CT 1096, Connecticut Annual Summary and Transmittal of CT 2020

What is the CT 1096, Connecticut Annual Summary And Transmittal Of CT

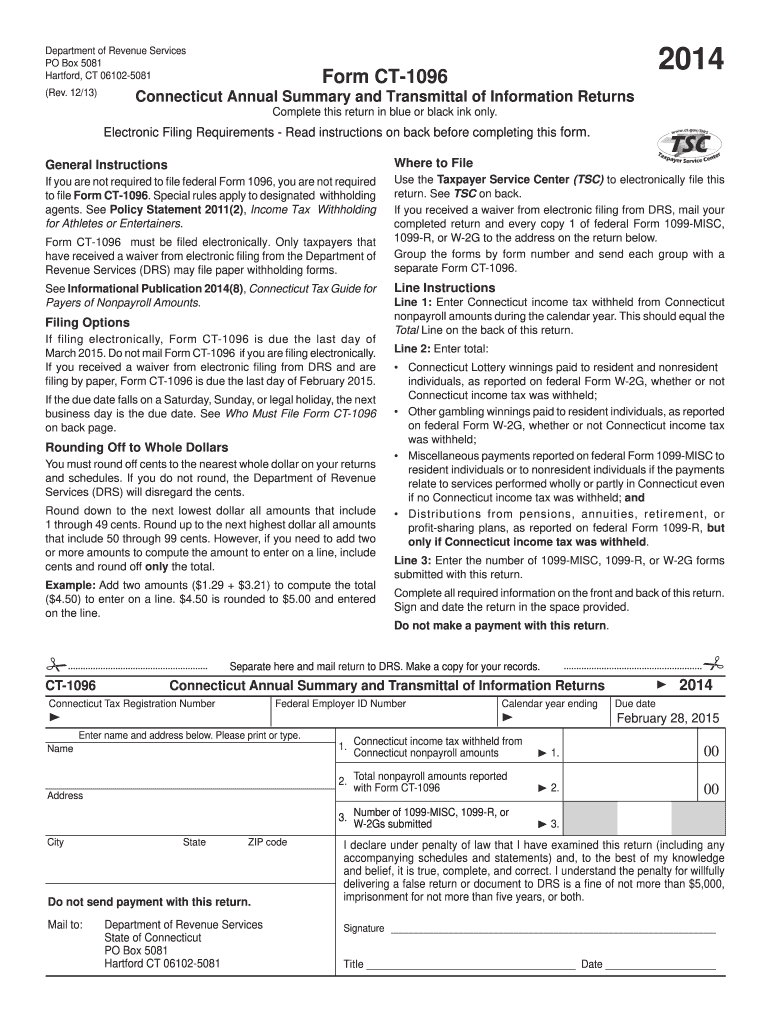

The CT 1096, Connecticut Annual Summary and Transmittal of CT, is a crucial form used by businesses in Connecticut to summarize and transmit information regarding their income tax withholding. This form is essential for employers who need to report the total amount of Connecticut income tax withheld from employees throughout the year. It serves as an annual report that consolidates the withholding data, allowing the Connecticut Department of Revenue Services to accurately assess tax compliance and ensure proper collection of state taxes.

Steps to complete the CT 1096, Connecticut Annual Summary And Transmittal Of CT

Completing the CT 1096 requires careful attention to detail to ensure accuracy. Here are the key steps:

- Gather all relevant payroll records for the year, including total wages paid and taxes withheld.

- Fill in the employer's information, including name, address, and federal employer identification number (FEIN).

- Report the total Connecticut income tax withheld for the year in the designated section.

- Include any additional information as required, such as the number of employees and their total wages.

- Review the completed form for accuracy, ensuring all figures are correct and all required information is included.

How to obtain the CT 1096, Connecticut Annual Summary And Transmittal Of CT

The CT 1096 form can be obtained from the Connecticut Department of Revenue Services website. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, businesses may also access the form through various tax preparation software that supports Connecticut tax forms. Ensure that you are using the most current version of the form to comply with state regulations.

Legal use of the CT 1096, Connecticut Annual Summary And Transmittal Of CT

The CT 1096 is legally binding when completed accurately and submitted on time. It is important for employers to understand that failing to file this form or providing incorrect information can lead to penalties. The form must be submitted in accordance with the guidelines set forth by the Connecticut Department of Revenue Services to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the CT 1096 to avoid penalties. The form is typically due on January thirty-first of the year following the tax year being reported. It is essential to keep track of any changes to deadlines announced by the Connecticut Department of Revenue Services, as these can vary based on specific circumstances or legislative changes.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the CT 1096 can result in significant penalties. Employers who fail to file the form on time or submit inaccurate information may face fines imposed by the Connecticut Department of Revenue Services. These penalties can accumulate, making timely and accurate submission crucial for maintaining compliance and avoiding financial repercussions.

Quick guide on how to complete ct 1096 connecticut annual summary and transmittal of ct

Complete CT 1096, Connecticut Annual Summary And Transmittal Of CT effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage CT 1096, Connecticut Annual Summary And Transmittal Of CT across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign CT 1096, Connecticut Annual Summary And Transmittal Of CT with ease

- Locate CT 1096, Connecticut Annual Summary And Transmittal Of CT and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign CT 1096, Connecticut Annual Summary And Transmittal Of CT and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1096 connecticut annual summary and transmittal of ct

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 connecticut annual summary and transmittal of ct

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the CT 1096, Connecticut Annual Summary And Transmittal Of CT?

The CT 1096, Connecticut Annual Summary And Transmittal Of CT, is a form used by employers to report the total annual Connecticut income tax withheld from their employees. It serves as a summary of all employee withholdings for the year and is required for tax compliance. Properly completing this form is essential for maintaining good standing with the Connecticut Department of Revenue Services.

-

How can airSlate SignNow help with the CT 1096, Connecticut Annual Summary And Transmittal Of CT?

airSlate SignNow streamlines the process of preparing and submitting the CT 1096, Connecticut Annual Summary And Transmittal Of CT, by providing an easy-to-use eSignature platform. Users can quickly fill out, sign, and send the necessary forms, making tax season less stressful. Our solution is designed to enhance efficiency and ensure compliance with all state requirements.

-

What are the pricing options for airSlate SignNow related to the CT 1096, Connecticut Annual Summary And Transmittal Of CT?

airSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring affordability while handling the CT 1096, Connecticut Annual Summary And Transmittal Of CT. Pricing varies based on features and the number of users, allowing businesses of all sizes to find a suitable solution. Explore our plans to determine which best fits your requirements.

-

What features do airSlate SignNow provide for managing the CT 1096, Connecticut Annual Summary And Transmittal Of CT?

Our platform offers a range of features designed to simplify the management of the CT 1096, Connecticut Annual Summary And Transmittal Of CT. Key features include customizable templates, secure eSignatures, document tracking, and easy sharing options. These tools help ensure that your tax documents are professionally managed and compliant with Connecticut regulations.

-

Are there any integrations available with airSlate SignNow to assist with the CT 1096, Connecticut Annual Summary And Transmittal Of CT?

Yes, airSlate SignNow offers various integrations with popular business applications that can assist in managing the CT 1096, Connecticut Annual Summary And Transmittal Of CT. You can connect with accounting software and payroll systems to automate data transfer and enhance accuracy. This integration helps save time and reduces the risk of errors in your tax reporting.

-

What benefits does airSlate SignNow provide for completing the CT 1096, Connecticut Annual Summary And Transmittal Of CT?

Using airSlate SignNow to complete the CT 1096, Connecticut Annual Summary And Transmittal Of CT, offers several benefits, including improved efficiency and reduced paper waste. Our solution allows for quick eSigning and easy submission, minimizing delays. Additionally, enhanced security features protect sensitive data throughout the process, giving you peace of mind.

-

Can airSlate SignNow help with archiving and storing the CT 1096, Connecticut Annual Summary And Transmittal Of CT?

Absolutely! airSlate SignNow provides secure cloud storage options for archiving the CT 1096, Connecticut Annual Summary And Transmittal Of CT, ensuring easy access for future reference. With our platform, you can organize your documents into folders and retrieve them whenever necessary. This ensures compliance with record-keeping regulations and helps maintain a clear audit trail.

Get more for CT 1096, Connecticut Annual Summary And Transmittal Of CT

Find out other CT 1096, Connecticut Annual Summary And Transmittal Of CT

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document