Ifta Texas Form 2019

What is the Ifta Texas Form

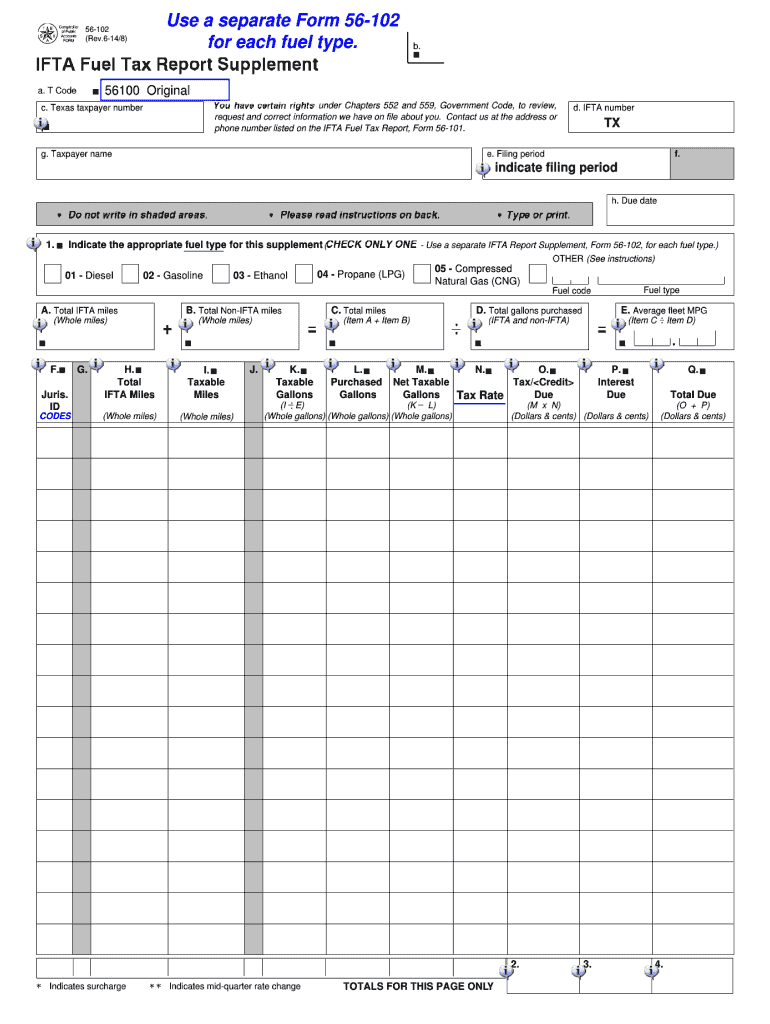

The Ifta Texas Form is a crucial document used by motor carriers to report and pay fuel taxes across multiple jurisdictions within the United States and Canada. The International Fuel Tax Agreement (IFTA) simplifies the fuel tax reporting process for interstate commercial carriers. This form allows carriers to consolidate their fuel tax reporting, ensuring compliance with state regulations while minimizing administrative burdens.

How to obtain the Ifta Texas Form

To obtain the Ifta Texas Form, individuals and businesses can visit the official website of the Texas Comptroller of Public Accounts. The form is typically available for download in PDF format, allowing users to print and complete it manually. Additionally, carriers may contact their local tax office for assistance in acquiring the form and understanding any specific requirements related to their operations.

Steps to complete the Ifta Texas Form

Completing the Ifta Texas Form involves several key steps:

- Gather necessary information: Collect data on fuel purchases, miles driven in each jurisdiction, and any exemptions that may apply.

- Fill out the form: Enter the required information accurately, ensuring that all calculations are correct.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties or delays.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, as outlined by state guidelines.

Legal use of the Ifta Texas Form

The Ifta Texas Form is legally binding when completed and submitted according to state regulations. It is essential for motor carriers to ensure that all information provided is truthful and accurate. Misrepresentation or failure to comply with IFTA regulations can result in significant penalties, including fines and interest on unpaid taxes. Understanding the legal implications of the form is vital for maintaining compliance and avoiding legal issues.

Key elements of the Ifta Texas Form

Several key elements must be included in the Ifta Texas Form:

- Carrier information: Details such as the name, address, and IFTA account number of the motor carrier.

- Fuel usage: A breakdown of fuel purchases by jurisdiction, including gallons purchased and total costs.

- Mileage records: Total miles driven in each jurisdiction, categorized by type of vehicle.

- Tax calculations: Accurate calculations of taxes owed based on fuel usage and mileage.

Filing Deadlines / Important Dates

Filing deadlines for the Ifta Texas Form are typically set quarterly. Carriers must submit their forms by the end of the month following the close of each quarter. Important dates to remember include:

- Quarter 1: Due by April 30

- Quarter 2: Due by July 31

- Quarter 3: Due by October 31

- Quarter 4: Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The Ifta Texas Form can be submitted through various methods, providing flexibility for carriers:

- Online: Many states offer online filing options through their tax agency websites, allowing for quick and efficient submissions.

- Mail: Carriers can print the completed form and send it via postal service to the designated state tax office.

- In-Person: Submissions can also be made in person at local tax offices, where assistance may be available for any questions or concerns.

Quick guide on how to complete ifta texas 2014 form

Prepare Ifta Texas Form effortlessly on any device

Online document administration has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without interruptions. Manage Ifta Texas Form on any device with airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to edit and eSign Ifta Texas Form with ease

- Locate Ifta Texas Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Ifta Texas Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta texas 2014 form

Create this form in 5 minutes!

How to create an eSignature for the ifta texas 2014 form

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Ifta Texas Form?

The Ifta Texas Form is a crucial document used for the International Fuel Tax Agreement which simplifies the reporting of fuel use by motor carriers. It allows businesses to report fuel taxes for operations in multiple jurisdictions from a single form, making it essential for compliance in Texas.

-

How can airSlate SignNow help with the Ifta Texas Form?

airSlate SignNow streamlines the process of filling out and eSigning the Ifta Texas Form. Our user-friendly interface allows you to complete the form digitally, ensuring efficiency and accuracy while meeting Texas state requirements.

-

What are the benefits of using airSlate SignNow for the Ifta Texas Form?

Using airSlate SignNow for the Ifta Texas Form offers various benefits, including improved document accuracy, time savings, and enhanced compliance. With eSigning capabilities, you can quickly obtain necessary signatures, ensuring a faster filing process.

-

Is there a cost associated with using airSlate SignNow for the Ifta Texas Form?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our service provides signNow value, enabling you to manage your Ifta Texas Form and other documents cost-effectively while ensuring compliance.

-

Can I integrate airSlate SignNow with other software for managing my Ifta Texas Form?

Yes, airSlate SignNow seamlessly integrates with various software platforms, allowing you to manage the Ifta Texas Form alongside your existing workflows. This integration can enhance data flow and ensure that all necessary information is efficiently processed.

-

What features does airSlate SignNow offer for the Ifta Texas Form?

airSlate SignNow offers a range of features tailored for the Ifta Texas Form, including customizable templates, eSigning, document sharing, and tracking. These features enhance productivity and simplify document management for businesses.

-

How secure is my data when using airSlate SignNow for the Ifta Texas Form?

The security of your data is a top priority at airSlate SignNow. We employ advanced encryption methods and comply with industry standards to protect your information while you complete the Ifta Texas Form.

Get more for Ifta Texas Form

Find out other Ifta Texas Form

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple