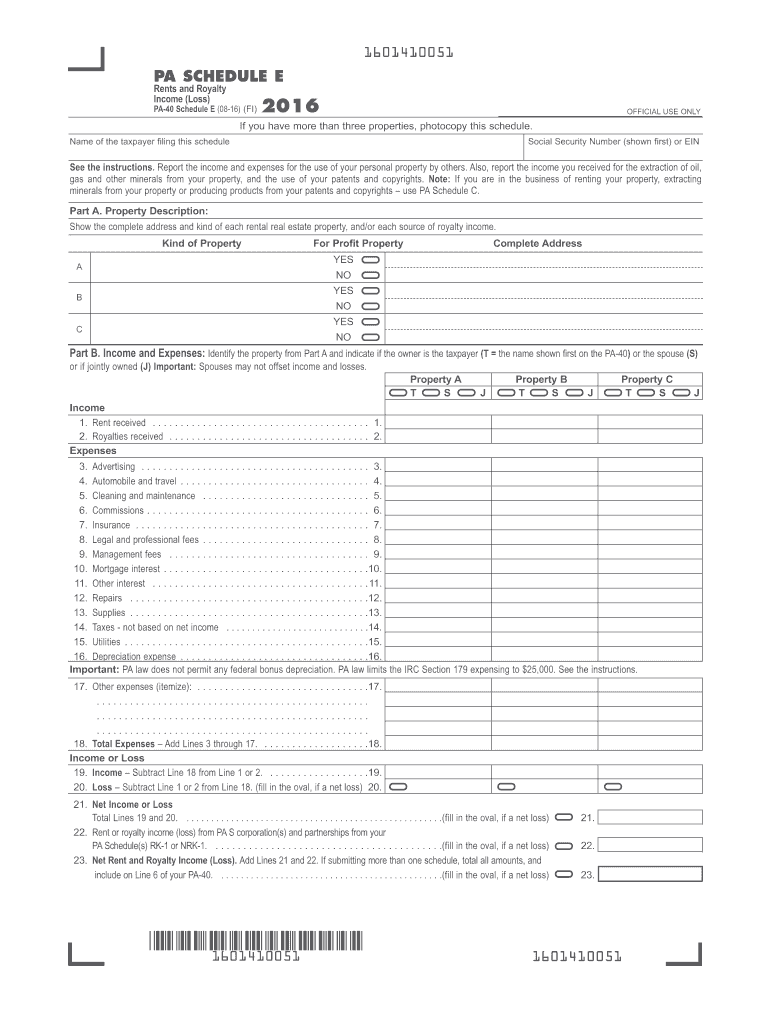

The Pennsylvania Income Tax Return PA 40 is the official form used by residents of Pennsylvania to report their income and calculate their state income tax liability. This form is essential for individuals earning income within the state and is a key component of the state's tax system. The PA 40 form collects various types of income, including wages, salaries, and business income, and allows taxpayers to claim deductions and credits applicable to their situation.

Steps to complete the Pennsylvania Income Tax Return PA 40 Revenue pa gov

Completing the Pennsylvania Income Tax Return PA 40 involves several steps to ensure accurate reporting of income and tax liability. Begin by gathering all necessary financial documents, including W-2 forms, 1099 forms, and any other income statements. Next, follow these steps:

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the appropriate sections of the form.

- Claim any deductions or credits for which you qualify.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submitting it.

How to obtain the Pennsylvania Income Tax Return PA 40 Revenue pa gov

The Pennsylvania Income Tax Return PA 40 can be obtained through various channels. Taxpayers can download the form directly from the Pennsylvania Department of Revenue's official website. Additionally, physical copies of the form may be available at local tax offices or public libraries. It is advisable to ensure you have the most current version of the form to comply with any recent changes in tax laws.

Required Documents

To accurately complete the Pennsylvania Income Tax Return PA 40, taxpayers should have several documents ready. These include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for reporting other income sources, such as freelance work.

- Records of any deductions or credits, such as receipts for charitable contributions.

- Any relevant documentation for business income, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Pennsylvania Income Tax Return PA 40 are crucial for compliance. Typically, the deadline for submitting the PA 40 is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file without penalties.

Legal use of the Pennsylvania Income Tax Return PA 40 Revenue pa gov

The Pennsylvania Income Tax Return PA 40 is legally binding when completed and submitted according to state regulations. To ensure its legal use, taxpayers must provide accurate information and comply with all relevant tax laws. Electronic submissions are accepted, and utilizing secure eSignature options can enhance the validity of the submission, ensuring it meets the legal standards set forth by the state.

Quick guide on how to complete 2015 pennsylvania income tax return pa 40 revenuepagov

Effortlessly prepare Pennsylvania Income Tax Return PA 40 Revenue pa gov on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without interruptions. Manage Pennsylvania Income Tax Return PA 40 Revenue pa gov on any device using the airSlate SignNow mobile applications for Android or iOS and streamline any document-related procedure today.

How to edit and eSign Pennsylvania Income Tax Return PA 40 Revenue pa gov effortlessly

- Obtain Pennsylvania Income Tax Return PA 40 Revenue pa gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or errors that require reprinting documents. airSlate SignNow fulfills your document management needs in just a few clicks from your selected device. Edit and eSign Pennsylvania Income Tax Return PA 40 Revenue pa gov while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 pennsylvania income tax return pa 40 revenuepagov

Create this form in 5 minutes!

How to create an eSignature for the 2015 pennsylvania income tax return pa 40 revenuepagov

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Pennsylvania Income Tax Return PA 40 for individuals?

The Pennsylvania Income Tax Return PA 40 is a state form used by residents to report their income and calculate their taxes owed to the state of Pennsylvania. This form is required for individuals who earn income in Pennsylvania and must be submitted to the Pennsylvania Department of Revenue via revenue.pa.gov.

-

How can I file my Pennsylvania Income Tax Return PA 40?

You can file your Pennsylvania Income Tax Return PA 40 electronically through an online service or manually by downloading the form from revenue.pa.gov. Using our easy-to-use platform, airSlate SignNow, you can sign and submit your documents swiftly, ensuring compliance and efficiency.

-

Are there any deadlines for submitting the Pennsylvania Income Tax Return PA 40?

The deadline for submitting your Pennsylvania Income Tax Return PA 40 is typically April 15 of each year, coinciding with the federal tax deadline. It is essential to check for any updates or changes on revenue.pa.gov to avoid late penalties.

-

What information do I need to complete the Pennsylvania Income Tax Return PA 40?

To complete the Pennsylvania Income Tax Return PA 40, you will need your income details, tax deductions, and any tax credits you may be eligible for. Gather your W-2 forms, 1099s, and other relevant documents before logging into revenue.pa.gov or using airSlate SignNow to streamline your filing.

-

Can I amend my Pennsylvania Income Tax Return PA 40 if I made a mistake?

Yes, if you discover an error on your Pennsylvania Income Tax Return PA 40, you can amend it by filing a PA 40-X form. It’s important to make these corrections as soon as possible and submit them to the Pennsylvania Department of Revenue via revenue.pa.gov.

-

What are the benefits of filing my Pennsylvania Income Tax Return PA 40 online?

Filing your Pennsylvania Income Tax Return PA 40 online offers several advantages, including quicker processing times and immediate acknowledgment of submission. Our platform, airSlate SignNow, ensures that your documents are securely eSigned and easily accessible through revenue.pa.gov.

-

Is there a fee to file my Pennsylvania Income Tax Return PA 40 using airSlate SignNow?

AirSlate SignNow provides a cost-effective solution for eSigning and submitting documents, and any fees associated with filing your Pennsylvania Income Tax Return PA 40 will be outlined on our platform. Generally, eFiling may come with a nominal fee, while eSigning is often free.

Get more for Pennsylvania Income Tax Return PA 40 Revenue pa gov

Find out other Pennsylvania Income Tax Return PA 40 Revenue pa gov

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement