Ct 1040nr Py Form 2019

What is the Ct 1040nr Py Form

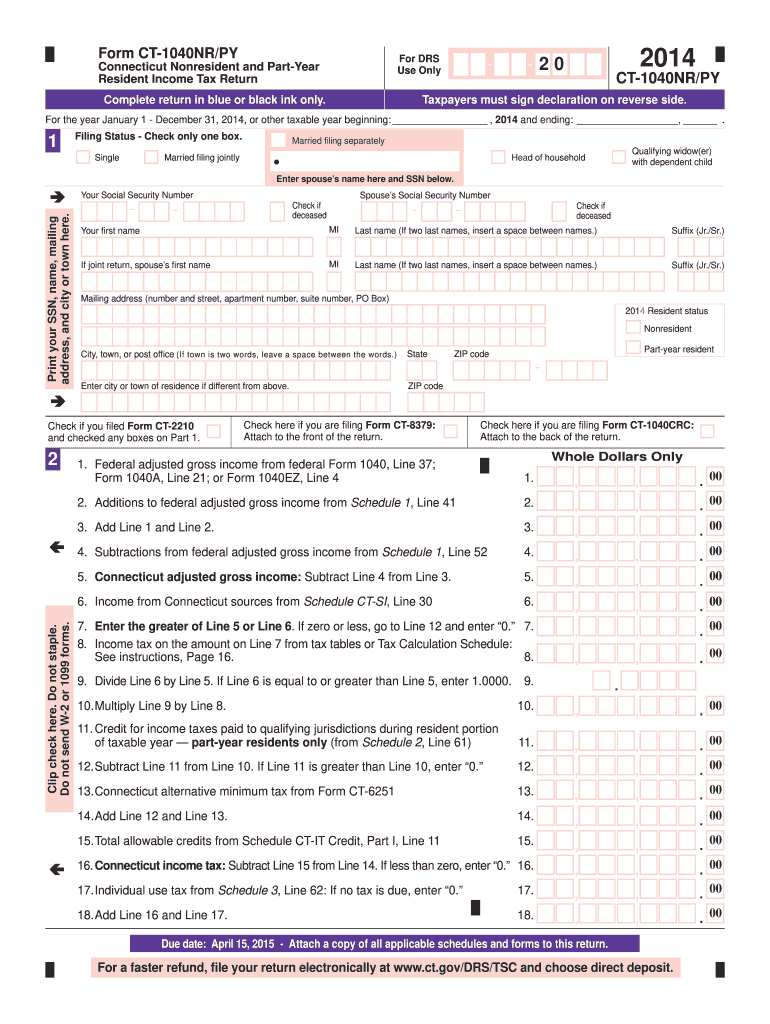

The Ct 1040nr Py Form is a state tax form specifically designed for non-resident taxpayers in Connecticut. This form is used to report income earned within the state by individuals who do not reside in Connecticut but have tax obligations due to their earnings. It serves as a crucial document for ensuring compliance with state tax laws and helps in determining the correct amount of tax owed to the state.

How to use the Ct 1040nr Py Form

Using the Ct 1040nr Py Form involves several steps to ensure accurate reporting of income. Taxpayers should first gather all necessary documentation, including W-2s, 1099s, and any other relevant income statements. Once the form is obtained, it should be filled out with personal information, income details, and any applicable deductions. After completing the form, taxpayers can submit it either electronically or via mail, depending on their preference and the specific guidelines provided by the Connecticut Department of Revenue Services.

Steps to complete the Ct 1040nr Py Form

Completing the Ct 1040nr Py Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant income documents, such as W-2s and 1099s.

- Obtain the Ct 1040nr Py Form from the Connecticut Department of Revenue Services.

- Fill out the form with your personal information, including name, address, and Social Security number.

- Report all income earned in Connecticut, ensuring to include any deductions you may qualify for.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following the submission guidelines provided.

Legal use of the Ct 1040nr Py Form

The legal use of the Ct 1040nr Py Form is essential for non-resident taxpayers to fulfill their tax obligations in Connecticut. By accurately completing and submitting this form, individuals ensure compliance with state tax laws, which can help avoid penalties and interest on unpaid taxes. The form also provides a record of income earned in the state, which is important for both the taxpayer and the state’s revenue collection efforts.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 1040nr Py Form are typically aligned with federal tax deadlines. Non-resident taxpayers should be aware that the standard due date for filing is usually April 15th of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions that may apply and ensure that they file their forms on time to avoid penalties.

Required Documents

To complete the Ct 1040nr Py Form accurately, several documents are required. These include:

- W-2 forms from employers showing income earned in Connecticut.

- 1099 forms for any additional income sources.

- Records of any deductions or credits you plan to claim.

- Identification information, such as your Social Security number.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1040nr Py Form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the Connecticut Department of Revenue Services' e-filing system, which is a convenient option for many. Alternatively, the form can be printed and mailed to the appropriate address provided by the state. In some cases, taxpayers may also have the option to submit the form in person at designated state offices, though this may vary based on current policies and procedures.

Quick guide on how to complete ct 1040nr py 2014 form

Complete Ct 1040nr Py Form effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and without interruptions. Handle Ct 1040nr Py Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Ct 1040nr Py Form without hassle

- Find Ct 1040nr Py Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Ct 1040nr Py Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040nr py 2014 form

Create this form in 5 minutes!

How to create an eSignature for the ct 1040nr py 2014 form

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Ct 1040nr Py Form?

The Ct 1040nr Py Form is the non-resident income tax return used by individuals who earn income in Connecticut but do not reside there. This form is essential for properly reporting income and ensuring compliance with Connecticut tax laws. Utilizing professional services like airSlate SignNow can streamline the process.

-

How do I file the Ct 1040nr Py Form electronically?

Filing the Ct 1040nr Py Form electronically is made simple with airSlate SignNow's eSignature solution. You can electronically sign and submit your tax forms while ensuring secure and efficient processing. This not only saves time but also reduces the risk of errors compared to traditional paper filing.

-

What are the benefits of using airSlate SignNow for the Ct 1040nr Py Form?

Using airSlate SignNow for the Ct 1040nr Py Form provides a hassle-free experience with features such as templates and automated workflows. You can manage documents efficiently, ensuring that every form is completed and signed correctly. Additionally, this solution is cost-effective, helping you save both time and money.

-

Is airSlate SignNow suitable for businesses needing to file Ct 1040nr Py Form?

Absolutely! airSlate SignNow is ideal for businesses that need to file the Ct 1040nr Py Form, allowing for multiple signers and document tracking. This platform ensures that your non-resident tax returns are submitted accurately and on time. Its collaborative features also enable seamless teamwork in document preparation.

-

What features does airSlate SignNow offer for tax forms like the Ct 1040nr Py Form?

airSlate SignNow offers a range of features for tax forms, including customizable templates, easy eSigning, and secure document storage. You can also set reminders and track the status of your Ct 1040nr Py Form to ensure that nothing falls through the cracks. This enhances efficiency and reduces the stress of tax season.

-

Can airSlate SignNow integrate with other tax software for the Ct 1040nr Py Form?

Yes, airSlate SignNow can integrate with various tax software solutions to facilitate the filing of your Ct 1040nr Py Form. This integration streamlines the process, allowing for easy transfer of data and minimizing manual entry. It's perfect for those who rely on software for their tax preparations.

-

What is the pricing for using airSlate SignNow for the Ct 1040nr Py Form?

airSlate SignNow offers a flexible pricing structure that accommodates different user needs while ensuring affordability for filing the Ct 1040nr Py Form. You can choose from various plans, including options for individuals and businesses, helping you find the perfect fit for your requirements without overspending.

Get more for Ct 1040nr Py Form

Find out other Ct 1040nr Py Form

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free