592 Form 2021

What is the 592 Form

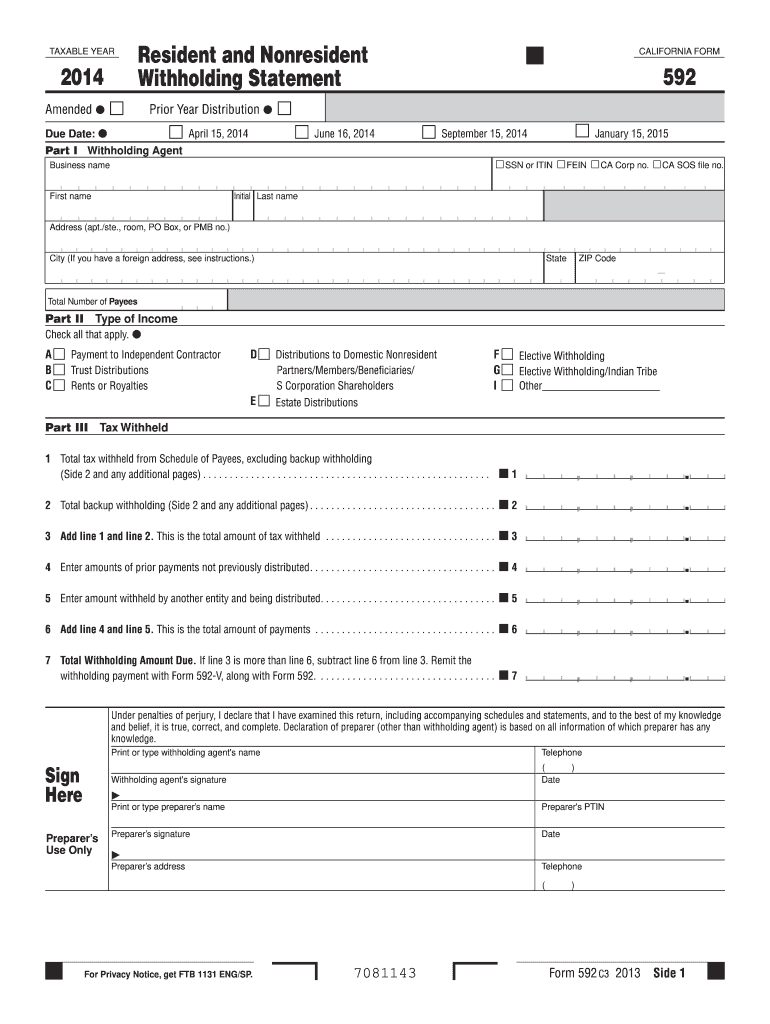

The 592 Form is a tax document used primarily in the United States for reporting California source income paid to non-residents. This form is essential for ensuring compliance with California tax laws regarding income earned by individuals or entities that do not reside in the state. It serves as a means for withholding agents to report and remit taxes on behalf of non-resident recipients, ensuring that the appropriate tax obligations are met.

How to use the 592 Form

Using the 592 Form involves several steps to ensure accurate reporting and compliance. First, determine if you need to file the form based on the income type and the residency status of the recipient. Next, gather all necessary information, including the recipient's name, address, and taxpayer identification number. Fill out the form accurately, detailing the income amounts and any tax withheld. Finally, submit the completed form to the California Franchise Tax Board by the designated deadline.

Steps to complete the 592 Form

Completing the 592 Form involves a systematic approach:

- Identify the income type and confirm the non-resident status of the recipient.

- Collect required information, including the recipient's details and income amounts.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate the total tax withheld and report it on the form.

- Review the completed form for accuracy before submission.

- Submit the form to the California Franchise Tax Board by the due date.

Legal use of the 592 Form

The legal use of the 592 Form is crucial for compliance with California tax regulations. This form is legally binding and must be filed correctly to avoid penalties. It ensures that non-resident income is reported and taxed appropriately, protecting both the withholding agent and the recipient from potential legal issues. Understanding the legal implications of using the 592 Form helps ensure that all parties fulfill their tax obligations under California law.

IRS Guidelines

While the 592 Form is specific to California, it is important to consider IRS guidelines when filing. The IRS requires that all income, including that of non-residents, be reported accurately. The 592 Form must align with federal tax regulations, ensuring that the information reported is consistent with IRS requirements. This alignment helps prevent discrepancies that could lead to audits or penalties from the IRS.

Form Submission Methods

The 592 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the California Franchise Tax Board's website.

- Mailing a physical copy of the form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can streamline the filing process and ensure timely compliance with tax obligations.

Quick guide on how to complete 2014 592 form

Manage 592 Form effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without interruptions. Manage 592 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign 592 Form with ease

- Obtain 592 Form and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and hit the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from the device of your choice. Edit and eSign 592 Form and ensure excellent communication at any step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 592 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 592 form

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is a 592 Form?

The 592 Form is a tax form used to report income earned by non-resident aliens and foreign entities. It is essential for compliance with California tax regulations. Understanding the 592 Form can help ensure accurate tax reporting and avoid potential penalties.

-

How can airSlate SignNow help with processing the 592 Form?

airSlate SignNow simplifies the process of creating and eSigning the 592 Form, making it easy to manage your documents online. With our intuitive interface, you can prepare and send this important tax form quickly and securely. Plus, you can ensure that all necessary signatures are obtained without the hassle of printing.

-

What features does airSlate SignNow offer for managing the 592 Form?

Our platform offers features like customizable templates, secure storage, and real-time tracking, specifically designed to facilitate the filling out and signing of the 592 Form. You can also create automated workflows to streamline your document management process. These features save time and enhance accuracy in tax documentation.

-

Is airSlate SignNow cost-effective for businesses needing the 592 Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses that need to manage the 592 Form. Our pricing plans are designed to fit various business sizes and needs, ensuring that you don't overpay for functionality. You can start with a free trial to see how we can save you both time and money.

-

Can I integrate airSlate SignNow into my existing systems for handling the 592 Form?

Absolutely! airSlate SignNow offers seamless integrations with various platforms, allowing you to connect your existing systems for managing the 592 Form. Whether you use CRM tools or document management systems, our integration options ensure a smooth workflow.

-

How does eSigning the 592 Form work with airSlate SignNow?

eSigning the 592 Form with airSlate SignNow is a straightforward process. You can upload the document, add required fields for signatures, and send it out to recipients via email. Subsequently, the signers can electronically sign the document, ensuring compliance and expediting the completion process.

-

What are the benefits of using airSlate SignNow for the 592 Form?

Using airSlate SignNow for the 592 Form offers several benefits, including increased efficiency, reduced errors, and secure document handling. With our platform, you can easily track document status and ensure that everything is completed on time, which is crucial for tax compliance and reporting.

Get more for 592 Form

- National park puzzle pages printable form

- Avis de reprise de logement pdf form

- Bharti axa form

- Telehealth encounter form

- Rd 108t trade in credit form state of michigan michigan

- State of connecticut criminal history record request form

- T4 summary fillable form

- Download the order form augsburg fortress canada

Find out other 592 Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF