Colorado SalesUse Tax Rates DR 1002 Colorado Gov Colorado 2020

What is the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado

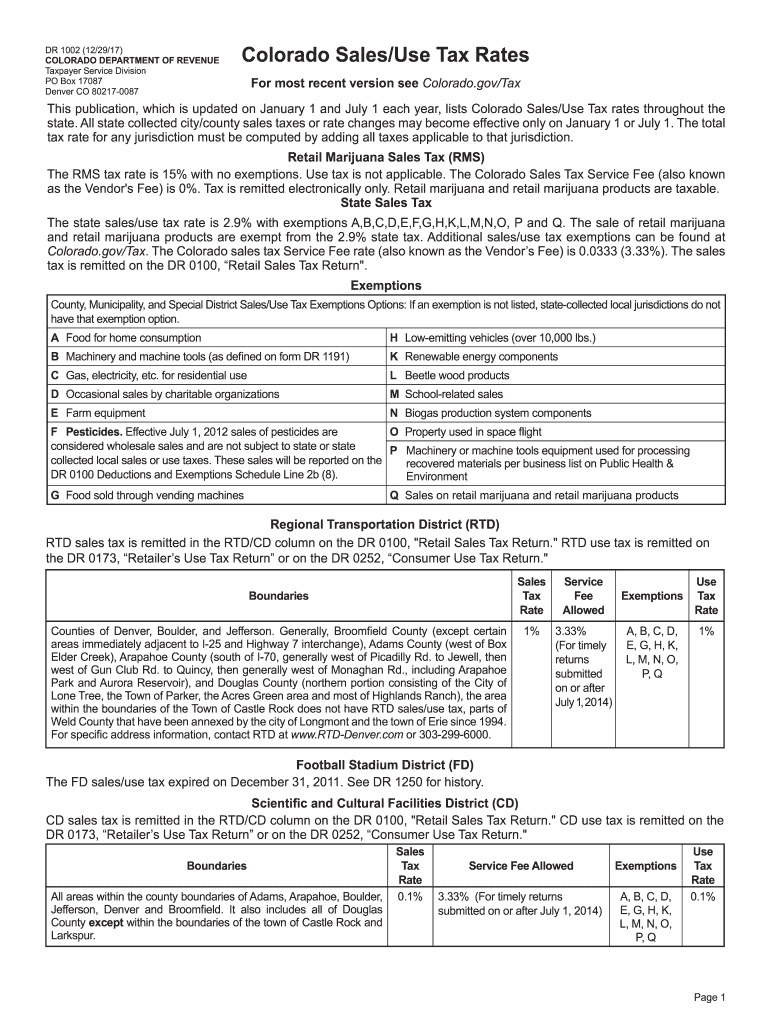

The Colorado SalesUse Tax Rates DR 1002 is a crucial document used by businesses and individuals to report and remit sales and use taxes in the state of Colorado. This form provides detailed information regarding the applicable sales and use tax rates for various jurisdictions within Colorado. It is essential for ensuring compliance with state tax laws and for accurately calculating the tax owed on sales transactions.

How to use the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado

To effectively use the Colorado SalesUse Tax Rates DR 1002, individuals and businesses should first familiarize themselves with the specific tax rates applicable to their location and the nature of their transactions. The form outlines the rates for different counties and municipalities, allowing users to determine the correct tax amount. It is advisable to keep this form handy when conducting sales or making purchases that are subject to sales tax.

Steps to complete the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado

Completing the Colorado SalesUse Tax Rates DR 1002 involves several key steps:

- Identify the correct tax rate based on your specific location and the nature of the transaction.

- Fill out the form with the necessary details, including the total sales amount and applicable tax rate.

- Calculate the total tax due by multiplying the sales amount by the tax rate.

- Submit the completed form to the appropriate tax authority, either electronically or via mail.

Legal use of the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado

The legal use of the Colorado SalesUse Tax Rates DR 1002 is governed by state tax regulations. This form must be filled out accurately to ensure compliance with Colorado tax laws. Failure to complete the form correctly can result in penalties or fines. It is important to retain a copy of the submitted form for your records, as it serves as proof of compliance.

Key elements of the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado

Key elements of the Colorado SalesUse Tax Rates DR 1002 include:

- The specific tax rates for different jurisdictions within Colorado.

- Instructions for calculating the total tax due based on sales amounts.

- Information regarding filing deadlines and submission methods.

- Contact information for the Colorado Department of Revenue for further assistance.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado SalesUse Tax Rates DR 1002 are critical to avoid penalties. Typically, the form must be submitted by the end of the month following the reporting period. It is advisable to check the Colorado Department of Revenue's website for the most current deadlines and any changes to the filing schedule.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Colorado SalesUse Tax Rates DR 1002 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete colorado salesuse tax rates dr 1002 coloradogov colorado

Accomplish Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado effortlessly on any gadget

Online document administration has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly and without interruptions. Manage Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado on various platforms with airSlate SignNow’s Android or iOS applications and enhance any document-driven task today.

The easiest way to alter and eSign Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado with ease

- Obtain Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all information and then click the Done button to secure your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from your selected device. Modify and eSign Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado and ensure outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado salesuse tax rates dr 1002 coloradogov colorado

Create this form in 5 minutes!

How to create an eSignature for the colorado salesuse tax rates dr 1002 coloradogov colorado

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What are the Colorado SalesUse Tax Rates DR 1002 forms?

The Colorado SalesUse Tax Rates DR 1002 forms are official documents used to report sales and use tax obligations in Colorado. Understanding these rates is crucial for businesses operating in the state to ensure compliance with tax laws. By utilizing the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado, businesses can accurately assess their tax liabilities.

-

How can airSlate SignNow help with Colorado SalesUse Tax Rates DR 1002 processes?

airSlate SignNow provides an efficient platform to eSign and manage documents related to the Colorado SalesUse Tax Rates DR 1002. Businesses can streamline their tax documentation processes, saving time and reducing errors when submitting to Colorado gov Colorado. With airSlate SignNow, you can ensure that all your tax paperwork is handled promptly and securely.

-

Are there any fees associated with using airSlate SignNow for tax documentation?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While there may be fees associated with the service, the cost-effectiveness it brings, particularly for managing documents related to the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado, makes it a valuable investment.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure storage to enhance your document management experience. These features allow you to efficiently handle forms like the Colorado SalesUse Tax Rates DR 1002 and ensure that you meet all filing requirements with Colorado gov Colorado effectively.

-

Can I integrate airSlate SignNow with other tools I use for business?

Absolutely! airSlate SignNow offers integrations with a variety of business applications, allowing for seamless workflow management. This ensures that you can easily connect your processes related to the Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado with your existing systems.

-

Is airSlate SignNow user-friendly for handling tax documents?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, which simplifies the process of managing tax documents such as the Colorado SalesUse Tax Rates DR 1002. Even users who may be new to electronic signing can navigate the platform with ease, helping to enhance productivity.

-

How secure is my data when using airSlate SignNow?

airSlate SignNow prioritizes data security and employs industry-standard encryption to protect your documents. This ensures that sensitive information, including those related to Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado, remains confidential and secure at all times.

Get more for Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado

Find out other Colorado SalesUse Tax Rates DR 1002 Colorado gov Colorado

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online