Form 199 California 2019

What is the Form 199 California

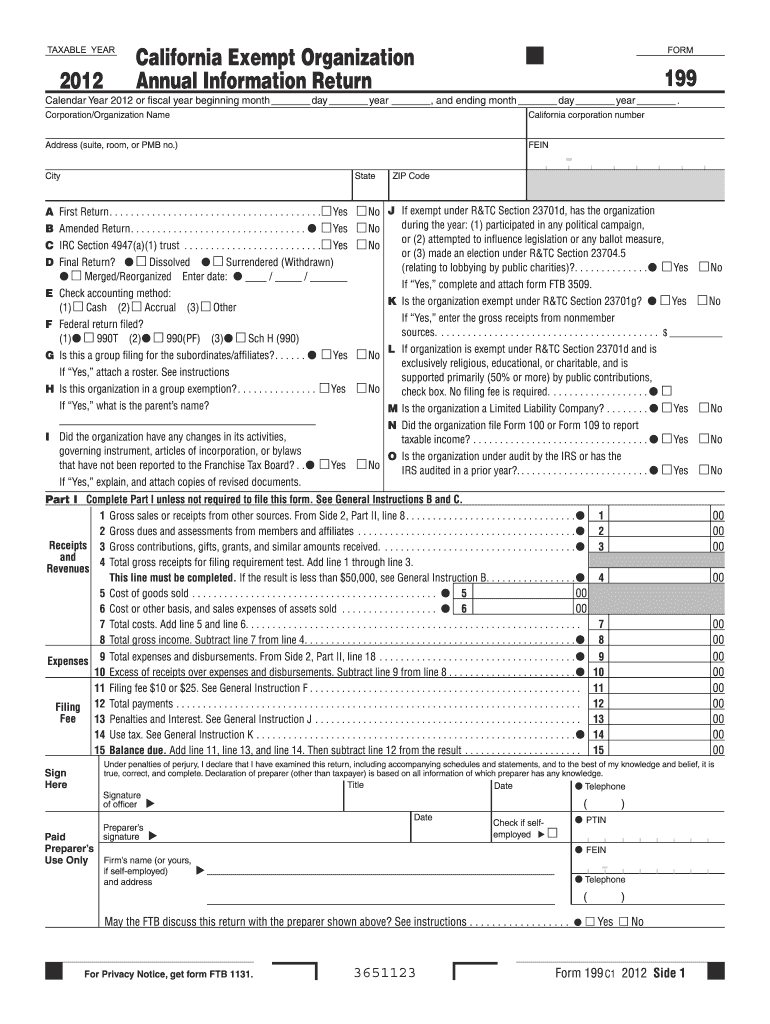

The Form 199 California, also known as the California Exempt Organization Annual Information Return, is a document that certain nonprofit organizations in California must file annually. This form is essential for maintaining the organization’s tax-exempt status and ensuring compliance with state regulations. It provides the California Franchise Tax Board with information about the organization’s activities, financials, and governance, helping to promote transparency and accountability within the nonprofit sector.

How to use the Form 199 California

Using the Form 199 California involves several steps to ensure accurate completion and submission. Organizations need to gather relevant financial data, including income, expenses, and assets, as well as details about their governance structure. The form can be filled out electronically or on paper, depending on the organization’s preference. After completing the form, it must be submitted to the California Franchise Tax Board by the specified deadline to avoid penalties.

Steps to complete the Form 199 California

Completing the Form 199 California requires careful attention to detail. Here are the steps to follow:

- Gather financial statements, including income and expense reports.

- Collect information about the organization’s governance, including board members and their roles.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form by the due date, either electronically or via mail.

Legal use of the Form 199 California

The legal use of the Form 199 California is crucial for maintaining compliance with state laws governing nonprofit organizations. Filing this form accurately and on time helps organizations uphold their tax-exempt status. Failure to comply with filing requirements can lead to penalties, including the loss of tax-exempt status. Organizations should ensure they understand the legal implications of the information they provide on this form.

Key elements of the Form 199 California

The Form 199 California includes several key elements that organizations must complete. These elements typically include:

- Basic information about the organization, such as its name, address, and tax identification number.

- Financial data, including total revenue, expenses, and net assets.

- Details about the organization’s activities and programs.

- Information regarding the organization’s governance structure, including board member names and positions.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 199 California to avoid penalties. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is typically due on May 15. It is essential to keep track of these dates to ensure timely submission and compliance with state regulations.

Quick guide on how to complete form 199 california 2012

Complete Form 199 California effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form 199 California on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 199 California seamlessly

- Obtain Form 199 California and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 199 California and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 199 california 2012

Create this form in 5 minutes!

How to create an eSignature for the form 199 california 2012

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 199 California and why do I need it?

Form 199 California is a specific tax form required for certain nonprofit organizations. Completing and submitting this form is essential for compliance with state regulations. By using airSlate SignNow, you can easily prepare and eSign Form 199 California, ensuring timely submission and adherence to legal requirements.

-

How can airSlate SignNow help me with Form 199 California?

airSlate SignNow offers a user-friendly platform for managing and eSigning documents, including Form 199 California. With our solution, you can streamline the process, automate reminders, and track the status of your submissions effortlessly. This saves you time and reduces the chances of error in your filing.

-

Is there a fee to eSign Form 199 California with airSlate SignNow?

Yes, airSlate SignNow provides a cost-effective subscription model that includes eSigning capabilities for documents like Form 199 California. Pricing varies based on the features you choose, but we ensure that our services remain budget-friendly for businesses of all sizes. This allows you to stay compliant without breaking the bank.

-

Can I integrate airSlate SignNow with my existing software for Form 199 California?

Absolutely! airSlate SignNow seamlessly integrates with various applications to facilitate the management of Form 199 California and other documents. Whether you're using CRM systems or document management tools, our platform can enhance your workflow, allowing for an efficient signing process.

-

What are the benefits of using airSlate SignNow for Form 199 California?

Using airSlate SignNow for Form 199 California provides numerous benefits, including enhanced security for your documents and a faster signing process. Our platform ensures that all signed forms are stored securely and can be easily accessed whenever needed. Additionally, the ease of use improves compliance management, freeing up resources for your organization.

-

How secure is airSlate SignNow for handling Form 199 California?

Security is a top priority for airSlate SignNow when managing sensitive documents like Form 199 California. We implement robust encryption and strict access controls to safeguard your information. You can trust that your data remains secure, even during the electronic signing process.

-

Is it easy to collaborate with others on Form 199 California using airSlate SignNow?

Yes, airSlate SignNow makes it incredibly easy to collaborate on Form 199 California with team members or stakeholders. Our platform allows multiple users to review, comment, and eSign documents in real-time. This collaborative approach streamlines communication and enhances the overall efficiency of the document signing process.

Get more for Form 199 California

- Service learning time sheet servicelearning cps k12 il form

- Clinical guide to the use of vitamin c pdf form

- Concussion symptom score sheet pdf form

- 461 5 army form

- Mvis credit card authorization form

- Is he a robber baron or captain of industry answer key form

- A star called henry pdf form

- Fillable online hbp request to withdraw funds from an form

Find out other Form 199 California

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF