Ct 1096 Form 2020

What is the Ct 1096 Form

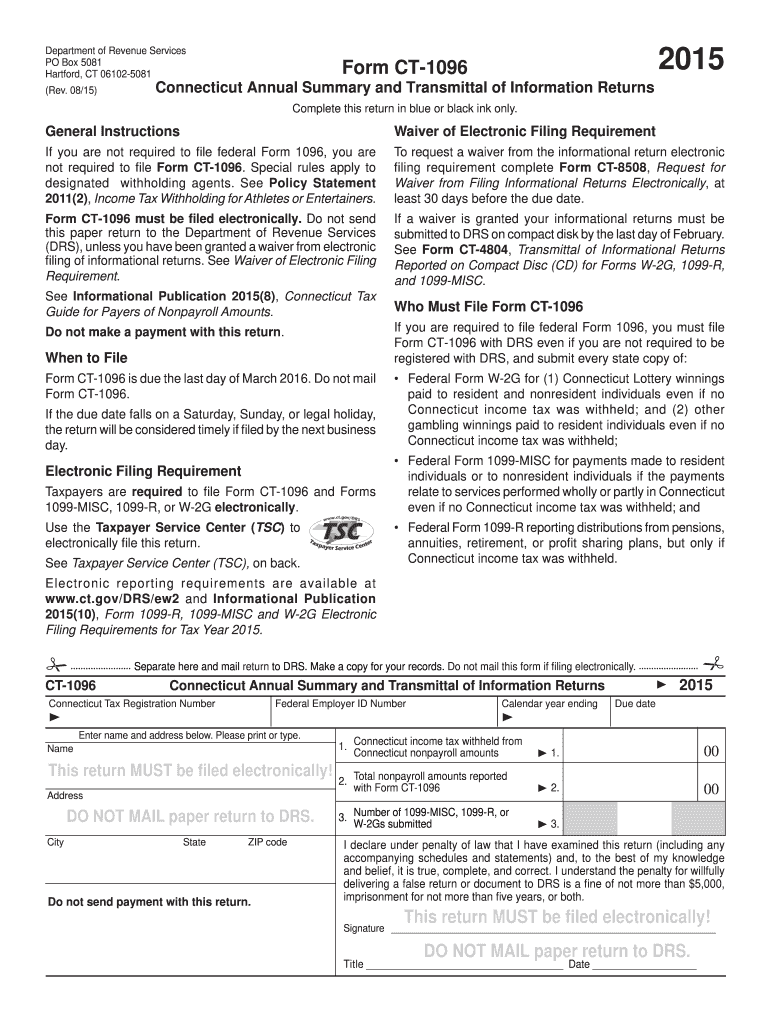

The Ct 1096 Form is a state-specific document used in Connecticut for reporting and summarizing information regarding certain types of income. This form is primarily utilized by businesses and organizations to report payments made to independent contractors and other non-employees. It serves as a means to ensure compliance with state tax regulations and provides essential information to the Connecticut Department of Revenue Services.

How to use the Ct 1096 Form

To effectively use the Ct 1096 Form, businesses must first gather all relevant payment information for the reporting year. This includes details about the recipients, such as their names, addresses, and Social Security numbers or Employer Identification Numbers. Once the data is collected, the form can be filled out accurately, ensuring that all required fields are completed. After filling out the form, it must be submitted to the appropriate state agency by the designated deadline.

Steps to complete the Ct 1096 Form

Completing the Ct 1096 Form involves several key steps:

- Gather all necessary information about payments made to contractors and non-employees.

- Fill in the recipient's details, including name, address, and identification number.

- Report the total amount paid to each recipient during the tax year.

- Review the form for accuracy and completeness.

- Submit the form to the Connecticut Department of Revenue Services by the deadline.

Legal use of the Ct 1096 Form

The Ct 1096 Form is legally binding and must be completed accurately to comply with state tax laws. Failure to file this form or providing incorrect information can result in penalties or fines imposed by the state. It is essential for businesses to understand their obligations regarding this form to avoid legal repercussions.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the Ct 1096 Form. Typically, this form is due by the end of January following the tax year in which payments were made. It is crucial to stay informed about any changes to these deadlines to ensure timely submission and compliance with state regulations.

Form Submission Methods

The Ct 1096 Form can be submitted through various methods, including:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person submission at designated state offices for those who prefer face-to-face interactions.

Who Issues the Form

The Ct 1096 Form is issued by the Connecticut Department of Revenue Services. This agency is responsible for overseeing tax compliance and ensuring that businesses adhere to state tax laws. It provides the necessary forms and resources to assist businesses in fulfilling their reporting requirements.

Quick guide on how to complete ct 1096 2015 form

Effortlessly Prepare Ct 1096 Form on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it on the internet. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Handle Ct 1096 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and Electronically Sign Ct 1096 Form with Ease

- Find Ct 1096 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ct 1096 Form to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1096 2015 form

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 2015 form

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Ct 1096 Form?

The Ct 1096 Form is a crucial document used for filing information returns in Connecticut. It gathers essential details about payments to non-residents, making it imperative for businesses to file accurately. Understanding the Ct 1096 Form can help ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Ct 1096 Form?

airSlate SignNow streamlines the process of preparing and electronically signing the Ct 1096 Form. With its user-friendly interface, you can easily upload, sign, and send important documents, saving time and reducing the hassle of paper filings. Utilizing airSlate SignNow can enhance your efficiency in managing tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ct 1096 Form?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs when handling the Ct 1096 Form. These plans are cost-effective, with options that allow you to pay for only what you need, making it a worthwhile investment for managing your document workflows and eSignatures.

-

What features does airSlate SignNow provide for managing the Ct 1096 Form?

airSlate SignNow provides features such as secure electronic signatures, document templates, and real-time tracking for the Ct 1096 Form. These features enhance the signing experience and provide an organized approach to filing important tax documents. Additionally, users can easily integrate with other business applications for a seamless workflow.

-

Can I integrate airSlate SignNow with other applications when handling the Ct 1096 Form?

Absolutely! airSlate SignNow offers integrations with various business applications, making it easier to manage data related to the Ct 1096 Form. Whether you need to connect with CRM systems, cloud storage solutions, or accounting software, airSlate SignNow ensures that your workflow remains efficient and interconnected.

-

How secure is airSlate SignNow when processing the Ct 1096 Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Ct 1096 Form. The platform employs advanced encryption and security protocols to keep your data safe. You can confidently send and sign documents knowing that crucial information is protected at all times.

-

What are the benefits of using airSlate SignNow for the Ct 1096 Form?

Using airSlate SignNow for the Ct 1096 Form offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced accuracy in your documentation. The eSigning process minimizes delays and errors, ensuring your forms are submitted on time. Furthermore, the platform’s user-friendly design makes it accessible for all team members.

Get more for Ct 1096 Form

- Downloadable blank league table template form

- 8005552546 form

- Prp section 4400 form

- Troop committee guidebook pdf form

- Fw 004 order on application for waiver of additional alpine courts ca form

- Interpreter request form superior court riverside riverside courts ca

- Gc 400e1gc 405e1 cash assets on hand at end of account period standard and simplified accounts judicial council forms courts ca

- Subject access request sar form subject access request gdpr

Find out other Ct 1096 Form

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement