Ct 3 Fillable Forms 2020

What is the Ct 3 Fillable Forms

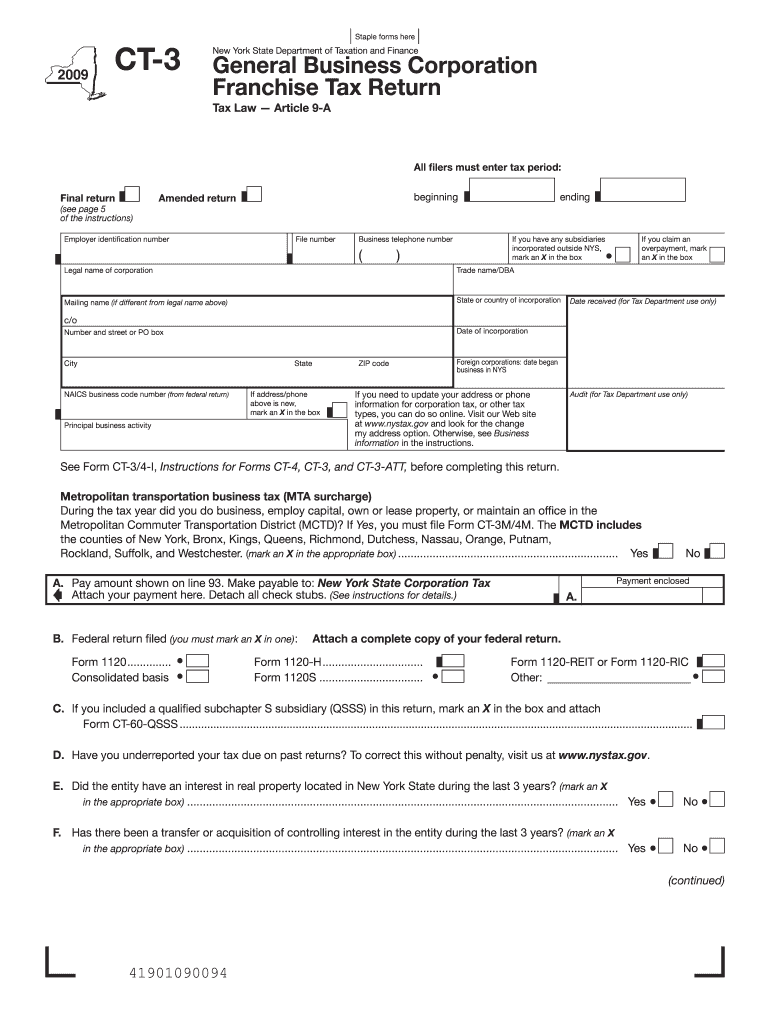

The Ct 3 Fillable Forms are tax documents used by corporations in the United States to report their income, deductions, and credits to the Internal Revenue Service (IRS). These forms are essential for ensuring compliance with federal tax laws and for determining the amount of tax owed. The fillable format allows users to enter information directly into the document, facilitating easier completion and submission.

How to use the Ct 3 Fillable Forms

Using the Ct 3 Fillable Forms involves several straightforward steps. First, download the form from a reliable source. Next, open the document in a compatible PDF reader that supports fillable forms. Enter the required information in the designated fields, ensuring accuracy to avoid any issues during processing. After completing the form, review all entries for correctness before saving the document. Finally, submit the filled form according to the specified submission methods.

Steps to complete the Ct 3 Fillable Forms

Completing the Ct 3 Fillable Forms requires attention to detail. Follow these steps:

- Download the form from a trusted source.

- Open the form in a PDF reader that supports fillable fields.

- Enter your business information, including name, address, and Employer Identification Number (EIN).

- Fill in the income and deduction sections accurately.

- Review all entries for any errors or omissions.

- Save the completed form securely on your device.

- Submit the form via the chosen method, ensuring it is sent by the deadline.

Legal use of the Ct 3 Fillable Forms

The legal use of the Ct 3 Fillable Forms hinges on compliance with IRS regulations. To be considered valid, the form must be completed accurately and submitted by the appropriate deadline. Additionally, electronic signatures may be used if they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Ensuring that the form is signed and dated correctly is crucial for its acceptance by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 Fillable Forms vary depending on the corporation's tax year. Typically, the forms are due on the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this means the forms are due on April 15. It is important to be aware of extensions that may apply, as well as any state-specific deadlines that could affect submission.

Form Submission Methods (Online / Mail / In-Person)

The Ct 3 Fillable Forms can be submitted through various methods, ensuring flexibility for users. Corporations can file online via the IRS e-file system, which is often the fastest option. Alternatively, the completed forms can be printed and mailed to the appropriate IRS address. In-person submissions may also be possible at designated IRS offices, although this option is less common. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits the corporation's needs.

Quick guide on how to complete ct 3 2008 fillable forms 2009

Prepare Ct 3 Fillable Forms seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Ct 3 Fillable Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Ct 3 Fillable Forms effortlessly

- Obtain Ct 3 Fillable Forms and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ct 3 Fillable Forms and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 2008 fillable forms 2009

Create this form in 5 minutes!

How to create an eSignature for the ct 3 2008 fillable forms 2009

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What are Ct 3 Fillable Forms?

Ct 3 Fillable Forms are electronic forms that allow users to complete and submit their tax information online. They simplify the tax filing process by enabling businesses to fill in their data seamlessly and efficiently. With airSlate SignNow, you can easily manage and sign Ct 3 Fillable Forms, enhancing your overall tax experience.

-

How can airSlate SignNow help with Ct 3 Fillable Forms?

airSlate SignNow offers a user-friendly platform to create, manage, and eSign Ct 3 Fillable Forms. You can quickly fill out, save, and send these forms securely, ensuring compliance and efficiency. Our solution not only speeds up the process but also reduces the risks of errors in form completion.

-

Are there any costs associated with using Ct 3 Fillable Forms on airSlate SignNow?

Yes, using Ct 3 Fillable Forms on airSlate SignNow comes with subscription plans designed to fit various business needs. These plans are competitively priced, ensuring you get a cost-effective solution for managing your forms. Visit our pricing page for more details on available options and features.

-

What features does airSlate SignNow provide for Ct 3 Fillable Forms?

AirSlate SignNow provides a host of features for managing Ct 3 Fillable Forms, including customizable templates, secure e-signature options, and automated reminders. Our platform also supports integration with popular applications, making it easier to import and export data efficiently. This user-friendly approach improves workflow and saves time.

-

Can I track the status of my Ct 3 Fillable Forms?

Absolutely! airSlate SignNow allows you to track the status of your Ct 3 Fillable Forms in real-time. You can see who has viewed or signed the document and receive notifications as the process progresses. This feature helps ensure that your forms are completed in a timely manner.

-

Is it secure to use airSlate SignNow for Ct 3 Fillable Forms?

Yes, airSlate SignNow prioritizes security and offers various measures to protect your Ct 3 Fillable Forms. Our platform is compliant with industry standards, employing encryption for data protection. You can confidently manage your documents knowing your information is safe.

-

What types of businesses can benefit from Ct 3 Fillable Forms?

Any business that needs to file taxes or manage financial documentation can benefit from Ct 3 Fillable Forms. Small to large enterprises can utilize airSlate SignNow's features to streamline their processes, improve accuracy, and save time. This tool is particularly beneficial for accounting firms and financial departments.

Get more for Ct 3 Fillable Forms

Find out other Ct 3 Fillable Forms

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy