Connecticut Tax Form 2020

What is the Connecticut Tax Form

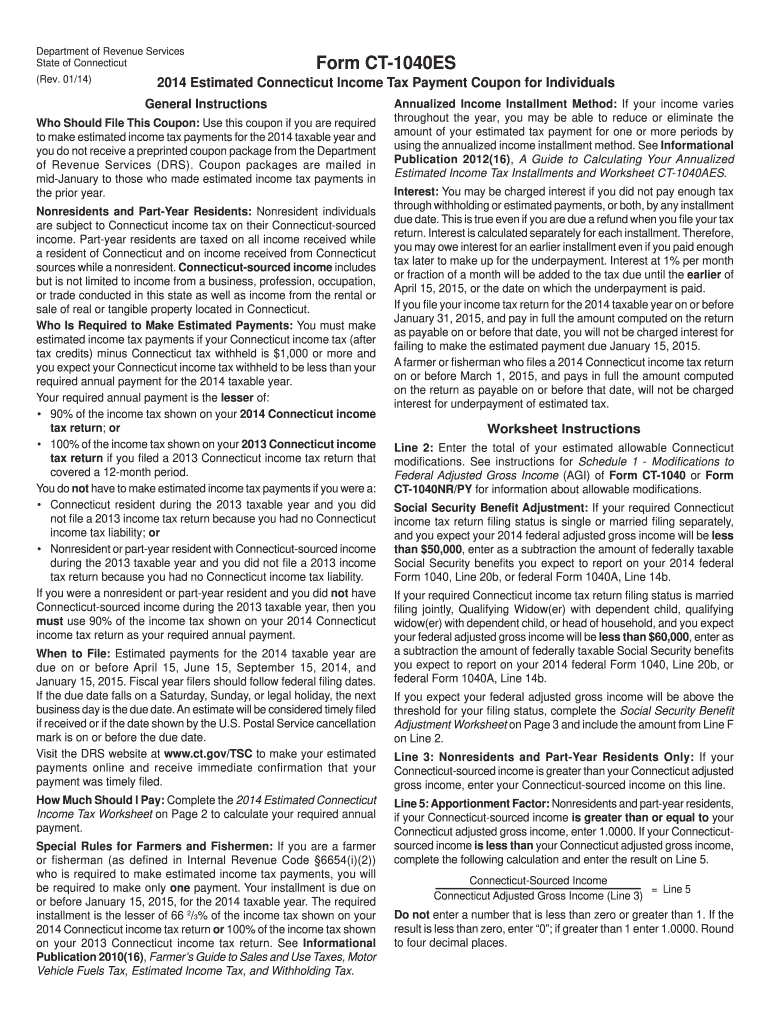

The Connecticut Tax Form is a document used by residents and businesses in Connecticut to report income and calculate tax liabilities. This form is essential for ensuring compliance with state tax laws. It encompasses various tax types, including individual income tax, corporate tax, and other specific tax obligations. Understanding the purpose and requirements of this form is crucial for accurate filing and avoiding penalties.

How to obtain the Connecticut Tax Form

To obtain the Connecticut Tax Form, individuals can visit the official website of the Connecticut Department of Revenue Services. The form is typically available for download in a PDF format, allowing users to print and fill it out manually. Additionally, copies may be available at local government offices or tax preparation services throughout the state. Ensuring you have the correct version of the form for the relevant tax year is important for accurate filing.

Steps to complete the Connecticut Tax Form

Completing the Connecticut Tax Form involves several key steps:

- Gather necessary financial documents, including W-2s, 1099s, and any relevant deductions.

- Download the appropriate form from the Connecticut Department of Revenue Services website.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Calculate your tax liability based on the provided guidelines and applicable rates.

- Review the form for accuracy and completeness before submission.

Legal use of the Connecticut Tax Form

The Connecticut Tax Form is legally binding when filled out and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. Electronic signatures, when used in conjunction with compliant eSignature solutions, can also be considered valid for the submission of this form, provided they meet specific legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Tax Form typically align with federal tax deadlines. Generally, individual income tax returns must be filed by April fifteenth. However, taxpayers should be aware of any extensions or specific dates that may apply to different tax types. Keeping track of these deadlines is crucial to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Connecticut Tax Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers choose to file electronically through the Connecticut Department of Revenue Services website.

- Mail: Completed forms can be mailed to the appropriate address as indicated on the form.

- In-Person: Taxpayers may also submit their forms at designated state offices during business hours.

Penalties for Non-Compliance

Failure to file the Connecticut Tax Form on time or providing inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is essential for all taxpayers to ensure they meet their obligations and avoid unnecessary complications.

Quick guide on how to complete 2014 connecticut tax form

Effortlessly Prepare Connecticut Tax Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without issues. Handle Connecticut Tax Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-oriented process today.

How to Modify and eSign Connecticut Tax Form with Ease

- Obtain Connecticut Tax Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose your preferred method for sharing your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and eSign Connecticut Tax Form to guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 connecticut tax form

Create this form in 5 minutes!

How to create an eSignature for the 2014 connecticut tax form

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Connecticut Tax Form, and why is it important?

The Connecticut Tax Form is a document required for filing taxes in the state of Connecticut. It ensures that individuals and businesses comply with state tax regulations. Properly completing and submitting this form is crucial to avoid penalties and ensure timely processing of your tax return.

-

How can airSlate SignNow help me with my Connecticut Tax Form?

airSlate SignNow streamlines the process of completing and eSigning your Connecticut Tax Form. With our user-friendly interface, you can easily fill out the form, sign it digitally, and send it directly to the state tax authority. This reduces errors and speeds up your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the Connecticut Tax Form?

Yes, there is a cost associated with using airSlate SignNow, but it is known for being a cost-effective solution. Our pricing plans are designed to accommodate different needs, offering value for both individuals and businesses looking to efficiently handle their Connecticut Tax Form and other documents.

-

What features does airSlate SignNow offer for managing the Connecticut Tax Form?

airSlate SignNow provides features such as template creation, automatic reminders, and secure cloud storage specifically for your Connecticut Tax Form. Our platform ensures that you can manage your documents efficiently, maintain compliance, and retrieve them easily whenever needed.

-

Can I integrate airSlate SignNow with other tools for managing my Connecticut Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with various productivity tools like Google Drive and Dropbox. This ensures you can store your Connecticut Tax Form and all related documents in one place, enhancing your workflow and document management.

-

How secure is my information when using airSlate SignNow for my Connecticut Tax Form?

Security is our top priority at airSlate SignNow. We implement robust encryption protocols to protect your sensitive information, including your Connecticut Tax Form. With features like two-factor authentication, you can trust that your data will remain private and secure.

-

What is the turnaround time for processing the Connecticut Tax Form using airSlate SignNow?

Using airSlate SignNow can signNowly reduce the turnaround time for processing your Connecticut Tax Form. Once completed and eSigned, documents can be submitted instantly, allowing for quicker state processing compared to traditional methods.

Get more for Connecticut Tax Form

- Abstinence contract form

- Webquest light and the electromagnetic spectrum answer key pdf form

- Derek rake fractionation pdf download form

- Cds notice of record and meeting dates form

- Deviation request form template excel 424095658

- Amerigroup prior authorization form pdf

- Court survival guide form

- Performance bond example

Find out other Connecticut Tax Form

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure