Ct 1096 Form 2020

What is the Ct 1096 Form

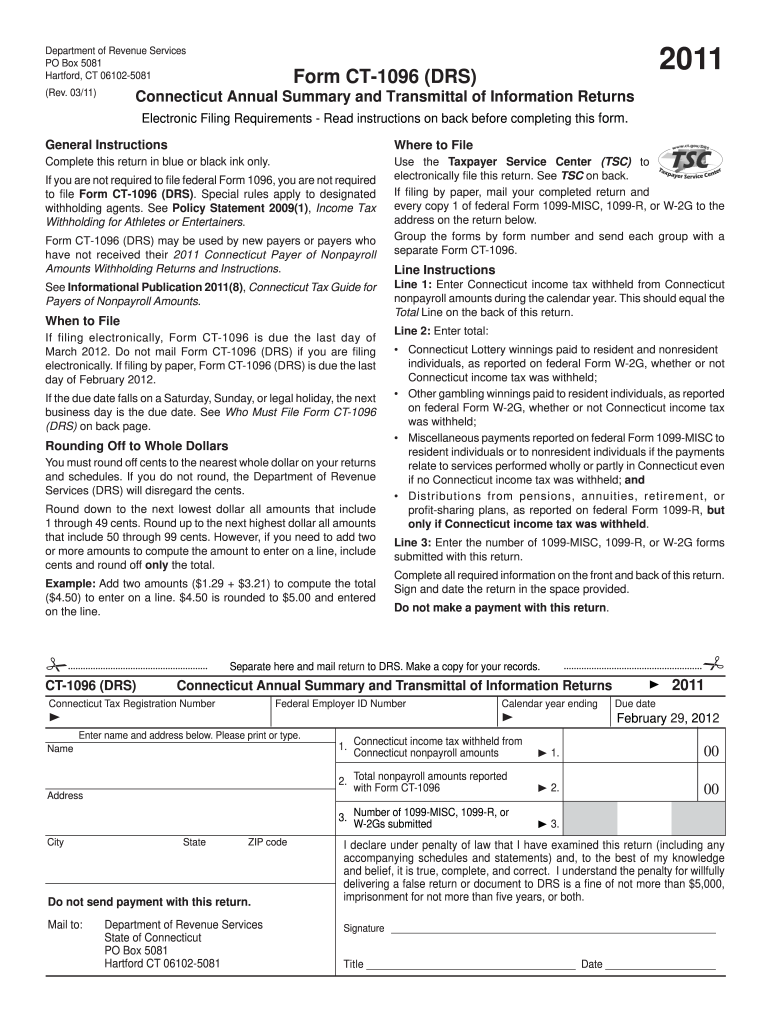

The Ct 1096 Form is a tax document used in the United States, specifically by businesses and organizations to report certain types of income. This form is typically associated with the reporting of payments made to independent contractors or other non-employees. It serves as a summary of the information provided on individual 1099 forms, which detail the specific payments made to each recipient. Understanding the purpose and requirements of the Ct 1096 Form is essential for compliance with federal tax regulations.

How to use the Ct 1096 Form

Using the Ct 1096 Form involves several steps to ensure accurate reporting of payments. First, gather all relevant 1099 forms that detail the payments made to contractors or non-employees throughout the tax year. Next, fill out the Ct 1096 Form by entering the total amounts reported on the individual 1099 forms. This summary form consolidates the information for submission to the IRS. Finally, ensure that the completed form is submitted by the designated deadline, along with the accompanying 1099 forms, to maintain compliance.

Steps to complete the Ct 1096 Form

Completing the Ct 1096 Form requires attention to detail. Follow these steps for accurate completion:

- Collect all 1099 forms that correspond to the payments made during the year.

- Enter your business information, including name, address, and Employer Identification Number (EIN).

- Summarize the total payments made to each recipient as reported on the 1099 forms.

- Double-check all entries for accuracy to avoid discrepancies.

- Sign and date the form before submission.

Legal use of the Ct 1096 Form

The legal use of the Ct 1096 Form is crucial for businesses to avoid penalties and ensure compliance with IRS regulations. This form must be filed accurately and on time to report payments made to contractors and non-employees. Failure to properly complete and submit the form can result in fines and other legal consequences. It is important to keep copies of submitted forms and any related documentation for record-keeping and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 1096 Form are critical for compliance. Typically, the form must be submitted to the IRS by the end of January following the tax year in which payments were made. Additionally, businesses should be aware of any state-specific deadlines that may apply. Keeping track of these dates helps ensure that all necessary forms are submitted on time, preventing penalties and interest on late filings.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1096 Form can be submitted in various ways, depending on the preferences of the business. Options include:

- Online Submission: Many businesses choose to file electronically through the IRS e-file system, which can streamline the process and reduce errors.

- Mail Submission: The form can be printed and mailed to the appropriate IRS address. Ensure that it is sent well before the deadline to allow for processing time.

- In-Person Submission: While less common, some businesses may opt to deliver forms directly to local IRS offices. This method can provide immediate confirmation of receipt.

Quick guide on how to complete ct 1096 form 2011

Easily Prepare Ct 1096 Form on Any Device

Managing documents online has become increasingly popular among enterprises and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it on the cloud. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Ct 1096 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Ct 1096 Form

- Locate Ct 1096 Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ct 1096 Form and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1096 form 2011

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 form 2011

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the Ct 1096 Form?

The Ct 1096 Form is a Connecticut tax form used to report the total amount of Connecticut income tax withheld from employees and payments made to non-residents. It's essential for businesses to ensure compliance with state tax regulations. By using the Ct 1096 Form correctly, you can avoid penalties and maintain accurate tax records.

-

How can airSlate SignNow help with the Ct 1096 Form?

airSlate SignNow simplifies the process of signing and sending your Ct 1096 Form electronically. Our platform allows for easy document management and tracking, ensuring that your forms are signed efficiently. With airSlate SignNow, you can focus on completing your taxes without the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ct 1096 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides access to essential features that can streamline your document signing process, including for the Ct 1096 Form. This cost-effective solution can save you time and resources in managing your tax-related documents.

-

What features does airSlate SignNow offer for handling the Ct 1096 Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, making it easy to handle the Ct 1096 Form. Our intuitive interface allows users to quickly prepare and send documents for eSignature. These features enhance efficiency and accuracy in your tax preparation process.

-

Can I integrate airSlate SignNow with other applications for the Ct 1096 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to automate workflows associated with the Ct 1096 Form. This capability ensures that your data is synchronized across platforms, making it easier to manage your tax documentation. Integration enhances productivity and simplifies your tax processes.

-

What are the benefits of using airSlate SignNow for the Ct 1096 Form?

Using airSlate SignNow for the Ct 1096 Form brings numerous benefits, including reduced turnaround time and improved accuracy. Our platform eliminates the challenges of paper documents and manual signatures, leading to quicker compliance. Additionally, eSigning the Ct 1096 Form increases security and accessibility, streamlining your overall workflow.

-

Is airSlate SignNow user-friendly for filing the Ct 1096 Form?

Yes, airSlate SignNow has been designed with user experience in mind, making it easy to file the Ct 1096 Form. The straightforward interface ensures that users can navigate through document preparation and signing without hassle. Whether you're new to eSignature solutions or an experienced user, airSlate SignNow is intuitive and accessible.

Get more for Ct 1096 Form

Find out other Ct 1096 Form

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online