Ct Form 990t 2019

What is the Ct Form 990t

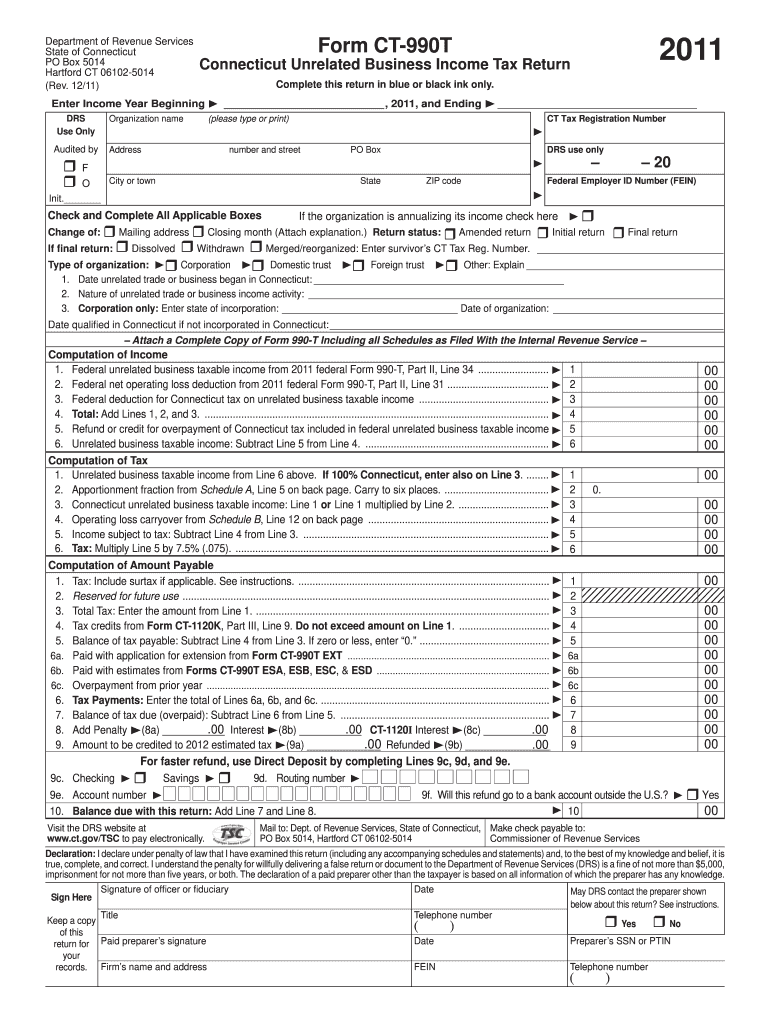

The Ct Form 990t is a tax form used by organizations in Connecticut to report unrelated business income. This form is essential for tax-exempt organizations that engage in activities not directly related to their exempt purpose. By filing the Ct Form 990t, organizations disclose their income from these unrelated business activities, ensuring compliance with state tax regulations. It is important for organizations to understand the implications of unrelated business income, as it may affect their tax-exempt status.

How to use the Ct Form 990t

Using the Ct Form 990t involves several steps. Organizations must first determine if they have any unrelated business income to report. If applicable, they should gather the necessary financial information related to these activities. The form requires details such as gross income, expenses incurred, and any applicable deductions. Once the information is compiled, organizations can fill out the form accurately, ensuring all sections are completed as required. After completing the form, it must be submitted to the appropriate state authority, either online or by mail.

Steps to complete the Ct Form 990t

Completing the Ct Form 990t requires a systematic approach:

- Gather Financial Records: Collect all relevant financial documents related to unrelated business income.

- Determine Income and Expenses: Calculate the total gross income and allowable expenses associated with unrelated business activities.

- Fill Out the Form: Carefully enter the gathered information into the appropriate sections of the Ct Form 990t.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid errors.

- Submit the Form: File the completed form with the state by the specified deadline, either electronically or via mail.

Legal use of the Ct Form 990t

The legal use of the Ct Form 990t is crucial for maintaining compliance with Connecticut tax laws. Organizations must file this form to report any unrelated business income, which is subject to taxation. Failure to file or inaccuracies in the form can lead to penalties and jeopardize the organization’s tax-exempt status. It is essential for organizations to understand the legal implications of their activities and ensure that they are reporting all required information accurately.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Ct Form 990t to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month following the end of the organization’s tax year. For example, if the tax year ends on December 31, the form would be due by May 15 of the following year. It is advisable for organizations to mark these dates on their calendars and prepare their filings in advance to ensure timely submission.

Required Documents

To complete the Ct Form 990t, organizations need to prepare several key documents:

- Financial Statements: Detailed financial records that outline income, expenses, and other relevant financial activities.

- Tax Exemption Documentation: Proof of the organization’s tax-exempt status, which may be required for verification.

- Supporting Schedules: Any additional schedules or forms that may be necessary to provide context or detail for the reported income.

Quick guide on how to complete 2011 ct form 990t

Complete Ct Form 990t effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly option to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Ct Form 990t on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Ct Form 990t with ease

- Locate Ct Form 990t and press Get Form to begin.

- Utilize the available tools to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that are specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a customary wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ct Form 990t and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 ct form 990t

Create this form in 5 minutes!

How to create an eSignature for the 2011 ct form 990t

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is Ct Form 990t and why is it important?

Ct Form 990t is a tax form that nonprofit organizations use to report unrelated business income to the IRS. Filing this form is crucial as it ensures compliance with tax laws and helps avoid penalties. By understanding how to accurately complete the Ct Form 990t, organizations can manage their tax obligations effectively.

-

How does airSlate SignNow simplify the process of filing Ct Form 990t?

airSlate SignNow simplifies the process of filing Ct Form 990t by providing a user-friendly platform for electronic signatures and document management. Users can easily create, edit, and send their forms without the hassle of paper-based processes. This ensures that your Ct Form 990t is filed efficiently and timely.

-

What are the pricing options for airSlate SignNow for handling Ct Form 990t?

airSlate SignNow offers several pricing plans tailored to organizations of different sizes. Depending on your needs, you can choose a plan that suits your budget while ensuring that you have all the necessary features for managing your Ct Form 990t. Contact our sales team for detailed pricing information.

-

Can airSlate SignNow integrate with my accounting software for Ct Form 990t?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions. This integration allows you to streamline the management of your financial documents and ensure the correct data is used when filing Ct Form 990t. Stay organized and efficient by synchronizing your tools.

-

What features does airSlate SignNow provide to assist with Ct Form 990t submissions?

airSlate SignNow offers features like templates, audit trails, and automated reminders to assist with Ct Form 990t submissions. These features enhance your document management process, ensuring that all required information is collected accurately and on time. This level of organization reduces the risk of errors in your tax filings.

-

Is there customer support available for users dealing with Ct Form 990t?

Absolutely, airSlate SignNow provides dedicated customer support for users navigating the Ct Form 990t process. Our support team is available to help with any questions about using our platform, ensuring that you have the assistance needed to complete your filings correctly. We're here to support your organization's success.

-

What are the benefits of using airSlate SignNow for completing Ct Form 990t?

Using airSlate SignNow for completing Ct Form 990t provides numerous benefits, including increased efficiency, reduced errors, and enhanced document security. With our platform, you can keep track of submissions and maintain compliance effortlessly. Additionally, e-signature features expedite the approval process, saving valuable time.

Get more for Ct Form 990t

Find out other Ct Form 990t

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure