Mw3 Reconcilation Form 2019

What is the Mw3 Reconciliation Form

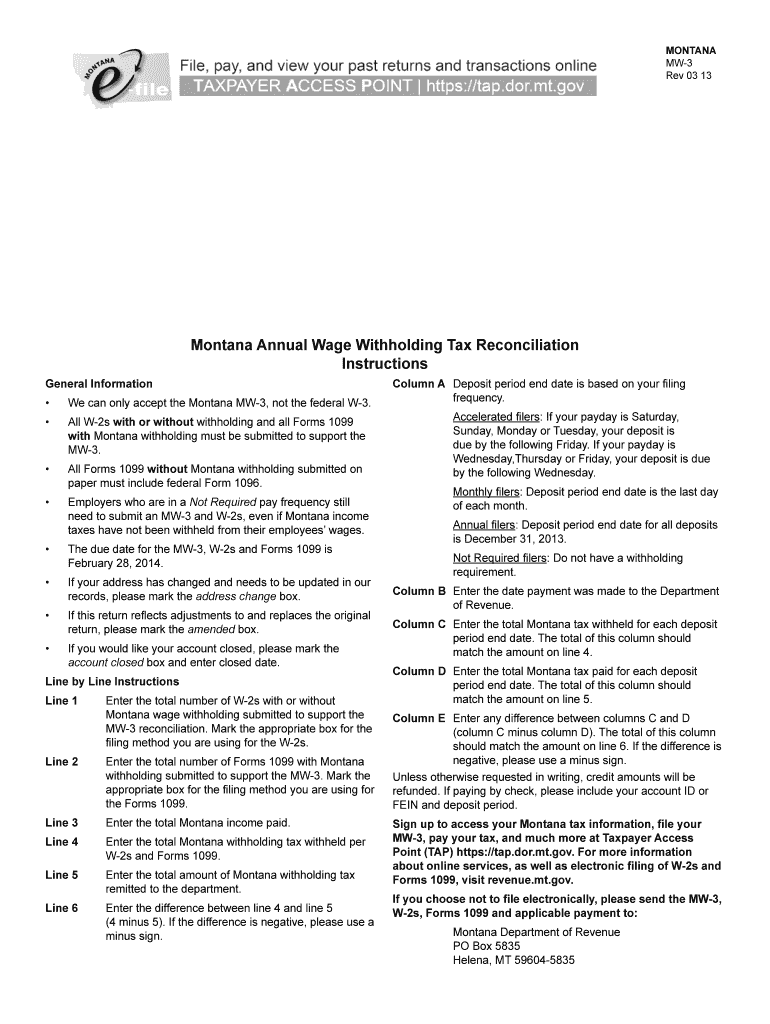

The Mw3 Reconciliation Form is a crucial document used primarily for tax purposes in the United States. It serves as a means to reconcile various financial accounts, ensuring that all reported income, deductions, and credits align with the records maintained by the Internal Revenue Service (IRS). This form is essential for individuals and businesses alike, as it helps to clarify discrepancies and confirm accurate tax reporting.

How to use the Mw3 Reconciliation Form

Using the Mw3 Reconciliation Form involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all relevant financial documents, including income statements, receipts, and previous tax returns. Next, fill out the form by entering the required information, such as total income, deductions, and credits. After completing the form, review it for any errors or omissions before submission. It is important to retain copies of the form and any supporting documents for your records.

Steps to complete the Mw3 Reconciliation Form

Completing the Mw3 Reconciliation Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts.

- Enter your total income accurately, including wages, dividends, and any other sources.

- List all deductions and credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Mw3 Reconciliation Form

The Mw3 Reconciliation Form is legally recognized when filled out correctly and submitted in accordance with IRS regulations. It is essential to adhere to all guidelines to ensure the form is considered valid. This includes using the correct version of the form, providing accurate information, and submitting it by the specified deadlines. Failure to comply with these requirements may result in penalties or delays in processing your tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Mw3 Reconciliation Form can vary based on individual circumstances, such as whether you are filing as an individual or a business entity. Generally, the form should be submitted by the tax filing deadline, which is typically April fifteenth for individuals. It is crucial to stay informed about any changes to these dates, as the IRS may adjust deadlines due to various factors, including natural disasters or legislative changes.

Who Issues the Form

The Mw3 Reconciliation Form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax administration and ensuring compliance with tax laws. The IRS provides guidelines and updates regarding the form, including any changes to its structure or requirements. It is important to refer to the IRS website or official publications for the most current information regarding the Mw3 Reconciliation Form.

Quick guide on how to complete mw3 reconcilation 2013 form

Complete Mw3 Reconcilation Form smoothly on any device

Online document management has become prevalent among companies and individuals. It presents an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents rapidly without delays. Manage Mw3 Reconcilation Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Mw3 Reconcilation Form effortlessly

- Locate Mw3 Reconcilation Form and click Get Form to commence.

- Use the facilities we offer to complete your document.

- Emphasize essential parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Mw3 Reconcilation Form and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mw3 reconcilation 2013 form

Create this form in 5 minutes!

How to create an eSignature for the mw3 reconcilation 2013 form

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the MW3 Reconciliation Form?

The MW3 Reconciliation Form is a crucial document used for reconciling tax overpayments in Pennsylvania. It ensures that taxpayers can accurately report their payments and claim refunds where applicable. By using the MW3 Reconciliation Form, businesses can streamline their tax processes, making compliance easier and more efficient.

-

How can airSlate SignNow help with the MW3 Reconciliation Form?

airSlate SignNow provides a user-friendly platform that allows users to easily fill out and eSign the MW3 Reconciliation Form. The intuitive interface enhances document management and ensures that all signatures are captured promptly. This functionality helps to reduce turnaround time and improve workflow for tax-related processes.

-

Is there a cost to use the MW3 Reconciliation Form with airSlate SignNow?

Yes, there are various pricing plans available with airSlate SignNow that cater to different business needs. These plans may vary based on features and the number of users. However, the cost is generally considered affordable given the efficiency and convenience offered in managing the MW3 Reconciliation Form.

-

What features does airSlate SignNow offer for eSigning the MW3 Reconciliation Form?

airSlate SignNow offers a range of features for eSigning the MW3 Reconciliation Form, including secure storage, customizable templates, and real-time tracking of document status. Users can also set reminders for signatures and receive notifications once the document is signed. These features signNowly enhance the usability and reliability of the entire process.

-

Can the MW3 Reconciliation Form be integrated with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing users to easily access and manage the MW3 Reconciliation Form alongside other essential business tools. This integration capability enhances efficiency by enabling cross-application workflows. It simplifies the overall document management process.

-

Is it easy to fill out the MW3 Reconciliation Form using airSlate SignNow?

Absolutely! airSlate SignNow features an easy-to-use interface that simplifies the process of filling out the MW3 Reconciliation Form. Users can quickly enter required information, electronically sign, and send the form with just a few clicks. This user-friendly experience is designed to save time and reduce errors.

-

What are the benefits of using airSlate SignNow for the MW3 Reconciliation Form?

Using airSlate SignNow for the MW3 Reconciliation Form offers numerous benefits, such as increased efficiency, reduced paper usage, and enhanced security. The platform also enables faster processing of documents, which is crucial for timely tax filings. Additionally, users can access their documents from anywhere, providing flexibility in managing their tax-related workflows.

Get more for Mw3 Reconcilation Form

- Intruder alarm maintenance checklist template form

- Index of credit card txt form

- Golf tournament contract template form

- Blank dd214 form

- Payroll direct deposit change form numerica credit union

- Dnr9032 b r1119 form

- Durable medical equipmentwheelchair request prior authorization form providers amerihealth caritas pennsylvania community

- Contract de colaborare ntre sc world travel srl form

Find out other Mw3 Reconcilation Form

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online