Online Ftb State of Ca Schedule K 1 for S Corp Form 2019

What is the Online Ftb State Of Ca Schedule K 1 For S Corp Form

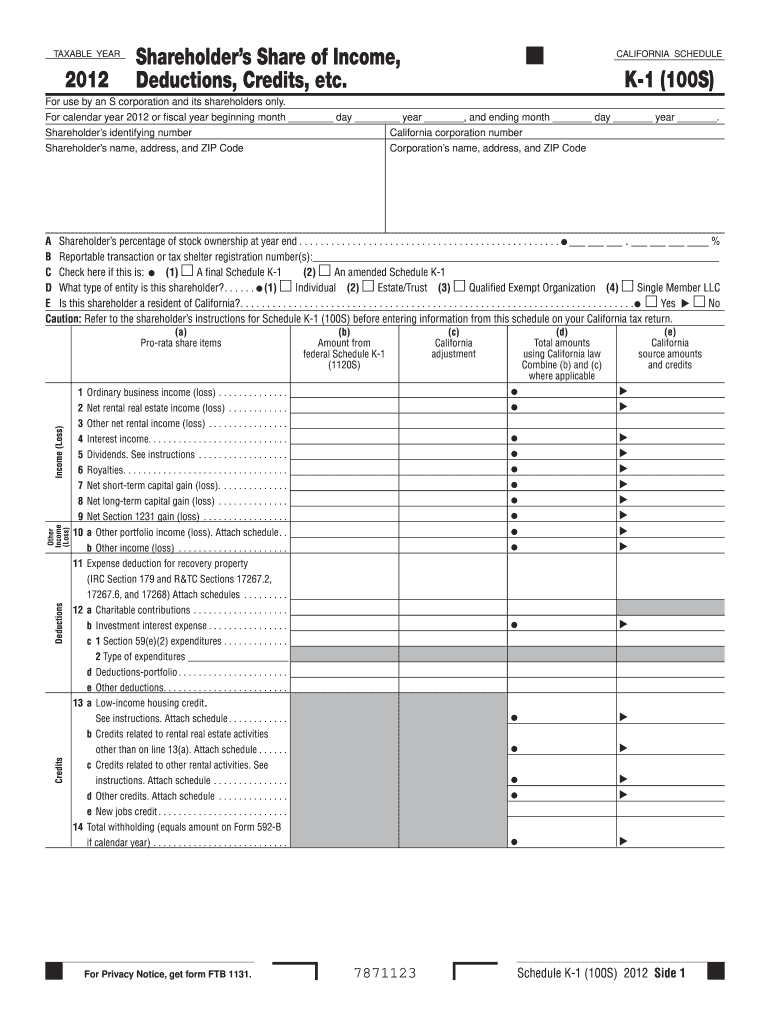

The Online Ftb State Of Ca Schedule K-1 for S Corp Form is a tax document used by S corporations in California to report income, deductions, and credits to shareholders. This form is essential for shareholders to accurately report their share of the corporation's income on their personal tax returns. The information provided on the Schedule K-1 helps ensure compliance with state tax regulations and provides transparency regarding the financial performance of the S corporation.

Steps to Complete the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Completing the Online Ftb State Of Ca Schedule K-1 for S Corp Form involves several steps:

- Access the form through the California Franchise Tax Board's website.

- Enter the S corporation's identifying information, including the name, address, and Employer Identification Number (EIN).

- Input the shareholder's details, including their name, address, and ownership percentage.

- Report the corporation's income, deductions, and credits as applicable.

- Review the information for accuracy before submission.

- Submit the completed form electronically or print it for mailing.

Legal Use of the Online Ftb State Of Ca Schedule K 1 For S Corp Form

The Online Ftb State Of Ca Schedule K-1 for S Corp Form is legally binding when completed and submitted according to California tax laws. To ensure its legality, the form must be filled out accurately, reflecting the true financial position of the S corporation. Compliance with eSignature laws is crucial if the form is submitted electronically, as it provides the necessary validation and security for both the corporation and its shareholders.

Key Elements of the Online Ftb State Of Ca Schedule K 1 For S Corp Form

Key elements of the Online Ftb State Of Ca Schedule K-1 for S Corp Form include:

- Shareholder Information: Name, address, and ownership percentage.

- Income Reporting: Details on ordinary business income, rental income, and other income types.

- Deductions and Credits: Information on deductions for expenses and credits applicable to shareholders.

- Signature: Required for validation when submitting electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Online Ftb State Of Ca Schedule K-1 for S Corp Form typically align with the tax return deadlines for S corporations. Generally, S corporations must file their tax returns by the fifteenth day of the third month after the end of their fiscal year. For most corporations operating on a calendar year, this means the deadline is March 15. Shareholders should receive their K-1 forms by this date to accurately complete their personal tax returns.

Form Submission Methods

The Online Ftb State Of Ca Schedule K-1 for S Corp Form can be submitted through various methods:

- Online Submission: Directly through the California Franchise Tax Board's e-filing system.

- Mail: Printed forms can be mailed to the appropriate tax authority.

- In-Person: Forms can be submitted at designated tax offices if required.

Quick guide on how to complete online ftb state of ca schedule k 1 for s corp 2012 form

Complete Online Ftb State Of Ca Schedule K 1 For S Corp Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute to traditional printed and signed documents, enabling you to access the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, alter, and eSign your documents quickly and without interruptions. Handle Online Ftb State Of Ca Schedule K 1 For S Corp Form on any device using airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to modify and eSign Online Ftb State Of Ca Schedule K 1 For S Corp Form with ease

- Locate Online Ftb State Of Ca Schedule K 1 For S Corp Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that aim.

- Create your signature with the Sign tool, which takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Online Ftb State Of Ca Schedule K 1 For S Corp Form to guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct online ftb state of ca schedule k 1 for s corp 2012 form

Create this form in 5 minutes!

How to create an eSignature for the online ftb state of ca schedule k 1 for s corp 2012 form

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

The Online Ftb State Of Ca Schedule K 1 For S Corp Form is a tax document that outlines each shareholder's share of income, deductions, and credits from the S corporation. It is essential for reporting to the IRS and the state of California. Completing this form online ensures accuracy and compliance with state requirements.

-

How can airSlate SignNow help me with the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

airSlate SignNow simplifies the process of filling out and eSigning the Online Ftb State Of Ca Schedule K 1 For S Corp Form. Our platform allows you to easily create, send, and manage your tax documents securely. This saves you time and reduces the risk of errors during tax season.

-

Is there a cost associated with using airSlate SignNow for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Yes, there is a subscription fee for using airSlate SignNow, but it's designed to be cost-effective for businesses. Our plans start with a basic option that provides access to essential features, making it affordable for users needing the Online Ftb State Of Ca Schedule K 1 For S Corp Form. You can choose a plan that best fits your business needs.

-

Is airSlate SignNow secure for submitting my Online Ftb State Of Ca Schedule K 1 For S Corp Form?

Absolutely! airSlate SignNow prioritizes your security with advanced encryption and secure storage of your data. When you submit your Online Ftb State Of Ca Schedule K 1 For S Corp Form, you can trust that your sensitive information is protected against unauthorized access.

-

Can I track the status of my Online Ftb State Of Ca Schedule K 1 For S Corp Form in airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Online Ftb State Of Ca Schedule K 1 For S Corp Form. This way, you can easily see when the document has been viewed and signed by all parties involved, ensuring a smooth process.

-

What integrations does airSlate SignNow offer for the Online Ftb State Of Ca Schedule K 1 For S Corp Form?

airSlate SignNow integrates with various apps and services, enhancing your workflow while handling the Online Ftb State Of Ca Schedule K 1 For S Corp Form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems for seamless document management and storage.

-

Do I need to install software to use airSlate SignNow for my Online Ftb State Of Ca Schedule K 1 For S Corp Form?

No installation is required! airSlate SignNow is a cloud-based platform, meaning you can access it from any device with an internet connection. Simply log in to your account, and you'll be able to complete your Online Ftb State Of Ca Schedule K 1 For S Corp Form without any software downloads.

Get more for Online Ftb State Of Ca Schedule K 1 For S Corp Form

Find out other Online Ftb State Of Ca Schedule K 1 For S Corp Form

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form