Colorado Form 104x 2019

What is the Colorado Form 104x

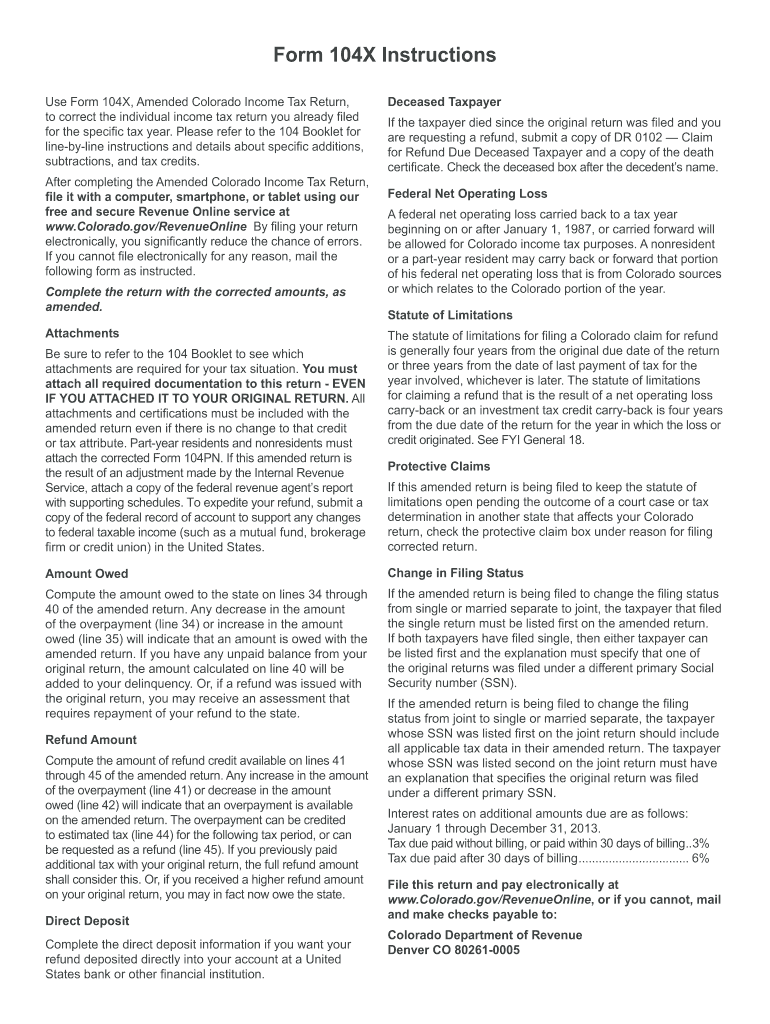

The Colorado Form 104x is a tax form used by individuals to amend their previously filed Colorado income tax returns. This form allows taxpayers to correct errors, update information, or make changes to their tax liabilities. It is essential for ensuring that the state tax records accurately reflect an individual's financial situation. The form is specifically designed for Colorado residents and must be filed with the Colorado Department of Revenue.

How to use the Colorado Form 104x

To effectively use the Colorado Form 104x, taxpayers must first gather all relevant documentation related to their original tax return. This includes W-2s, 1099s, and any other supporting documents that pertain to the changes being made. After completing the form, individuals should review it carefully to ensure accuracy before submission. It is crucial to provide clear explanations for the amendments made, as this will help expedite the review process by the Colorado Department of Revenue.

Steps to complete the Colorado Form 104x

Completing the Colorado Form 104x involves several key steps:

- Obtain a copy of the original Colorado income tax return.

- Download or print the Colorado Form 104x from the Colorado Department of Revenue website.

- Fill in the required information, including personal details and the specific changes being made.

- Attach any necessary documentation that supports the amendments.

- Review the form for accuracy and completeness.

- Submit the completed form to the Colorado Department of Revenue by mail or electronically, if available.

Legal use of the Colorado Form 104x

The Colorado Form 104x is legally recognized as a valid method for amending tax returns in the state. To ensure its legal validity, taxpayers must adhere to specific guidelines set forth by the Colorado Department of Revenue. This includes submitting the form within the designated time frame for amendments and providing accurate information. Utilizing a reliable eSignature platform can enhance the legal standing of the document, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines associated with the Colorado Form 104x. Generally, the form must be filed within three years from the original due date of the tax return being amended. This timeline is crucial for ensuring that any refunds or adjustments are processed in a timely manner. Additionally, if the amendment results in additional tax owed, it is advisable to file and pay as soon as possible to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The Colorado Form 104x can be submitted through various methods, providing flexibility for taxpayers. Individuals can file the form by mail, sending it directly to the Colorado Department of Revenue. Some taxpayers may also have the option to submit the form electronically, depending on the available services. In-person submissions may be possible at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete 2012 colorado form 104x

Effortlessly Complete Colorado Form 104x on Any Device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Colorado Form 104x on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Easiest Way to Edit and eSign Colorado Form 104x Without Stress

- Find Colorado Form 104x and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Colorado Form 104x to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 colorado form 104x

Create this form in 5 minutes!

How to create an eSignature for the 2012 colorado form 104x

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Colorado Form 104x?

The Colorado Form 104x is an amendment form used to correct errors on your previously filed Colorado state income tax return. It allows taxpayers to make adjustments to their reported income, deductions, and credits. Understanding how to properly complete the Colorado Form 104x is essential for accurate tax reporting and compliance.

-

How can airSlate SignNow help with completing the Colorado Form 104x?

airSlate SignNow provides a seamless electronic signing experience, making it easy for users to fill out and eSign the Colorado Form 104x. With its intuitive interface, you can upload your amended tax form, add necessary signatures, and send it securely. This simplifies the process of submitting amendments while ensuring compliance with state regulations.

-

What are the pricing options for using airSlate SignNow for Colorado Form 104x?

airSlate SignNow offers competitive pricing plans designed to meet varying business needs. Users can choose from monthly or annual subscriptions, which include features like unlimited eSigning of documents, including the Colorado Form 104x. It’s a cost-effective solution for individuals and businesses looking to manage their document workflows efficiently.

-

Are there any features that specifically assist with the Colorado Form 104x?

Yes, airSlate SignNow includes features such as document templates, field tagging for easier completion, and secure storage for your Colorado Form 104x and related documents. These features streamline the amendment process and help ensure that your forms are filled out correctly and filed on time, reducing the risk of errors.

-

Can airSlate SignNow integrate with other tax software for handling the Colorado Form 104x?

Absolutely! airSlate SignNow is designed to integrate with various tax preparation and accounting software, enhancing your ability to manage the Colorado Form 104x efficiently. With these integrations, you can seamlessly import data, reducing entry errors and ensuring that your amended tax returns are accurate and timely.

-

What benefits does airSlate SignNow provide when handling tax documents like the Colorado Form 104x?

Using airSlate SignNow offers multiple benefits, including increased efficiency, reduced paper waste, and enhanced security for electronic documents. When amendments like the Colorado Form 104x are signed electronically, the overall process is faster and easier, enabling timely submissions and peace of mind knowing your information is protected.

-

Is it easy to track the status of the Colorado Form 104x after eSigning?

Yes, airSlate SignNow provides features that allow users to track the status of their documents, including the Colorado Form 104x, post-signing. You can receive real-time updates on who has signed the document and confirm when it has been filed. This tracking capability adds an extra layer of transparency to your amendment process.

Get more for Colorado Form 104x

Find out other Colorado Form 104x

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe