Form Ct 990t 2019

What is the Form CT 990T

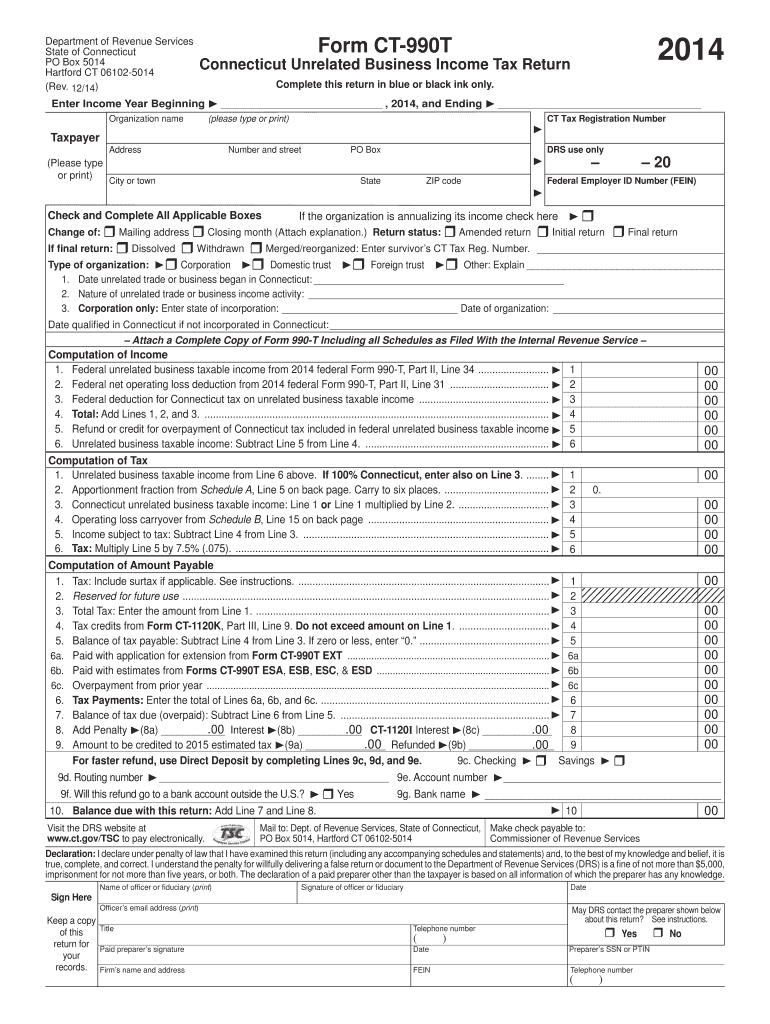

The Form CT 990T is a tax form used by organizations in Connecticut to report unrelated business income. This form is required for tax-exempt organizations that earn income from activities not directly related to their primary purpose. It helps the state assess the tax obligations of these organizations, ensuring compliance with state tax laws.

How to use the Form CT 990T

To effectively use the Form CT 990T, organizations must first determine if they have any unrelated business income to report. This involves identifying income generated from activities that are not substantially related to the organization's exempt purpose. Once identified, organizations can fill out the form with the necessary financial details, including gross income, deductions, and the resulting taxable income.

Steps to complete the Form CT 990T

Completing the Form CT 990T involves several key steps:

- Gather financial records related to unrelated business income.

- Fill out the identification section with the organization's details.

- Report all sources of unrelated business income in the appropriate sections.

- Calculate allowable deductions and determine the taxable income.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form CT 990T to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s tax year. For example, if the tax year ends on December 31, the form would be due by May 15 of the following year.

Legal use of the Form CT 990T

The legal use of the Form CT 990T is crucial for maintaining compliance with state tax regulations. Organizations must ensure that they accurately report their unrelated business income to avoid potential penalties. Proper filing demonstrates transparency and adherence to the laws governing tax-exempt entities in Connecticut.

Key elements of the Form CT 990T

Key elements of the Form CT 990T include:

- Identification of the organization, including name and address.

- Details of unrelated business income sources.

- Allowable deductions related to the income.

- Computation of taxable income.

- Signature of an authorized representative.

Quick guide on how to complete form ct 990t 2014

Complete Form Ct 990t seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without delays. Handle Form Ct 990t on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form Ct 990t effortlessly

- Locate Form Ct 990t and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal significance as an old-fashioned handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Ct 990t and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 990t 2014

Create this form in 5 minutes!

How to create an eSignature for the form ct 990t 2014

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is Form Ct 990t and why do I need it?

Form Ct 990t is a tax form used by organizations in Connecticut to report unrelated business income. It is essential for non-profits that earn income from activities not directly related to their charter. Understanding how to properly complete Form Ct 990t can help avoid penalties and ensure compliance with state regulations.

-

How does airSlate SignNow help with Form Ct 990t?

airSlate SignNow streamlines the process of completing and submitting Form Ct 990t with its user-friendly eSigning capabilities. You can easily fill out, sign, and manage documents related to your tax filings, all in one place. This saves time and reduces errors in your submission process.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. You can choose from individual plans to enterprise solutions that include features for managing Form Ct 990t and other documents efficiently. Visit our pricing page to find a plan that fits your organization’s needs.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and Dropbox. This allows you to import files and manage your documents for Form Ct 990t without hassle. These integrations enhance your workflow and make it easier to access all necessary documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides robust features like templates, automated workflows, and secure cloud storage that are ideal for managing tax documents such as Form Ct 990t. With these tools, you can ensure that your forms are completed accurately and efficiently, giving you peace of mind come tax season.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures, including bank-level encryption, to protect your sensitive documents like Form Ct 990t. You can confidently send and store your tax-related documents knowing they are secure.

-

Can I track the status of my Form Ct 990t submissions?

Yes, airSlate SignNow allows you to track the status of your Form Ct 990t submissions in real time. You will receive notifications when the document has been viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form Ct 990t

Find out other Form Ct 990t

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now