541 Form 2019

What is the 541 Form

The 541 Form is a tax document used primarily by partnerships and limited liability companies (LLCs) in the United States to report income, deductions, and credits. This form is essential for entities that are treated as partnerships for tax purposes, allowing them to report their income and expenses to the Internal Revenue Service (IRS). The information provided on the 541 Form helps the IRS assess the tax obligations of the entity and its partners.

How to use the 541 Form

Using the 541 Form involves several key steps. First, gather all necessary financial information, including income, expenses, and any deductions applicable to your partnership or LLC. Next, accurately fill out the form, ensuring that all figures are correct and reflect your entity's financial activities for the tax year. Once completed, the form must be submitted to the IRS by the designated deadline, along with any required schedules or attachments that provide additional details on income and deductions.

Steps to complete the 541 Form

Completing the 541 Form requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, including income statements and expense receipts.

- Fill out the identification section, providing the entity's name, address, and Employer Identification Number (EIN).

- Report income by entering total revenue and any other income sources on the form.

- Deduct allowable expenses by listing them in the appropriate sections, ensuring compliance with IRS guidelines.

- Calculate the total taxable income and any credits that may apply.

- Review the completed form for accuracy and completeness before submission.

Legal use of the 541 Form

The 541 Form is legally binding when filled out and submitted according to IRS regulations. It is crucial to ensure that all information is accurate and truthful, as any discrepancies could lead to penalties or audits. The form must be signed by an authorized representative of the partnership or LLC, affirming that the information provided is correct to the best of their knowledge. Compliance with legal requirements helps maintain the integrity of the entity and protects against potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 541 Form are critical to avoid penalties. Generally, the form must be submitted by the fifteenth day of the third month following the end of the tax year. For partnerships and LLCs operating on a calendar year basis, this typically falls on March 15. It is important to keep track of these dates and ensure timely filing to maintain compliance with IRS regulations.

Form Submission Methods

The 541 Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through IRS e-file, which allows for faster processing and confirmation of receipt.

- Mailing a paper copy to the appropriate IRS address, ensuring sufficient postage and tracking if necessary.

- In-person submission at designated IRS offices, though this option may require an appointment.

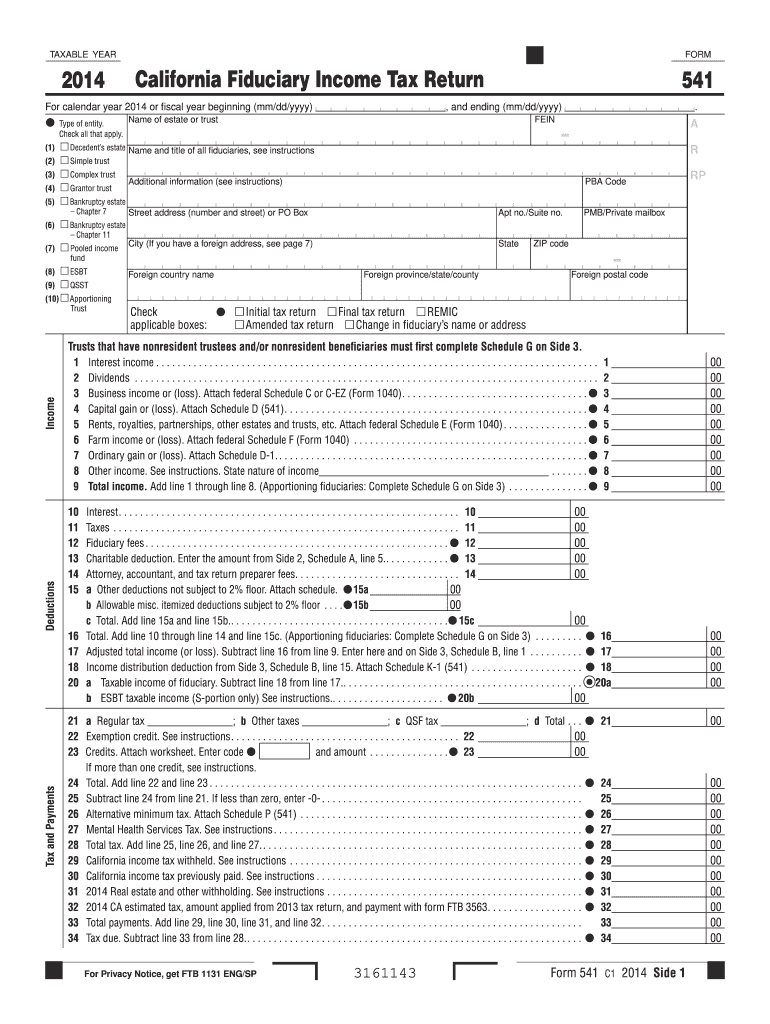

Quick guide on how to complete 2014 541 form

Complete 541 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage 541 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign 541 Form with ease

- Find 541 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign 541 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 541 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 541 form

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is a 541 Form and how is it used?

The 541 Form is a specific document used for various business applications, including filing taxes and reporting financial information. By utilizing airSlate SignNow, businesses can easily create, send, and eSign their 541 Form, ensuring compliance and efficiency in their processes.

-

How does airSlate SignNow simplify the eSigning process for the 541 Form?

airSlate SignNow streamlines the eSigning process for the 541 Form by allowing users to send documents for signature directly from the platform. Its intuitive interface guides users through the signing process, ensuring that every signature and initial is collected promptly and securely.

-

What are the pricing options for using airSlate SignNow for 541 Forms?

airSlate SignNow offers a range of pricing plans to accommodate businesses of all sizes. Whether you need a basic plan for occasional 541 Form eSigning or a premium plan with advanced features, there is an option to meet your needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for 541 Form management?

Yes, airSlate SignNow supports integration with various software solutions, enhancing how you manage your 541 Form and other documents. Popular integrations include CRM systems, project management tools, and cloud storage services, promoting seamless workflows.

-

What are the benefits of using airSlate SignNow for my 541 Form?

Using airSlate SignNow for your 541 Form provides enhanced efficiency and security. You can quickly collect signatures, track document status, and store files securely, eliminating the need for paper-driven processes and reducing turnaround time.

-

Is airSlate SignNow compliant with legal standards for eSigning the 541 Form?

Absolutely! airSlate SignNow complies with all legal standards and regulations for electronic signatures, including the ESIGN Act and UETA. This ensures that your signed 541 Form holds the same legal weight as a traditional handwritten signature.

-

How can I track the status of my 541 Form using airSlate SignNow?

airSlate SignNow provides real-time tracking for your 541 Form, allowing you to see when the document is sent, viewed, and signed. This feature helps you manage your workflow efficiently and ensures timely completion of all required signatures.

Get more for 541 Form

- Student name rater date form

- Synthes large ex fix inventory form

- Facta alert validation form

- Uhs rechecking form

- Reference ccs entry form

- Bayer womens healthcare cupport benefit investigation request form

- Informed consent for image treatments

- Live blood analysis consent form health coach naturopathic

Find out other 541 Form

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure