Ca Form 588 2020

What is the Ca Form 588

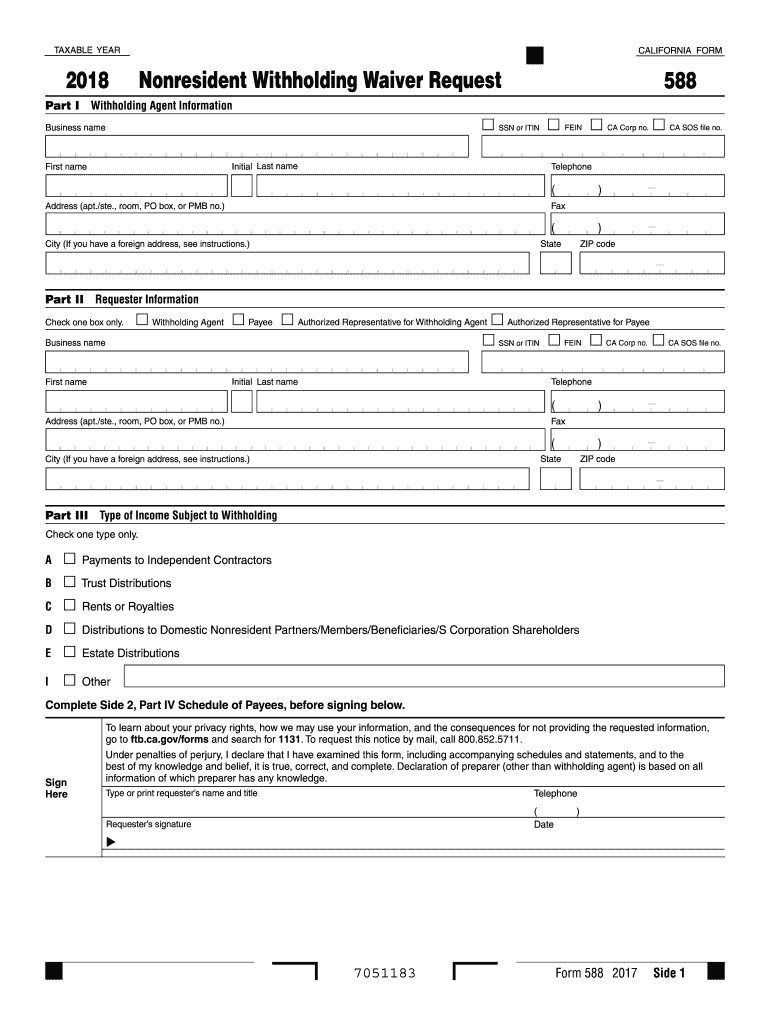

The Ca Form 588, also known as the "Nonresident Withholding Agreement," is a crucial document used in California for tax purposes. It is primarily designed for nonresident individuals or entities that earn income in California. This form helps ensure that the correct amount of state income tax is withheld from payments made to nonresidents. Understanding the Ca Form 588 is essential for compliance with California tax laws, as it outlines the obligations of both the payer and the payee regarding withholding tax responsibilities.

How to use the Ca Form 588

Using the Ca Form 588 involves several key steps. First, the nonresident must complete the form accurately, providing necessary details such as name, address, and taxpayer identification number. The form must then be submitted to the payer, who is responsible for withholding the appropriate amount of tax from payments made to the nonresident. It is important for both parties to retain copies of the completed form for their records. Additionally, the payer must remit the withheld taxes to the California Franchise Tax Board according to the established deadlines.

Steps to complete the Ca Form 588

Completing the Ca Form 588 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Ca Form 588 from the California Franchise Tax Board.

- Fill in the required information, including the nonresident's name, address, and taxpayer identification number.

- Indicate the type of income being received and the applicable withholding rate.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the payer before any payments are made.

Legal use of the Ca Form 588

The legal use of the Ca Form 588 is essential for ensuring compliance with California tax regulations. When properly completed and submitted, the form provides a legal basis for withholding taxes from payments made to nonresidents. It is important to ensure that all information is accurate and that the form is filed in a timely manner to avoid potential penalties. The California Franchise Tax Board recognizes the Ca Form 588 as a valid document for establishing withholding obligations, making it a vital part of tax compliance for nonresidents earning income in the state.

Key elements of the Ca Form 588

Several key elements are essential to the Ca Form 588. These include:

- Identification Information: This includes the name, address, and taxpayer identification number of the nonresident.

- Income Type: The form requires the specification of the type of income being received, such as rental income or wages.

- Withholding Rate: The applicable withholding rate must be indicated based on the type of income and the nonresident's tax status.

- Signature: The form must be signed and dated by the nonresident to validate the information provided.

Who Issues the Form

The Ca Form 588 is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's tax laws and ensuring compliance among taxpayers. Nonresidents who earn income in California must utilize this form to establish their withholding tax obligations. It is advisable to refer to the FTB's official resources for the most current version of the form and any updates to the filing process.

Quick guide on how to complete ca form 588 2012

Effortlessly Prepare Ca Form 588 on Any Device

Digital document administration has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly, without holdups. Manage Ca Form 588 across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The most efficient method to modify and eSign Ca Form 588 effortlessly

- Find Ca Form 588 and click Get Form to begin.

- Use the tools at your disposal to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or inaccuracies that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Modify and eSign Ca Form 588 to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca form 588 2012

Create this form in 5 minutes!

How to create an eSignature for the ca form 588 2012

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ca Form 588 and why is it important?

The Ca Form 588 is a necessary form for entities seeking to claim exemption from California withholding tax. It allows businesses to document their eligibility for tax benefits within California, making it vital for compliance and financial accuracy. Utilizing airSlate SignNow to eSign this form ensures it is processed swiftly and securely.

-

How does airSlate SignNow streamline the process of filling out the Ca Form 588?

airSlate SignNow simplifies the Ca Form 588 process by providing an intuitive interface that allows for easy data entry and customizable templates. Users can complete, sign, and send the form in one seamless workflow, reducing manual errors and saving time. This efficiency ensures your documentation is completed as quickly as possible.

-

What are the key features of airSlate SignNow for managing the Ca Form 588?

With airSlate SignNow, users benefit from features like reusable templates, multi-party signing, and secure storage for the Ca Form 588. These features facilitate collaboration and ensure that all necessary parties can review and sign documents without delays. Additionally, the platform offers real-time tracking and notifications.

-

Is airSlate SignNow cost-effective for handling documents like the Ca Form 588?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage documents, including the Ca Form 588. Plans are competitively priced, allowing businesses of all sizes to streamline their workflows without breaking the bank. The savings gained from improved efficiency often outweigh the costs.

-

Can I integrate airSlate SignNow with other software for managing the Ca Form 588?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing users to streamline the management of the Ca Form 588 alongside other business tools. This integration means that you can synchronize your document processes with customer relationship management (CRM) software, accounting systems, and more.

-

How secure is airSlate SignNow when handling sensitive forms like the Ca Form 588?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the Ca Form 588. The platform employs advanced encryption methods and complies with industry standards to protect your data. This ensures that your information remains confidential and secure during the signing process.

-

Can airSlate SignNow assist in keeping track of amendments to the Ca Form 588?

Yes, airSlate SignNow has robust tracking capabilities that help users manage amendments to the Ca Form 588 efficiently. The platform allows easy access to archived versions of documents, making it simple to reference past submissions and changes. This feature aids in maintaining compliance and accurate records over time.

Get more for Ca Form 588

Find out other Ca Form 588

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure