Form Withholding 2020

What is the Form Withholding

The Form Withholding is a crucial document used primarily for tax purposes in the United States. It allows employers to report the amount of federal income tax withheld from employees' wages. This form ensures that the correct amount of taxes is collected throughout the year, helping employees avoid a large tax bill when they file their annual returns. Understanding the purpose and function of this form is essential for both employers and employees to maintain compliance with IRS regulations.

How to use the Form Withholding

To effectively use the Form Withholding, employers must first complete the form accurately, detailing the employee's information and the amount withheld. Employees should review their withholding status regularly, especially when there are changes in their financial situation, such as marriage, divorce, or changes in dependents. This ensures that the correct amount of tax is withheld, preventing underpayment or overpayment throughout the year.

Steps to complete the Form Withholding

Completing the Form Withholding involves several important steps:

- Gather necessary information, including employee details and tax identification numbers.

- Determine the appropriate withholding amount based on the employee's earnings and filing status.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS, either electronically or by mail, depending on your preference.

Legal use of the Form Withholding

The legal use of the Form Withholding is governed by IRS regulations, which dictate how and when employers must report withheld taxes. Compliance with these regulations is essential to avoid penalties. Employers must ensure that the form is filled out correctly and submitted on time, adhering to all federal and state laws regarding tax withholding. Failure to comply can result in significant fines and legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form Withholding are critical to ensure compliance with IRS requirements. Typically, employers must submit the form by the end of the tax year, which is December thirty-first. Additionally, employers should be aware of quarterly deadlines for submitting withheld taxes. Keeping track of these important dates helps prevent penalties and ensures that employees' tax obligations are met in a timely manner.

Penalties for Non-Compliance

Non-compliance with the requirements related to the Form Withholding can lead to various penalties imposed by the IRS. These may include fines for late submission, failure to file, or inaccuracies in reporting withheld amounts. It is crucial for employers to understand these penalties and take proactive measures to ensure that all forms are completed accurately and submitted on time to avoid unnecessary financial repercussions.

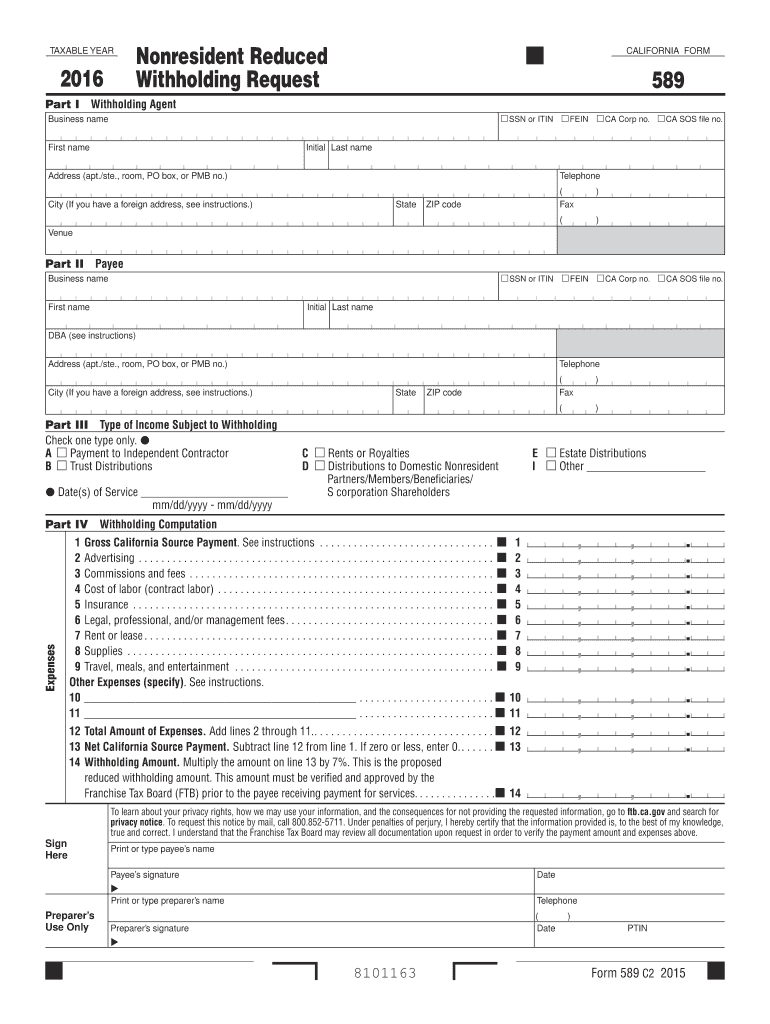

Quick guide on how to complete 2016 form withholding

Effortlessly Prepare Form Withholding on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without holdups. Manage Form Withholding on any device using airSlate SignNow apps for Android or iOS, and enhance any document-focused workflow today.

The Easiest Method to Modify and Electronically Sign Form Withholding

- Find Form Withholding and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Withholding to guarantee excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form withholding

Create this form in 5 minutes!

How to create an eSignature for the 2016 form withholding

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form Withholding in airSlate SignNow?

Form Withholding in airSlate SignNow refers to the process of preventing unauthorized access to sensitive documents by implementing eSigning workflows. This feature enhances compliance and security, ensuring that only designated signers can access and sign important forms related to withholding information.

-

How does airSlate SignNow's Form Withholding feature benefit my business?

The Form Withholding feature helps businesses protect sensitive data and meet compliance standards. By utilizing this tool, you can ensure that only authorized personnel can view and sign critical documents, thus reducing the risk of data bsignNowes and reinforcing trust with your clients.

-

Is there a cost associated with using Form Withholding in airSlate SignNow?

airSlate SignNow offers a range of pricing plans that include the Form Withholding feature. Depending on your business needs, you can choose a plan that suits your budget while still providing robust eSigning capabilities and secure document management.

-

Can I integrate Form Withholding with my existing software?

Yes, airSlate SignNow's Form Withholding feature can be easily integrated with a variety of CRM, ERP, and productivity tools. This seamless integration allows for streamlined workflows, making it easier to manage forms and documents across platforms while maintaining secure withholding practices.

-

Does airSlate SignNow provide templates for Form Withholding?

Absolutely! airSlate SignNow offers customizable templates for various document types involving Form Withholding. This feature enables you to quickly generate compliant forms that can be easily sent out for eSigning, saving you time and ensuring accuracy.

-

How secure is Form Withholding in airSlate SignNow?

AirSlate SignNow prioritizes security with robust encryption and authentication measures in place for Form Withholding. Each signed document is securely stored, and you can establish user permissions to ensure that only authorized individuals have access to sensitive information.

-

What types of documents can be protected with Form Withholding?

With airSlate SignNow, you can protect a variety of document types using Form Withholding, including contracts, tax documents, and personal information forms. This versatility ensures that any sensitive data requiring withholding can be securely managed and electronically signed.

Get more for Form Withholding

- Federal monthly supervision report form

- Tennessee last will and testament form

- Water heater and smoke detector statement of compliance form

- Revision of wage garnishment form instructions

- Department of justice complaint form

- Delegate anne healey scholarship application form

- Bbq dinner order form

- Anne healey scholarship form

Find out other Form Withholding

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast