Form 590 P 2019

What is the Form 590 P

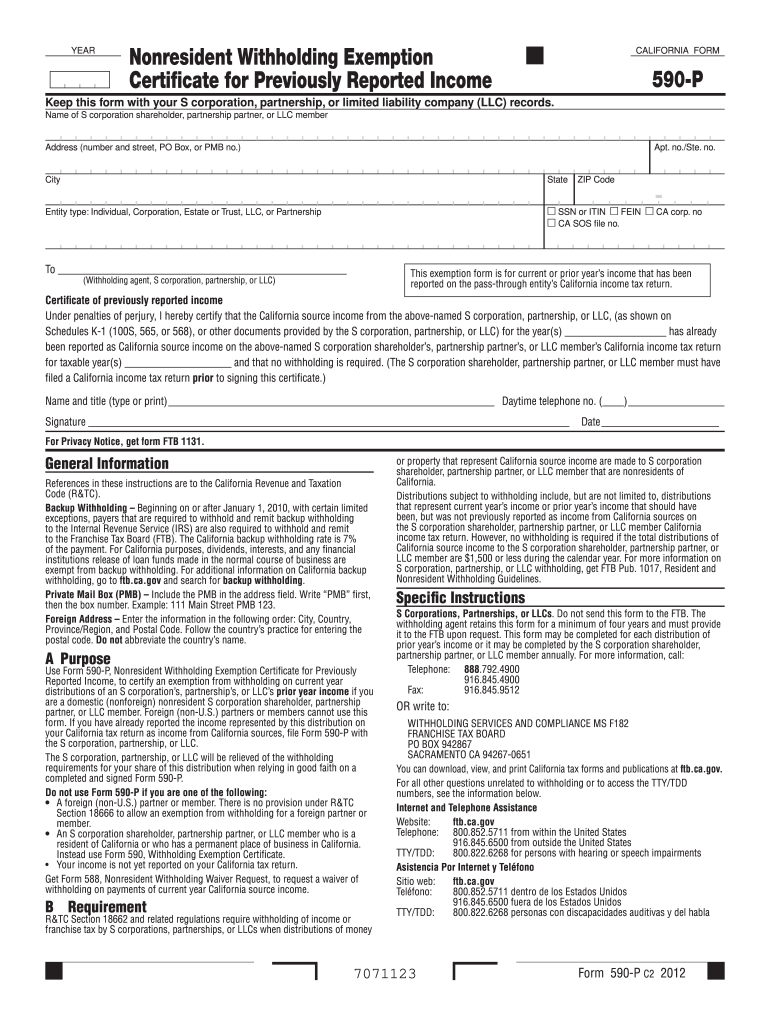

The Form 590 P is a tax form used in the United States for reporting the withholding of California state taxes. It is specifically designed for individuals and entities that are required to report California source income. The form serves as a declaration of the tax withheld on payments made to non-residents and is crucial for ensuring compliance with California tax regulations. Understanding its purpose and requirements is essential for accurate tax reporting and avoidance of penalties.

How to use the Form 590 P

Using the Form 590 P involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant income documents that pertain to California source income. Next, fill out the form by providing details such as the payer's information, the recipient's information, and the amount of tax withheld. After completing the form, review it carefully to confirm that all entries are correct. Finally, submit the form to the appropriate tax authority as specified in the instructions.

Steps to complete the Form 590 P

Completing the Form 590 P requires careful attention to detail. Follow these steps:

- Begin by downloading the latest version of the form from the California Franchise Tax Board website.

- Fill in the payer's name, address, and identification number.

- Provide the recipient's name, address, and identification number.

- Specify the amount of California source income and the tax withheld.

- Sign and date the form to certify the accuracy of the information provided.

Legal use of the Form 590 P

The legal use of the Form 590 P is governed by California tax laws. Proper completion and submission of this form are essential for compliance with state regulations regarding tax withholding. Failure to use the form correctly can result in penalties, including fines and interest on unpaid taxes. It is important to ensure that all information is accurate and that the form is submitted by the specified deadlines to avoid legal complications.

Key elements of the Form 590 P

Several key elements must be included in the Form 590 P to ensure its validity:

- Payer's name and address

- Recipient's name and address

- Identification numbers for both payer and recipient

- Details of the California source income

- The total amount of tax withheld

- Signature of the payer

- Date of completion

Form Submission Methods

The Form 590 P can be submitted through various methods, depending on the preferences of the payer. The primary submission methods include:

- Online submission through the California Franchise Tax Board's e-file system.

- Mailing a physical copy of the form to the appropriate tax office.

- In-person delivery at designated tax offices.

Quick guide on how to complete form 590 p 2013

Complete Form 590 P seamlessly on any device

Digital document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Form 590 P on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Form 590 P effortlessly

- Find Form 590 P and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 590 P and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 590 p 2013

Create this form in 5 minutes!

How to create an eSignature for the form 590 p 2013

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 590 P and how does it work with airSlate SignNow?

Form 590 P is a document essential for businesses as it certifies your entity’s residency status for tax purposes. With airSlate SignNow, you can easily prepare, send, and eSign Form 590 P electronically, streamlining your workflow and ensuring compliance.

-

How much does it cost to use airSlate SignNow for Form 590 P?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The costs depend on the features you select, but using airSlate SignNow to manage Form 590 P is an affordable option compared to traditional methods, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing Form 590 P?

AirSlate SignNow provides a range of features, including customizable templates, automated workflows, and secure cloud storage specifically for Form 590 P. These features simplify the process of preparing and managing your documents, ensuring accuracy and compliance.

-

Can I integrate airSlate SignNow with other software for managing Form 590 P?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your ability to manage Form 590 P alongside other workflows. This integration helps streamline processes and improves overall efficiency, making document management more cohesive.

-

What are the benefits of using airSlate SignNow for electronic signatures on Form 590 P?

Using airSlate SignNow for electronic signatures on Form 590 P enhances security and expedites the signing process. It ensures your documents are signed promptly and securely, saving time and fostering better collaboration between parties involved.

-

Is airSlate SignNow user-friendly for preparing Form 590 P?

Absolutely! airSlate SignNow is designed with a user-friendly interface that makes preparing Form 590 P straightforward. You can quickly create and edit your documents without any hassle, even if you're not tech-savvy.

-

How does airSlate SignNow ensure the security of Form 590 P documents?

AirSlate SignNow prioritizes the security of your documents, including Form 590 P, using encryption and secure data storage measures. These protocols ensure that sensitive information remains protected throughout the signing and storage process.

Get more for Form 590 P

Find out other Form 590 P

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe