2019-2026 Form

What is the California Nonresident K 1100s Form

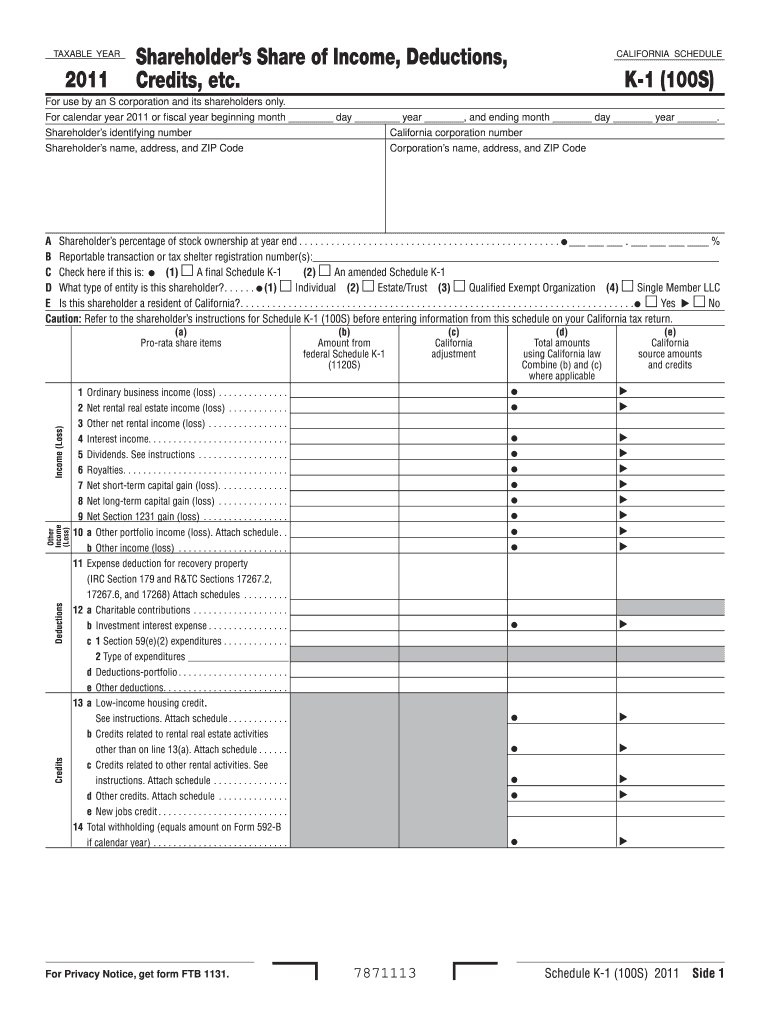

The California Nonresident K-1100S Form is a tax document used by nonresident individuals who earn income from California sources. This form allows nonresidents to report their California income and calculate their tax liability. It is essential for ensuring compliance with California tax laws and for determining the correct amount of state tax owed. Nonresidents must accurately complete this form to avoid penalties and ensure proper tax reporting.

How to use the California Nonresident K 1100s Form

Using the California Nonresident K-1100S Form involves several steps. First, gather all necessary information regarding your income earned in California. This includes wages, interest, dividends, and any other income sources. Next, accurately fill out the form, ensuring that all figures are correct and that you provide any required supporting documentation. After completing the form, review it for accuracy before submitting it to the California Franchise Tax Board. This process helps ensure that your tax obligations are met and minimizes the risk of errors.

Steps to complete the California Nonresident K 1100s Form

Completing the California Nonresident K-1100S Form involves a systematic approach:

- Gather your income documents, including W-2s and 1099s.

- Download the latest version of the K-1100S Form from the California Franchise Tax Board website.

- Fill in your personal information, including your name, address, and identification number.

- Report your California source income accurately in the designated sections.

- Calculate your total tax liability based on the provided instructions.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the submission guidelines.

Key elements of the California Nonresident K 1100s Form

The California Nonresident K-1100S Form includes several key elements that are crucial for accurate tax reporting. These elements typically include:

- Personal Information: Name, address, and identification number of the taxpayer.

- Income Reporting: Sections for detailing California source income, including wages and business income.

- Tax Calculation: A section for calculating the total tax owed based on reported income.

- Signature: A required signature to validate the form and confirm accuracy.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the California Nonresident K-1100S Form is essential to avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year being reported. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the deadlines each tax year to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The California Nonresident K-1100S Form can be submitted through various methods. Taxpayers have the option to file online using the California Franchise Tax Board's e-file services, which provide a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate address specified by the Franchise Tax Board. In-person submission is generally not available for this form, but taxpayers can visit local offices for assistance if needed. Choosing the right submission method can streamline the filing process and ensure compliance.

Quick guide on how to complete california nonresident k 1100s 2011 form

Finalise [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow offers all the resources you require to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Formulate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Adjust and electronically sign [SKS] to ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california nonresident k 1100s 2011 form

Related searches to California Nonresident K 1100s Form

Create this form in 5 minutes!

How to create an eSignature for the california nonresident k 1100s 2011 form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the California Nonresident K 1100s Form?

The California Nonresident K 1100s Form is a tax document used by nonresidents in California to report income earned in the state. It offers a streamlined way for nonresident taxpayers to comply with state tax regulations. Understanding this form is essential for managing California tax obligations accurately.

-

Who needs to file the California Nonresident K 1100s Form?

Nonresidents who earn California-sourced income are required to file the California Nonresident K 1100s Form. This includes individuals and entities that receive income from California businesses, rentals, or investments. Filing this form ensures proper reporting and tax compliance.

-

How can airSlate SignNow assist with the California Nonresident K 1100s Form?

airSlate SignNow simplifies the process of completing and eSigning the California Nonresident K 1100s Form. With our user-friendly platform, you can easily fill out, send, and securely sign documents online. Our service streamlines collaboration and ensures a fast turnaround.

-

What are the pricing options for using airSlate SignNow for California Nonresident K 1100s Form?

airSlate SignNow offers a variety of pricing plans tailored to meet your business needs, starting with a free trial. Each plan includes access to essential features for managing documents like the California Nonresident K 1100s Form. Visit our pricing page for detailed information on features and costs.

-

What features does airSlate SignNow provide for managing forms like the California Nonresident K 1100s Form?

airSlate SignNow provides features such as customizable templates, easy eSigning, and secure document storage. These tools make it efficient to manage the California Nonresident K 1100s Form and other important documents. Additionally, users can track the status of sent forms in real-time.

-

Are there any integrations available with airSlate SignNow for filing the California Nonresident K 1100s Form?

Yes, airSlate SignNow offers integrations with various popular applications to help streamline your workflow. This includes integration with CRM systems, cloud storage, and accounting software. These integrations simplify the process of filling out and filing the California Nonresident K 1100s Form.

-

What benefits do users of airSlate SignNow experience when dealing with the California Nonresident K 1100s Form?

Users of airSlate SignNow benefit from enhanced efficiency, ensuring that the California Nonresident K 1100s Form is completed and submitted on time. The platform eliminates paperwork hassles and reduces processing time. Additionally, users appreciate the security features and ease of use.

Get more for California Nonresident K 1100s Form

- Georgia corporation form

- Oregon living form

- Ca poa form

- Connecticut business corporation form

- Music legal documents form

- Texas lease agreement form

- California living wills and health care package form

- Maryland marital domestic separation and property settlement agreement minor children parties may have joint property or debts form

Find out other California Nonresident K 1100s Form

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free