South Carolina Sc1120 Form 2020

What is the South Carolina SC1120 Form

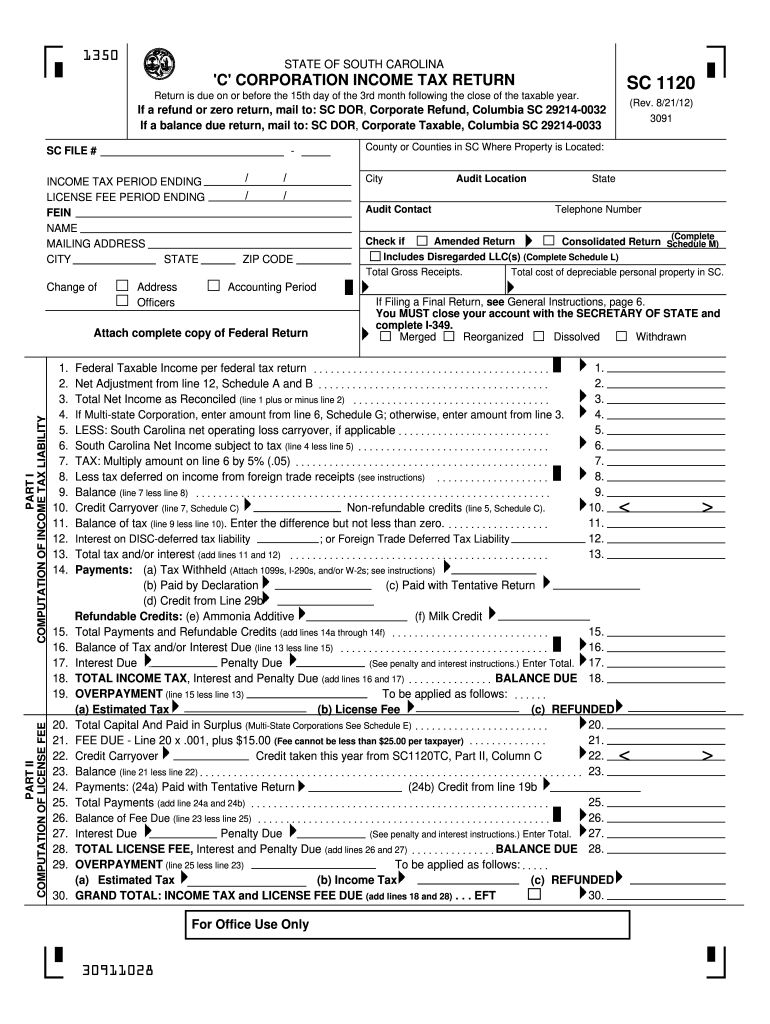

The South Carolina SC1120 Form is a tax return specifically designed for corporations operating within the state. This form is essential for reporting income, deductions, and credits to the South Carolina Department of Revenue. Corporations must complete this form to comply with state tax regulations and ensure proper assessment of their tax liabilities. The SC1120 is particularly relevant for C corporations and is used to calculate the state corporate income tax owed based on the corporation's net income.

How to use the South Carolina SC1120 Form

Using the South Carolina SC1120 Form involves several key steps. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form by providing detailed information about your corporation's income, deductions, and credits. It is crucial to ensure that all figures are correct to avoid penalties. After completing the form, it can be submitted either electronically or via mail, depending on the preferred filing method. Always keep a copy of the submitted form for your records.

Steps to complete the South Carolina SC1120 Form

Completing the South Carolina SC1120 Form requires careful attention to detail. Follow these steps:

- Begin by entering your corporation's name, address, and federal employer identification number (EIN).

- Report total income by summarizing all revenue sources.

- List allowable deductions, including business expenses and losses.

- Calculate the taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Complete any additional schedules required for specific deductions or credits.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the South Carolina SC1120 Form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is usually due by April 15. It is essential to stay informed about any changes to deadlines or extensions that may apply, as failure to file on time can result in penalties and interest on unpaid taxes.

Legal use of the South Carolina SC1120 Form

The South Carolina SC1120 Form is legally binding when completed accurately and submitted in compliance with state regulations. Corporations are required to maintain records supporting the information reported on the form, including financial statements and documentation for deductions. The form must be signed by an authorized representative of the corporation, affirming that the information provided is true and correct. Non-compliance with filing requirements can lead to legal consequences, including fines or audits by the South Carolina Department of Revenue.

Key elements of the South Carolina SC1120 Form

Several key elements are integral to the South Carolina SC1120 Form. These include:

- Corporate Information: Basic details such as the corporation's name, address, and EIN.

- Income Reporting: A section for detailing all sources of income.

- Deductions: Areas to list allowable business expenses that reduce taxable income.

- Tax Calculation: A formula to determine the total tax liability based on net income.

- Signature Section: A place for an authorized representative to sign and date the form.

Quick guide on how to complete south carolina sc1120 2012 form

Prepare South Carolina Sc1120 Form easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without setbacks. Manage South Carolina Sc1120 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign South Carolina Sc1120 Form effortlessly

- Locate South Carolina Sc1120 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign South Carolina Sc1120 Form and ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina sc1120 2012 form

Create this form in 5 minutes!

How to create an eSignature for the south carolina sc1120 2012 form

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the South Carolina Sc1120 Form?

The South Carolina Sc1120 Form is a state tax document used by corporations to report their income and calculate their state tax liabilities in South Carolina. Understanding this form is crucial for maintaining compliance with state tax regulations. Businesses must ensure accurate completion of the South Carolina Sc1120 Form to avoid penalties.

-

How can airSlate SignNow help with the South Carolina Sc1120 Form?

airSlate SignNow provides a seamless platform for businesses to electronically sign and send the South Carolina Sc1120 Form. With user-friendly features, you can easily gather signatures from necessary parties, ensuring that your tax documents are efficiently managed and sent on time. This accelerates the filing process and enhances compliance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business sizes and needs. Starting from a basic package to advanced features, you can select the plan that best suits your requirements for handling the South Carolina Sc1120 Form and other documents. Each plan is designed to deliver cost-effective solutions for electronic signatures.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you gain access to multiple features including template creation, document tracking, and cloud storage. These features make it easy to manage the South Carolina Sc1120 Form alongside other necessary documents, enhancing productivity. The platform also offers custom branding options to maintain your business identity.

-

How secure is the airSlate SignNow platform for sending the South Carolina Sc1120 Form?

Security is a top priority for airSlate SignNow users. The platform employs advanced encryption measures and secure sign-in protocols to protect sensitive information within the South Carolina Sc1120 Form and other documents. This ensures that your documents are safe from unauthorized access and data bsignNowes.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports various integrations with software tools such as CRM systems, cloud storage services, and more. This allows for seamless workflows when managing the South Carolina Sc1120 Form and other important documents. You can easily connect your existing applications for improved efficiency.

-

Is airSlate SignNow user-friendly for first-time users?

Absolutely! airSlate SignNow is designed with a user-friendly interface that simplifies document signing and management. First-time users will find it intuitive to navigate while preparing the South Carolina Sc1120 Form and obtaining signatures. Comprehensive support resources are also available to assist users.

Get more for South Carolina Sc1120 Form

Find out other South Carolina Sc1120 Form

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online