Form 199 2019

What is the Form 199

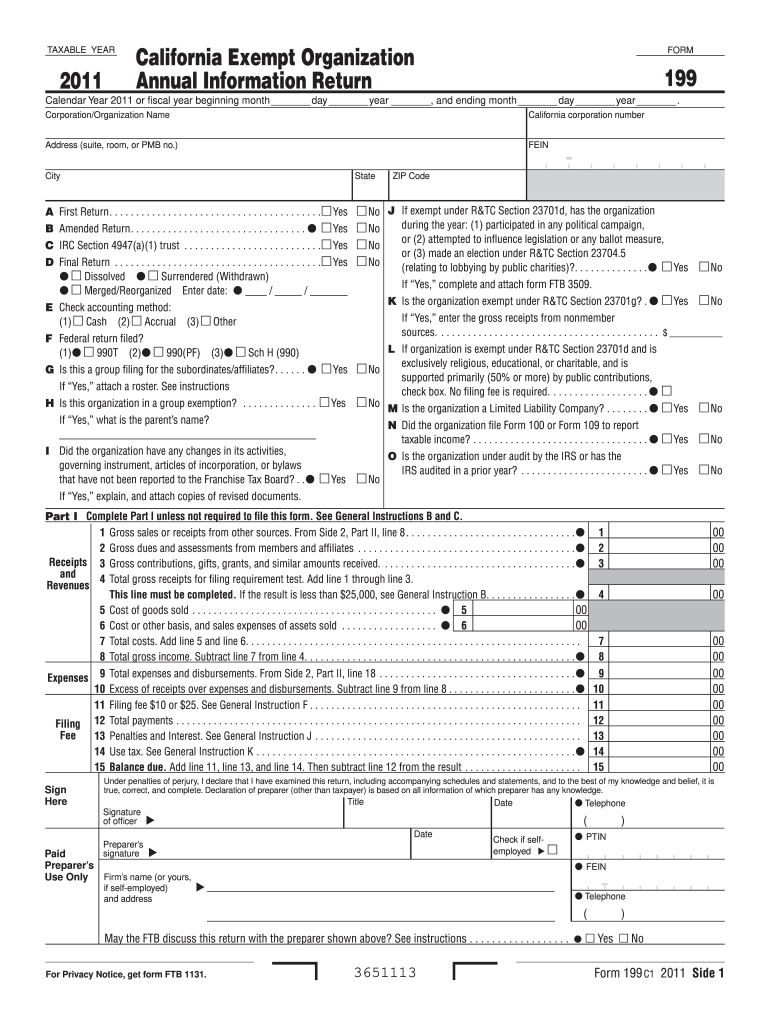

The Form 199 is a tax document used by certain business entities in the United States to report income and expenses. This form is typically utilized by limited liability companies (LLCs) and partnerships that are classified as pass-through entities for tax purposes. It allows these entities to provide necessary financial information to the Internal Revenue Service (IRS) and ensure compliance with federal tax regulations.

How to use the Form 199

Using the Form 199 involves several steps to ensure accurate reporting. First, gather all relevant financial documents, including income statements and expense reports. Next, fill out the form with the required information, such as business income, deductions, and credits. It is important to review the completed form for accuracy before submission. Finally, submit the form to the IRS by the designated deadline, ensuring that any required payments are made on time.

Steps to complete the Form 199

Completing the Form 199 involves a systematic approach:

- Collect all necessary financial records, including receipts and bank statements.

- Determine the correct filing status of your business entity.

- Fill in the identification section with your business name, address, and Employer Identification Number (EIN).

- Report total income and allowable deductions accurately.

- Ensure all calculations are correct, particularly in the income and tax liability sections.

- Review the form for completeness and accuracy.

- Submit the form to the IRS by the filing deadline.

Legal use of the Form 199

The legal use of the Form 199 is governed by IRS regulations, which stipulate that accurate reporting is essential for compliance. This form must be filed by the appropriate entities to avoid penalties. Additionally, it is crucial to retain copies of the submitted form and any supporting documents for record-keeping purposes, as they may be required for future audits or inquiries by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 199 typically align with the tax year of the business entity. Generally, the form must be submitted by March 15 for entities operating on a calendar year basis. If an extension is needed, it is essential to file for an extension before the deadline and ensure that the completed form is submitted by the extended due date. Awareness of these deadlines helps prevent late filing penalties.

Required Documents

To complete the Form 199 accurately, certain documents are required:

- Financial statements, including income and expense reports.

- Bank statements for the reporting period.

- Previous year’s tax returns for reference.

- Documentation for any deductions or credits claimed.

Penalties for Non-Compliance

Failure to file the Form 199 on time or inaccuracies in reporting can result in significant penalties. These penalties may include fines imposed by the IRS, interest on unpaid taxes, and potential audits. It is crucial for business entities to adhere to filing requirements to avoid these consequences and maintain compliance with federal tax laws.

Quick guide on how to complete 2011 form 199

Complete Form 199 effortlessly on any platform

Digital document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 199 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Form 199 with ease

- Obtain Form 199 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 199 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 199

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 199

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is Form 199 and how does it work with airSlate SignNow?

Form 199 is a tax form used by certain businesses to report financial information. With airSlate SignNow, you can easily fill out, send, and eSign Form 199, ensuring compliance while streamlining your documentation process. Our platform makes it simple and efficient to manage all your documents electronically.

-

How much does airSlate SignNow cost for managing Form 199?

Pricing for airSlate SignNow is competitive, offering various plans to cater to different business needs. Depending on the plan you choose, you can effectively manage Form 199 and other documents with ease. For exact pricing details, visit our website or contact our sales team for a personalized quote.

-

Can I integrate airSlate SignNow with other software for processing Form 199?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, enabling you to manage Form 199 without any hassle. Whether it's CRM systems or accounting software, our integrations help streamline your workflow. This connectivity ensures that your processes around Form 199 are efficient and automated.

-

What features does airSlate SignNow offer specifically for Form 199?

airSlate SignNow provides a range of features designed to enhance the handling of Form 199, including customizable templates, secure eSignature capabilities, and advanced tracking. These features help ensure that your form is filled, signed, and returned promptly, improving overall efficiency. You can also organize and store Form 199 digitally for easy access.

-

Is airSlate SignNow legally binding for eSigning Form 199?

Absolutely! eSignatures provided through airSlate SignNow are legally binding and comply with regulations like the ESIGN Act and UETA. This means that when you eSign Form 199 using our platform, you can be confident in its legal validity. Our secure technology guarantees the authenticity and integrity of your signed documents.

-

How does airSlate SignNow enhance the security of Form 199 submissions?

AirSlate SignNow prioritizes security by employing advanced encryption protocols and secure storage solutions to protect your Form 199 submissions. We understand the importance of confidentiality, especially with sensitive tax information. Our platform ensures that your data remains safe and compliant with industry standards.

-

Can I track the status of my Form 199 using airSlate SignNow?

Yes, with airSlate SignNow, you can track the status of your Form 199 submissions in real-time. Our platform provides notifications and updates so you know when your form is viewed, signed, or completed. This tracking feature adds transparency and peace of mind to your document management processes.

Get more for Form 199

Find out other Form 199

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online