South Carolina Tax Form 290 2020

What is the South Carolina Tax Form 290

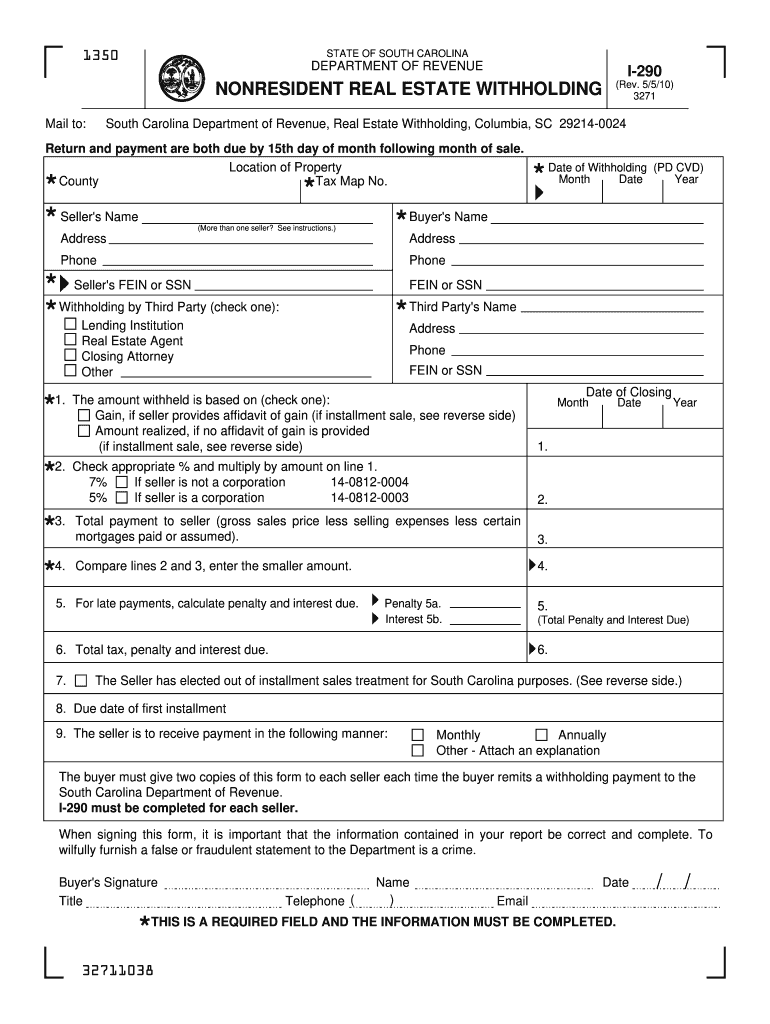

The South Carolina Tax Form 290 is a tax form used by individuals and businesses in South Carolina to report specific tax information to the state. This form is particularly relevant for those who are claiming a credit for taxes paid to other states, ensuring that taxpayers do not face double taxation. Understanding the purpose of this form is essential for accurate tax reporting and compliance with state tax laws.

How to use the South Carolina Tax Form 290

Using the South Carolina Tax Form 290 involves several key steps. First, gather all necessary documentation, including income statements and records of taxes paid to other states. Next, accurately fill out the form, ensuring that all information is complete and correct. Once completed, the form can be submitted according to the preferred filing method, whether online, by mail, or in person. Utilizing digital tools can streamline this process, making it easier to manage and submit your tax information efficiently.

Steps to complete the South Carolina Tax Form 290

Completing the South Carolina Tax Form 290 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and records of taxes paid to other states.

- Begin filling out the form by entering your personal information, such as your name, address, and Social Security number.

- Provide details of your income and the taxes you have paid to other states, ensuring accuracy in all figures.

- Review the completed form for any errors or omissions before finalizing it.

- Choose your submission method and file the form with the South Carolina Department of Revenue.

Legal use of the South Carolina Tax Form 290

The legal use of the South Carolina Tax Form 290 is governed by state tax laws. To ensure that the form is considered valid, it must be completed accurately and submitted within the designated time frame. The form serves as an official document that can be used to claim credits and report income, making it essential for taxpayers to adhere to all legal requirements associated with its use.

Filing Deadlines / Important Dates

Filing deadlines for the South Carolina Tax Form 290 are crucial for compliance. Typically, the form must be submitted by the same deadline as your annual tax return, which is usually April fifteenth. However, if you are filing for an extension, be sure to check the specific dates as they may vary. Staying informed about these deadlines helps avoid penalties and ensures timely processing of your tax information.

Required Documents

When completing the South Carolina Tax Form 290, certain documents are required to support your claims. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of taxes paid to other states.

- Any additional documentation that substantiates your income and tax credits.

Having these documents ready will facilitate a smoother filing process and help ensure that your form is accurate.

Quick guide on how to complete south carolina tax form 290 2010

Complete South Carolina Tax Form 290 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely archive it online. airSlate SignNow provides you with all the resources needed to generate, modify, and eSign your documents swiftly without any hurdles. Manage South Carolina Tax Form 290 on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to change and eSign South Carolina Tax Form 290 without difficulty

- Find South Carolina Tax Form 290 and click Get Form to commence.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or errors necessitating the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign South Carolina Tax Form 290 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina tax form 290 2010

Create this form in 5 minutes!

How to create an eSignature for the south carolina tax form 290 2010

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the South Carolina Tax Form 290?

The South Carolina Tax Form 290 is a tax return form used for reporting income and calculating taxes owed in the state of South Carolina. This form is essential for businesses and individuals to ensure compliance with state tax regulations and to accurately report their financial activities.

-

How can airSlate SignNow help with South Carolina Tax Form 290?

airSlate SignNow simplifies the process of completing and submitting the South Carolina Tax Form 290 by allowing users to create, edit, and eSign documents electronically. This streamlines the submission process and ensures that your tax form is submitted quickly and securely.

-

Is there a cost associated with using airSlate SignNow for South Carolina Tax Form 290?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your usage, you can select a plan that provides access to features necessary for managing your South Carolina Tax Form 290 efficiently, often with a cost-effective solution.

-

Can I integrate airSlate SignNow with other software for managing South Carolina Tax Form 290?

Absolutely! airSlate SignNow offers integration capabilities with various software applications, allowing users to seamlessly manage their South Carolina Tax Form 290. This feature helps in enhancing workflow efficiency and maintaining accurate records within your existing systems.

-

What features does airSlate SignNow provide for completing the South Carolina Tax Form 290?

airSlate SignNow provides features such as customizable templates, electronic signatures, and automated reminders, which are beneficial for completing the South Carolina Tax Form 290. These features ensure that your document is completed accurately and on time while reducing the risk of errors.

-

Is eSigning the South Carolina Tax Form 290 legally binding?

Yes, eSigning the South Carolina Tax Form 290 using airSlate SignNow is legally binding and complies with U.S. Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that your electronically signed documents are valid and enforceable in a court of law.

-

How secure is airSlate SignNow for handling my South Carolina Tax Form 290?

airSlate SignNow prioritizes security with advanced features such as data encryption and secure cloud storage to protect your South Carolina Tax Form 290. Your sensitive tax documents are safeguarded, providing you with peace of mind as you manage your forms online.

Get more for South Carolina Tax Form 290

- Indiana driving test score sheet form

- Bharti axa neft form

- Stellenbosch student contract form

- Identifying ionic and covalent bonds worksheet answer key form

- Caltrans corrosion guidelines form

- Boston brace scoliosis measurement form

- Burlington jaycees arts crafts amp vendor fair form

- Business license application elsmere form

Find out other South Carolina Tax Form 290

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple