Virginia Tax Form 2020

What is the Virginia Tax Form

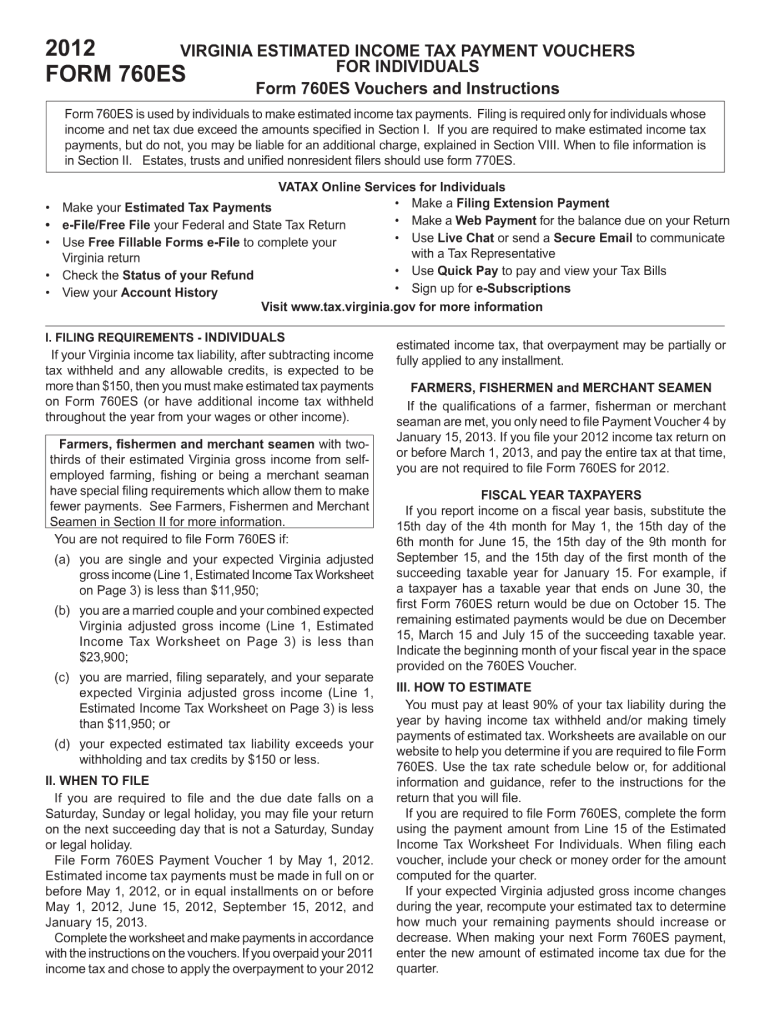

The Virginia Tax Form is an essential document used by residents and businesses in Virginia to report income and calculate state taxes. This form is designed to ensure compliance with state tax laws and regulations. It encompasses various types of tax filings, including individual income tax, corporate tax, and other specific tax obligations. Understanding the purpose and requirements of the Virginia Tax Form is crucial for accurate tax reporting and timely submission.

How to use the Virginia Tax Form

Using the Virginia Tax Form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, determine the appropriate version of the form needed based on your filing status and income type. Fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. If filing electronically, follow the platform's instructions for e-filing; if submitting by mail, ensure it is sent to the correct address as indicated on the form.

Steps to complete the Virginia Tax Form

Completing the Virginia Tax Form involves a systematic approach:

- Gather all relevant financial documents, including income statements and deduction records.

- Select the correct form version based on your filing requirements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability and any payments made throughout the year.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial to avoid penalties. The Virginia Tax Form is typically due on May 1st for individual income tax returns. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Businesses may have different deadlines based on their fiscal year. It's important to check for any specific extensions or changes announced by the Virginia Department of Taxation.

Required Documents

To complete the Virginia Tax Form accurately, certain documents are required:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or investment earnings.

- Documentation for deductions, including receipts for medical expenses, charitable contributions, and mortgage interest.

Form Submission Methods

The Virginia Tax Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online e-filing through approved tax software, which is often the quickest method.

- Mailing a paper form to the designated address provided on the form.

- In-person submission at local tax offices, which may offer assistance for complex filings.

Quick guide on how to complete 2012 virginia tax form

Handle Virginia Tax Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly and efficiently. Manage Virginia Tax Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to alter and electronically sign Virginia Tax Form with ease

- Locate Virginia Tax Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Virginia Tax Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 virginia tax form

Create this form in 5 minutes!

How to create an eSignature for the 2012 virginia tax form

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is a Virginia Tax Form?

A Virginia Tax Form is a document required by the state of Virginia for various tax obligations, including income tax returns and other state taxes. It’s essential for residents and businesses to file the correct forms to ensure compliance with state laws. Utilizing airSlate SignNow can simplify the eSignature process for all your Virginia Tax Form filings.

-

How can airSlate SignNow help with Virginia Tax Forms?

airSlate SignNow provides a user-friendly platform to eSign and manage your Virginia Tax Forms efficiently. With features like document editing and secure cloud storage, you can easily complete and send your tax forms electronically. This streamlines the filing process and helps ensure that your Virginia Tax Form submissions are timely and accurate.

-

Is there a cost associated with using airSlate SignNow for Virginia Tax Forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes features that facilitate the eSigning and management of documents such as Virginia Tax Forms. Consider the subscription that best fits your requirement for a cost-effective solution.

-

Are there any specific features in airSlate SignNow that assist with Virginia Tax Forms?

airSlate SignNow includes features like customizable document templates, bulk sending, and in-person signing that are particularly useful for Virginia Tax Forms. These functionalities enhance ease-of-use and ensure all necessary legal aspects are covered when completing your tax documents. Additionally, the audit trail feature provides peace of mind by tracking all actions taken on your forms.

-

How secure is the signing process for Virginia Tax Forms with airSlate SignNow?

The signing process for Virginia Tax Forms using airSlate SignNow is highly secure. The platform employs advanced encryption and complies with legal regulations to protect your sensitive information. You can confidently send and sign your tax forms knowing that they are safeguarded against unauthorized access.

-

Can I integrate airSlate SignNow with other software for filing Virginia Tax Forms?

Yes, airSlate SignNow integrates seamlessly with many software applications that may assist in handling Virginia Tax Forms. You can connect with popular platforms like Google Drive and Dropbox, allowing for a smooth workflow. This integration helps save time and ensures all your tax documents are organized and accessible.

-

What benefits can I expect when using airSlate SignNow for my Virginia Tax Forms?

Using airSlate SignNow for your Virginia Tax Forms provides numerous benefits, such as improved efficiency in document processing and a reduced risk of errors. The ability to eSign documents remotely means you can complete your tax obligations anytime, anywhere. This not only saves time but also helps you stay compliant with state regulations.

Get more for Virginia Tax Form

Find out other Virginia Tax Form

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form