4891 Form 2019

What is the 4891 Form

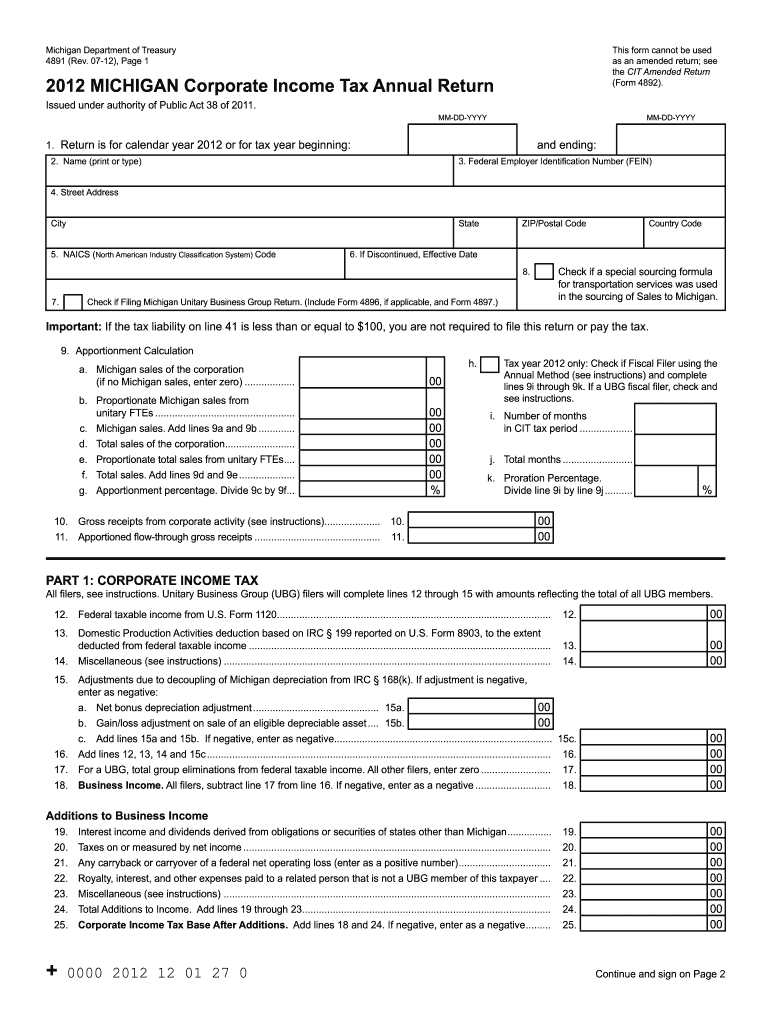

The 4891 Form is a document used primarily in the context of tax reporting and compliance in the United States. It is often associated with specific tax-related requirements that individuals or businesses must fulfill. Understanding the purpose and function of the 4891 Form is essential for accurate reporting and adherence to IRS regulations. This form may be required for various taxpayer scenarios, including self-employed individuals and businesses, making it crucial for maintaining compliance with tax obligations.

How to use the 4891 Form

Using the 4891 Form involves several key steps to ensure that all necessary information is accurately captured. First, individuals should gather all relevant financial documents that pertain to their income and expenses for the reporting period. Next, the form should be filled out carefully, ensuring that all fields are completed with accurate data. After filling out the form, it is advisable to review it for any errors before submission. This process helps prevent delays in processing and potential penalties from the IRS.

Steps to complete the 4891 Form

Completing the 4891 Form requires a systematic approach to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary documents, including income statements and expense records.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check the form for any errors or omissions.

- Sign and date the form, if required.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the 4891 Form

The legal use of the 4891 Form is governed by IRS regulations, which outline how and when this form must be utilized. It is essential for taxpayers to understand the legal implications of submitting this form, including the potential for audits or penalties if the form is not completed correctly. Compliance with IRS guidelines ensures that the form is legally binding and recognized for tax purposes. Utilizing a reliable eSigning tool can enhance the legal validity of the form by providing necessary authentication and security measures.

Filing Deadlines / Important Dates

Filing deadlines for the 4891 Form are critical to avoid penalties and ensure compliance with tax regulations. Typically, the form must be submitted by specific dates set by the IRS, which can vary based on the taxpayer's situation. It is important to stay informed about these deadlines, as late submissions may result in fines or additional interest on owed taxes. Taxpayers should mark their calendars with important dates and consider setting reminders to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The 4891 Form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online: Many taxpayers opt to file electronically using IRS-approved software, which can streamline the process and reduce errors.

- Mail: The form can be printed and sent via postal service to the appropriate IRS address. Ensure proper postage and tracking for confirmation.

- In-Person: Taxpayers may also choose to submit the form in person at designated IRS offices, which can be beneficial for immediate assistance or clarification.

Quick guide on how to complete 2012 4891 form

Complete 4891 Form easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your files swiftly without delays. Handle 4891 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The most efficient way to modify and eSign 4891 Form effortlessly

- Obtain 4891 Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign 4891 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 4891 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 4891 form

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the 4891 Form?

The 4891 Form is a crucial document used for various business processes, including contract agreements and service certifications. With airSlate SignNow, you can easily create, send, and eSign the 4891 Form, ensuring a streamlined workflow and secure transactions.

-

How does airSlate SignNow simplify the 4891 Form process?

airSlate SignNow simplifies the 4891 Form process by providing an intuitive interface that allows users to customize and send documents quickly. Our platform supports electronic signatures, making it easy to get the necessary approvals without the hassle of printing and scanning.

-

What are the pricing options for using airSlate SignNow for the 4891 Form?

airSlate SignNow offers flexible pricing options tailored to fit different business needs while handling the 4891 Form. Packages vary from basic plans suitable for small businesses to advanced options for larger enterprises, allowing users to choose a plan that best suits their requirements.

-

Can I integrate airSlate SignNow with other software for handling the 4891 Form?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing effective management of the 4891 Form. Whether it's CRM systems or document management solutions, our integrations ensure that your workflow is efficient and well-coordinated across platforms.

-

What benefits does electronic signing of the 4891 Form offer?

Electronic signing of the 4891 Form offers numerous benefits, including enhanced security, faster turnaround times, and improved user experience. By using airSlate SignNow, businesses can reduce delays associated with traditional signing methods, which ultimately accelerates their operations.

-

Is it legal to eSign the 4891 Form using airSlate SignNow?

Yes, it is legal to eSign the 4891 Form using airSlate SignNow in compliance with electronic signature laws, such as the E-SIGN Act and UETA. Our platform ensures that all electronic signatures are secure and legally binding, giving users peace of mind.

-

How can I track the status of my 4891 Form in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your 4891 Form in real-time. Our notification system provides updates on when your document is viewed, signed, or completed, allowing you to stay informed throughout the signing process.

Get more for 4891 Form

Find out other 4891 Form

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement