Virginia Form R 1 2020

What is the Virginia Form R 1

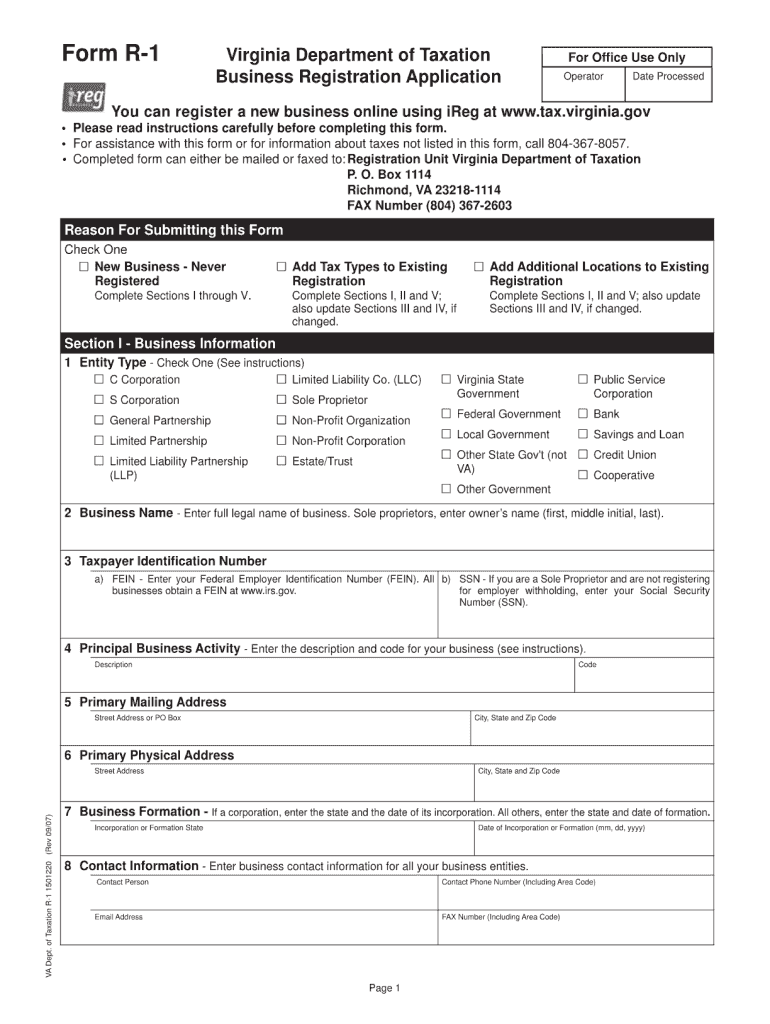

The Virginia Form R-1 is a tax form used primarily by businesses in Virginia to report and remit withholding tax. This form is essential for employers who withhold income tax from employee wages, ensuring compliance with state tax regulations. It serves as a summary of the total amount withheld during a specific period and is typically submitted on a quarterly or annual basis, depending on the employer's tax obligations.

How to use the Virginia Form R 1

To use the Virginia Form R-1 effectively, employers must first gather all relevant payroll information for the reporting period. This includes total wages paid, the amount withheld for state income tax, and any adjustments for prior periods. Once this data is compiled, employers fill out the form accurately, ensuring that all figures reflect the actual amounts withheld. After completing the form, it must be submitted to the Virginia Department of Taxation along with any payment due for the withheld taxes.

Steps to complete the Virginia Form R 1

Completing the Virginia Form R-1 involves several key steps:

- Gather payroll records for the reporting period.

- Calculate total wages paid to employees.

- Determine the total amount of state income tax withheld.

- Fill out the form, ensuring all information is accurate.

- Review the form for any errors or omissions.

- Submit the completed form and payment to the Virginia Department of Taxation.

Legal use of the Virginia Form R 1

The Virginia Form R-1 is legally binding when completed accurately and submitted on time. Employers are required by law to withhold state income tax from employee wages and report this information to the state. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is crucial for businesses to maintain accurate records and ensure timely submission to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form R-1 vary based on the reporting period. Generally, employers must file quarterly, with deadlines typically falling on the last day of the month following the end of each quarter. For annual filers, the deadline is usually January 31 of the following year. It is important for employers to be aware of these dates to ensure compliance and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Virginia Form R-1 can be submitted through various methods. Employers have the option to file online through the Virginia Department of Taxation's website, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate address provided by the state or submitted in person at designated tax offices. Each method has its own processing times and requirements, so employers should choose the one that best suits their needs.

Quick guide on how to complete virginia form r 1 2007

Manage Virginia Form R 1 effortlessly on any device

Digital document management has become a go-to solution for companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your paperwork swiftly without interruptions. Handle Virginia Form R 1 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Virginia Form R 1 with ease

- Obtain Virginia Form R 1 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Virginia Form R 1 and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct virginia form r 1 2007

Create this form in 5 minutes!

How to create an eSignature for the virginia form r 1 2007

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is Virginia Form R 1 and how can airSlate SignNow help?

Virginia Form R 1 is a tax document that can be complex to handle. airSlate SignNow simplifies the process by allowing businesses to fill out, sign, and send Virginia Form R 1 electronically, ensuring compliance and efficient document management.

-

Is airSlate SignNow a cost-effective solution for managing Virginia Form R 1?

Yes, airSlate SignNow provides a budget-friendly option for managing Virginia Form R 1. With tiered pricing plans, businesses can choose the one that best fits their needs, ensuring affordability without compromising on features.

-

What features does airSlate SignNow offer for Virginia Form R 1?

airSlate SignNow offers several features for Virginia Form R 1, including customizable templates, secure eSigning, and seamless document sharing. These features streamline the preparation and submission of Virginia Form R 1, making it easier for businesses to comply with state regulations.

-

Can I integrate airSlate SignNow with other software for handling Virginia Form R 1?

Absolutely! airSlate SignNow integrates with various applications, enhancing your workflow for Virginia Form R 1. This allows you to connect with your existing software systems, boosting efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for Virginia Form R 1?

Using airSlate SignNow for Virginia Form R 1 offers numerous benefits, including faster processing times and reduced paperwork. The platform ensures that your documents are legally compliant and securely stored, giving businesses peace of mind.

-

Is it easy to navigate airSlate SignNow when filling out Virginia Form R 1?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface makes it easy for anyone to navigate and complete Virginia Form R 1, regardless of their technical expertise.

-

How secure is airSlate SignNow for handling Virginia Form R 1?

Security is a top priority with airSlate SignNow. When dealing with Virginia Form R 1, your data is protected through advanced encryption and secure access controls, ensuring that sensitive information remains confidential.

Get more for Virginia Form R 1

- Notice to enter dwelling form

- Aarp retirement budget worksheet excel form

- Modified checklist for autism in toddlers form

- Henry county business license application form

- Cdtfa 65 460809060 form

- Preemployment questionnaire equal opportunity employer application for employment personal information date name last name

- Application form yef version 261213 sme bank

- Uncontested stipulated parentage judgment forms packet

Find out other Virginia Form R 1

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form