Colorado 104pn Form 2020

What is the Colorado 104pn Form

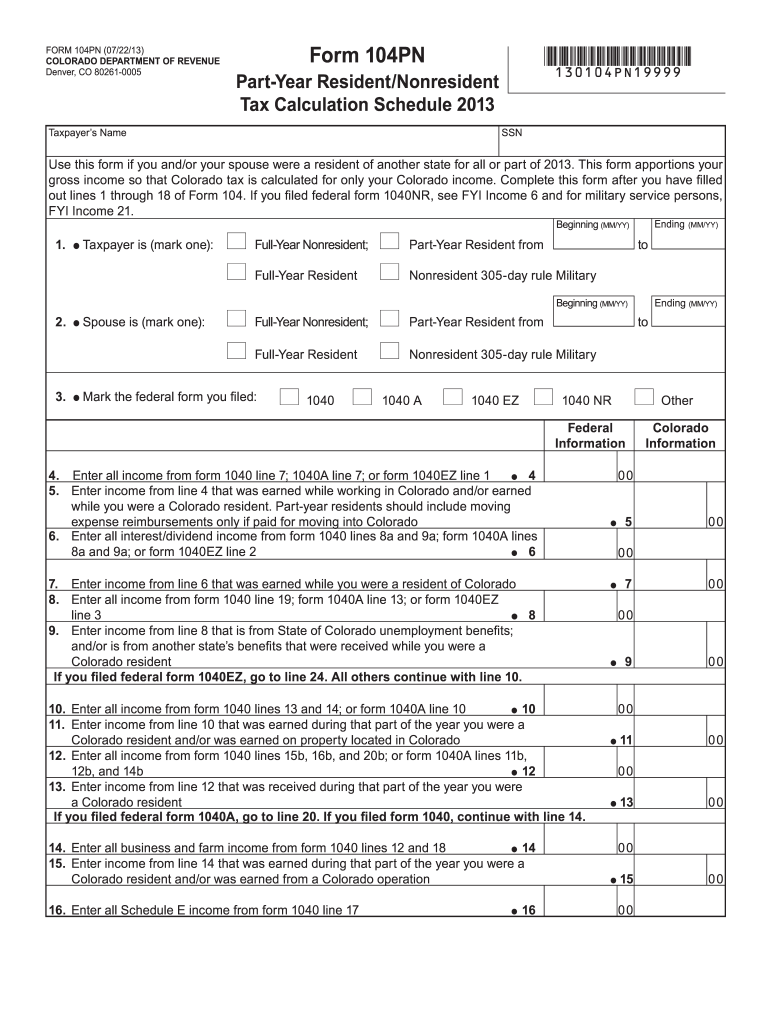

The Colorado 104pn Form is a state-specific tax form used by individuals to report their income and calculate their tax liability in the state of Colorado. This form is particularly relevant for part-year residents or non-residents who have earned income in Colorado. It allows taxpayers to accurately reflect their income earned within the state and ensures compliance with Colorado tax laws.

How to use the Colorado 104pn Form

To effectively use the Colorado 104pn Form, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires detailed information about income sources, deductions, and credits applicable to the taxpayer's situation. After filling out the form, it is crucial to review it for accuracy before submission to avoid potential penalties or delays in processing.

Steps to complete the Colorado 104pn Form

Completing the Colorado 104pn Form involves several steps:

- Gather all relevant income documentation.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income earned in Colorado during the tax year.

- Calculate any applicable deductions and credits.

- Review the completed form for accuracy.

- Submit the form by the designated deadline.

Key elements of the Colorado 104pn Form

Essential elements of the Colorado 104pn Form include sections for personal information, income reporting, deductions, and credits. Taxpayers must provide accurate figures to ensure proper tax calculation. The form also includes instructions for specific line items, which help guide users through the completion process.

Legal use of the Colorado 104pn Form

The Colorado 104pn Form is legally recognized for tax reporting purposes when completed accurately and submitted on time. It is essential for taxpayers to adhere to state laws regarding income reporting and tax obligations. Failure to use the form correctly can result in penalties, interest on unpaid taxes, and potential legal consequences.

Filing Deadlines / Important Dates

Taxpayers must be aware of critical deadlines related to the Colorado 104pn Form. Generally, the filing deadline aligns with the federal tax deadline, which is typically April 15. However, it is advisable to check for any changes or extensions that may apply in a given tax year to ensure timely submission.

Quick guide on how to complete 2013 colorado 104pn form

Easily prepare Colorado 104pn Form on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditionally printed and signed paperwork, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without any delays. Manage Colorado 104pn Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Colorado 104pn Form effortlessly

- Obtain Colorado 104pn Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using the tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to submit your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Update and eSign Colorado 104pn Form while ensuring excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 colorado 104pn form

Create this form in 5 minutes!

How to create an eSignature for the 2013 colorado 104pn form

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the Colorado 104pn Form?

The Colorado 104pn Form is a state-specific tax form used by individuals to claim a refund or tax credit. It helps residents ensure they meet their tax obligations efficiently. Utilizing tools like airSlate SignNow can simplify the process of completing and submitting the Colorado 104pn Form.

-

How does airSlate SignNow facilitate the completion of the Colorado 104pn Form?

airSlate SignNow provides an intuitive platform that allows users to create, complete, and eSign the Colorado 104pn Form easily. With drag-and-drop features and customizable fields, you can ensure accuracy in your tax documentation. This streamlines the entire process, saving you valuable time and effort.

-

Is airSlate SignNow cost-effective for users filing the Colorado 104pn Form?

Yes, airSlate SignNow offers competitively priced plans suitable for individuals and businesses alike. The platform provides a cost-effective solution for managing eSignatures and document workflows related to the Colorado 104pn Form. You can save on printing and mailing costs while ensuring quick submission of your form.

-

What are the key features of airSlate SignNow for managing the Colorado 104pn Form?

Key features include eSignature capabilities, document templates, and real-time collaboration, all designed to make handling the Colorado 104pn Form easier. Users can securely sign documents online, share with necessary parties, and track the status of submissions seamlessly. These features enhance the user experience and make compliance simpler.

-

Can I integrate airSlate SignNow with other software for my Colorado 104pn Form needs?

Absolutely! airSlate SignNow offers integrations with popular software such as CRMs and accounting tools. This capability makes it easier to manage your documents related to the Colorado 104pn Form within your existing workflows. You can automate tedious processes, reducing human error and enhancing productivity.

-

What benefits does airSlate SignNow provide for eSigning the Colorado 104pn Form?

Using airSlate SignNow for eSigning the Colorado 104pn Form offers various benefits, including easy access, speed, and security. Users can sign documents from anywhere, ensuring timely submission of tax forms. Additionally, the platform uses advanced security measures to protect your sensitive information, giving you peace of mind.

-

How can I ensure that my completed Colorado 104pn Form is compliant?

To ensure compliance when using the Colorado 104pn Form, it's essential to check that you've filled out all required fields correctly. airSlate SignNow provides helpful templates and guidelines to assist you during the process. Additionally, consider consulting with a tax professional if you have specific questions about compliance.

Get more for Colorado 104pn Form

- Iit jam offer letter form

- The hartford ada medical assessment form

- Sasra complaint form

- Bajaj allianz hospital cash daily allowance claim form

- Computer workstation ergonomic evaluation stanford form

- Form mv 150 pa

- Application for business cdr form

- Afp rsbs in quezon city metro manila yellow pages ph form

Find out other Colorado 104pn Form

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF