Ct 3 Form 2020

What is the Ct 3 Form

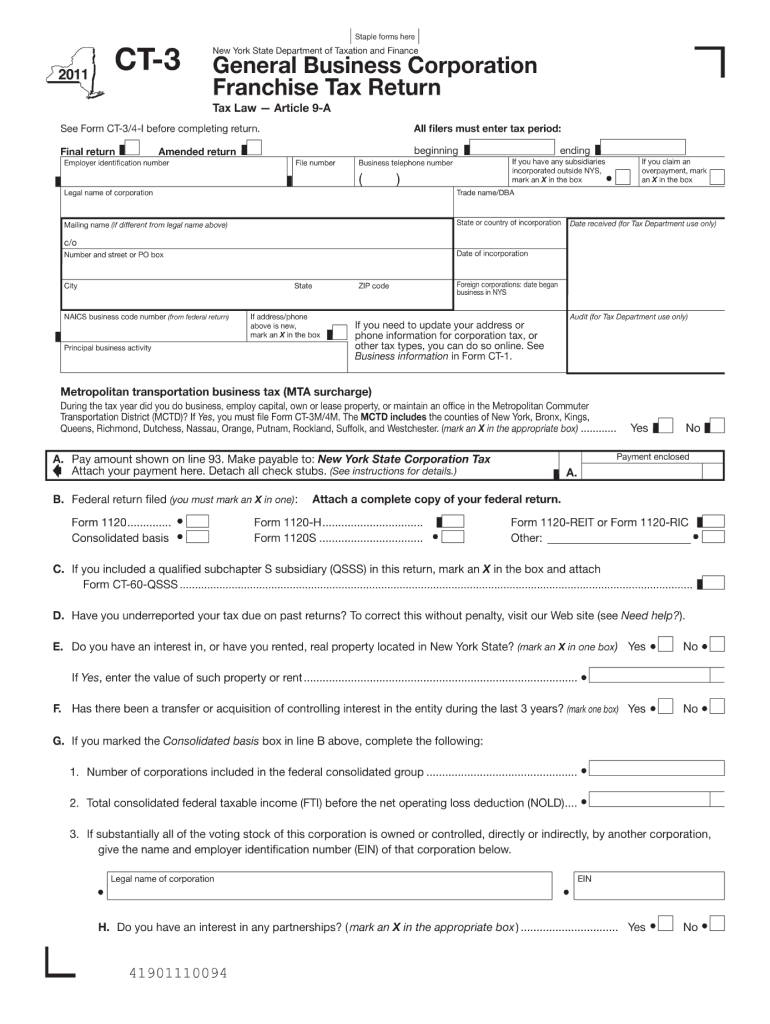

The Ct 3 Form is a tax document used by corporations in New York City to report their income and calculate their tax liability. This form is essential for any corporation operating within the city limits, as it ensures compliance with local tax regulations. The Ct 3 Form requires detailed financial information, including revenue, expenses, and deductions, to accurately assess the corporation's tax obligations.

How to use the Ct 3 Form

Using the Ct 3 Form involves several steps. First, gather all necessary financial documents, such as income statements and expense reports. Next, fill out the form with accurate information regarding your corporation's financial activities for the tax year. Pay close attention to the instructions provided with the form to ensure all sections are completed correctly. Once filled out, the form must be submitted to the appropriate tax authority by the designated deadline.

Steps to complete the Ct 3 Form

Completing the Ct 3 Form requires careful attention to detail. Follow these steps:

- Collect financial documents, including profit and loss statements.

- Complete the identification section with your corporation's name, address, and EIN.

- Report total income, including gross receipts and other income sources.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the taxable income and apply the appropriate tax rate.

- Review the completed form for accuracy before submission.

Legal use of the Ct 3 Form

The Ct 3 Form is legally binding and must be filed accurately to avoid penalties. The information provided on this form is subject to review by tax authorities, and any discrepancies can lead to audits or fines. It is crucial to adhere to all legal requirements when completing and submitting the form to ensure compliance with New York City tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 Form are critical to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this means the form is generally due by April fifteenth. It is essential to mark your calendar and ensure timely submission to avoid late fees.

Form Submission Methods

The Ct 3 Form can be submitted through various methods. Corporations may file the form online through the New York City Department of Finance website, which offers a streamlined process for electronic submission. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Ensure that you retain copies of the submitted form for your records.

Quick guide on how to complete ct 3 2011 form

Complete Ct 3 Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files quickly and without obstacles. Manage Ct 3 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Ct 3 Form seamlessly

- Obtain Ct 3 Form and click on Get Form to commence.

- Utilize the tools available to complete your form.

- Select pertinent sections of your documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct 3 Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 2011 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3 2011 form

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a Ct 3 Form?

The Ct 3 Form is a tax return specifically designed for corporations in New York City. It allows businesses to report their income, calculate their tax liabilities, and ensure compliance with local regulations. Understanding how to complete the Ct 3 Form is essential for accurate tax reporting.

-

How can airSlate SignNow help with the Ct 3 Form?

AirSlate SignNow allows users to easily create, send, and eSign the Ct 3 Form and other necessary documents. With its intuitive interface, you can streamline your tax preparation process by ensuring that all necessary signatures are obtained electronically. This saves time and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ct 3 Form?

AirSlate SignNow offers various pricing plans tailored to suit different business needs, including those handling the Ct 3 Form. These plans are designed to be cost-effective, ensuring that you get the best value for the features offered. You can choose a plan that fits your budget while ensuring compliance with tax requirements.

-

What features does airSlate SignNow provide for handling the Ct 3 Form?

AirSlate SignNow provides features like eSigning, customizable templates, and secure document storage for easy handling of the Ct 3 Form. Additionally, the platform facilitates real-time collaboration, allowing multiple users to work on the form simultaneously, enhancing efficiency in tax preparation.

-

Can I integrate airSlate SignNow with other software for the Ct 3 Form?

Yes, airSlate SignNow offers integrations with various third-party applications to simplify the process of managing the Ct 3 Form. This includes accounting software and document management systems that can help you streamline tax documentation and compliance processes. Integration ensures a seamless workflow.

-

What are the benefits of using airSlate SignNow for the Ct 3 Form?

Using airSlate SignNow for your Ct 3 Form comes with numerous benefits, including increased efficiency, better compliance, and reduced paper waste. The platform’s electronic signing feature speeds up the approval process, allowing you to file your taxes on time. It also provides a secure way to manage sensitive tax documents.

-

How secure is airSlate SignNow when handling the Ct 3 Form?

AirSlate SignNow prioritizes security, implementing advanced encryption and compliance with industry standards to protect your Ct 3 Form and other sensitive information. User authentication and secure storage ensure that only authorized personnel can access your documents, giving you peace of mind.

Get more for Ct 3 Form

Find out other Ct 3 Form

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple