RI1040MU CREDIT for INCOME TAXES PAID to MULTIPLE STATES Names Shown on Form RI1040 Your Social Security Number NOTE Enter MU in 2019

Understanding the RI1040MU Credit

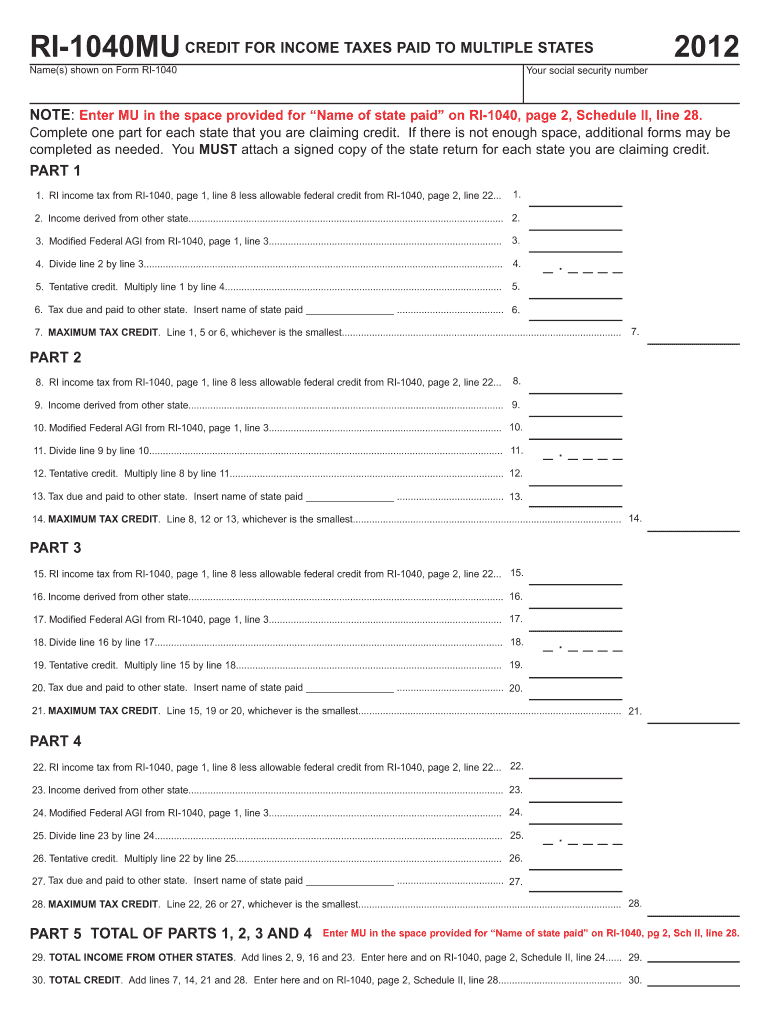

The RI1040MU credit for income taxes paid to multiple states allows taxpayers to claim a credit for taxes paid to other states while filing their Rhode Island state tax return. This credit is essential for individuals who earn income in more than one state, as it helps prevent double taxation. To qualify for this credit, you must ensure that the names of the states where taxes were paid are accurately reflected on Form RI1040. This information is crucial for the proper calculation of your tax liability.

Steps to Complete the RI1040MU Credit Form

Completing the RI1040MU credit requires careful attention to detail. Begin by gathering all necessary documentation, including your tax returns from the states where you paid taxes. On Form RI1040, navigate to Page 2, Schedule II, Line 28. Here, you will enter "MU" in the designated space for the name of the state where taxes were paid. Ensure that all amounts are accurately reported to facilitate a smooth processing of your credit claim.

Legal Use of the RI1040MU Credit

The legal use of the RI1040MU credit is governed by state tax laws. It is important to adhere to all guidelines set forth by the Rhode Island Division of Taxation to ensure compliance. The credit can only be claimed if taxes were paid to another state on income that is also taxed by Rhode Island. Failure to meet these legal requirements may result in penalties or denial of the credit.

Key Elements of the RI1040MU Credit

Several key elements define the RI1040MU credit. Firstly, the credit is limited to the amount of tax paid to the other state, which cannot exceed the Rhode Island tax liability on the same income. Additionally, accurate reporting of your Social Security Number and the names of the states on Form RI1040 is critical. This ensures that the credit is applied correctly and that your tax return is processed without issues.

Eligibility Criteria for the RI1040MU Credit

To be eligible for the RI1040MU credit, taxpayers must have filed tax returns in both Rhode Island and the other state where income was earned. You must also provide proof of the taxes paid to the other state. This may include copies of tax returns or official state tax documents. Meeting these criteria is essential to successfully claim the credit and avoid complications during the tax filing process.

Filing Deadlines for the RI1040MU Credit

Filing deadlines for the RI1040MU credit align with the general tax filing deadlines for Rhode Island. Typically, individual income tax returns are due by April 15. However, if you require additional time, you can file for an extension. It is important to keep track of these deadlines to ensure that your claim for the credit is submitted on time, preventing any potential penalties or interest charges.

Quick guide on how to complete ri1040mu credit for income taxes paid to multiple states names shown on form ri1040 2012 your social security number note enter

Complete RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES Names Shown On Form RI1040 Your Social Security Number NOTE Enter MU In effortlessly on any gadget

Managing documents online has surged in popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right forms and securely retain them online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES Names Shown On Form RI1040 Your Social Security Number NOTE Enter MU In on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES Names Shown On Form RI1040 Your Social Security Number NOTE Enter MU In without hassle

- Find RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES Names Shown On Form RI1040 Your Social Security Number NOTE Enter MU In and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you prefer. Edit and electronically sign RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES Names Shown On Form RI1040 Your Social Security Number NOTE Enter MU In and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri1040mu credit for income taxes paid to multiple states names shown on form ri1040 2012 your social security number note enter

Create this form in 5 minutes!

How to create an eSignature for the ri1040mu credit for income taxes paid to multiple states names shown on form ri1040 2012 your social security number note enter

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES?

The RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES allows taxpayers to claim a credit for taxes paid to other states, as shown on Form RI1040. This is particularly important for individuals who may be working in multiple jurisdictions. When filing, ensure your Social Security Number and the correct entries are made as per Schedule II, Line 28 of the RI1040 form.

-

How do I fill out the RI1040MU section on my tax form?

To fill out the RI1040MU section, ensure that you enter 'MU' in the space provided for the Name of State paid on RI1040, Page 2, Schedule II, Line 28. This indicates you are claiming the credit for taxes paid to multiple states. Double-check your Social Security Number for accuracy to avoid any processing delays.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as eSigning, secure document storage, and automated workflows to help manage tax documents efficiently. With these tools, you can easily send and receive documents related to the RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES. This streamlines your tax filing process and reduces errors.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, making it an ideal choice for managing tax documents related to the RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES. Our pricing plans are competitive, ensuring you get robust features without breaking the bank.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tax preparation software, enhancing your ability to manage the necessary documents for the RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES. This integration allows you to streamline your workflows and keep all your data coordinated.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including those for the RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES, offers numerous benefits. It simplifies the signing process, enhances security, and provides easy access to all your documents from anywhere, empowering you to manage your tax filings with confidence.

-

How secure is airSlate SignNow for my tax information?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption and secure servers to protect your sensitive tax information, including details related to the RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES. You can trust that your data is safe with us.

Get more for RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES Names Shown On Form RI1040 Your Social Security Number NOTE Enter MU In

- Tomorrows scholar forms

- T mobile fraud affidavit form

- Franschhoek high school form

- How to fill out statement of sole responsibility form

- Scoring fundations unit tests form

- Workmen compensation policy pdf new india assurance form

- Medical records release form emerald city naturopathic clinic

- Mercyone centerville medical center 1 saint joseph dr form

Find out other RI1040MU CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES Names Shown On Form RI1040 Your Social Security Number NOTE Enter MU In

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document