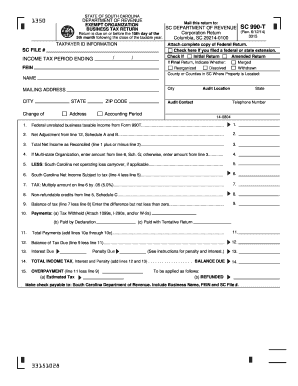

Form Sc 990 T 2020

What is the Form Sc 990 T

The Form Sc 990 T is a tax form used by certain organizations in the United States to report unrelated business income. This form is essential for tax-exempt organizations, such as charities and non-profits, that generate income from activities not directly related to their primary purpose. By filing this form, organizations ensure compliance with IRS regulations and accurately report any taxable income they may have earned.

How to use the Form Sc 990 T

To effectively use the Form Sc 990 T, organizations should first determine if they have any unrelated business income that must be reported. This includes income from activities that are not substantially related to the organization's exempt purpose. Once it is established that unrelated business income exists, the organization can proceed to fill out the form, detailing the sources of income and any allowable deductions. After completing the form, it must be submitted to the IRS by the appropriate deadline to avoid penalties.

Steps to complete the Form Sc 990 T

Completing the Form Sc 990 T involves several key steps:

- Gather financial records related to unrelated business income.

- Identify and list all sources of unrelated business income.

- Calculate allowable deductions related to that income.

- Fill out the form accurately, ensuring all information is complete.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the required deadline.

Legal use of the Form Sc 990 T

The legal use of the Form Sc 990 T is governed by IRS regulations, which stipulate that tax-exempt organizations must report any unrelated business income. Failure to file this form when required can lead to penalties and loss of tax-exempt status. Organizations must ensure that the information provided is truthful and complete to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form Sc 990 T vary based on the organization's fiscal year. Generally, the form is due on the 15th day of the fifth month after the end of the organization's tax year. Organizations can apply for an extension, but they must still pay any taxes owed by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form Sc 990 T can be submitted to the IRS through various methods. Organizations may file the form electronically using approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not available for this form, making electronic and mail submissions the primary options.

Penalties for Non-Compliance

Organizations that fail to file the Form Sc 990 T when required may face significant penalties. The IRS imposes fines based on the duration of the delay and the size of the organization. Additionally, failure to report unrelated business income can lead to further scrutiny from the IRS, potentially resulting in the loss of tax-exempt status if not addressed promptly.

Quick guide on how to complete form sc 990 t 2014

Complete Form Sc 990 T effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without complications. Manage Form Sc 990 T on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and eSign Form Sc 990 T with ease

- Find Form Sc 990 T and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form Sc 990 T and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form sc 990 t 2014

Create this form in 5 minutes!

How to create an eSignature for the form sc 990 t 2014

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is Form Sc 990 T?

Form Sc 990 T, also known as the Exempt Organization Business Income Tax Return, is required for certain tax-exempt organizations to report unrelated business income. This form helps ensure compliance with IRS regulations while maintaining your non-profit status. Understanding and accurately filing Form Sc 990 T is crucial for avoiding penalties.

-

How can airSlate SignNow assist with Form Sc 990 T?

airSlate SignNow simplifies the process of preparing and eSigning documents related to Form Sc 990 T. With our intuitive interface, you can easily streamline your documentation process, making it efficient and secure. This ensures that your organization remains compliant while reducing administrative burdens.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including affordable options for non-profits. Reduced pricing structures are available for organizations focusing on compliance, such as Form Sc 990 T filing requirements. Check our website for detailed pricing and features tailored to your specific requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers robust features for document management, including customizable templates, real-time collaboration, and advanced signing options. These features facilitate the preparation and submission of crucial documents like Form Sc 990 T. Our platform ensures that all your paperwork is organized and accessible whenever needed.

-

How can I ensure compliance while using airSlate SignNow for Form Sc 990 T?

To ensure compliance when using airSlate SignNow for Form Sc 990 T, utilize our built-in tools for tracking document statuses and versions. Our solution allows you to maintain detailed records of all edits and signatures for audit purposes. This level of organization and tracking is essential to stay compliant with IRS requirements.

-

Is airSlate SignNow secure for handling financial documents?

Yes, airSlate SignNow employs top-level security measures, including data encryption and secure access protocols, to protect sensitive information like Form Sc 990 T. We prioritize privacy and compliance, ensuring that your financial documents are safeguarded throughout the signing process. You can trust our platform to keep your data confidential.

-

Can I integrate airSlate SignNow with other software for managing Form Sc 990 T?

Absolutely! airSlate SignNow offers seamless integrations with various software applications to enhance your document management process. This allows you to sync data from tools that help you manage Form Sc 990 T, leading to greater efficiency and accuracy in filing. Review our integration options to find the best fit for your needs.

Get more for Form Sc 990 T

- Printable allergy action plan pdf 269713164 form

- Full and final settlement agreement template south africa form

- Planholder contact information form

- Philippine registry form for persons with disability ver 3 0 pdf

- Addenbrookes clinic 8 form

- Animal behavior observation sheet form

- Matrimony form

- Nh vin verification form

Find out other Form Sc 990 T

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT