Ct Form Waiver Penalty 2020

What is the Ct Form Waiver Penalty

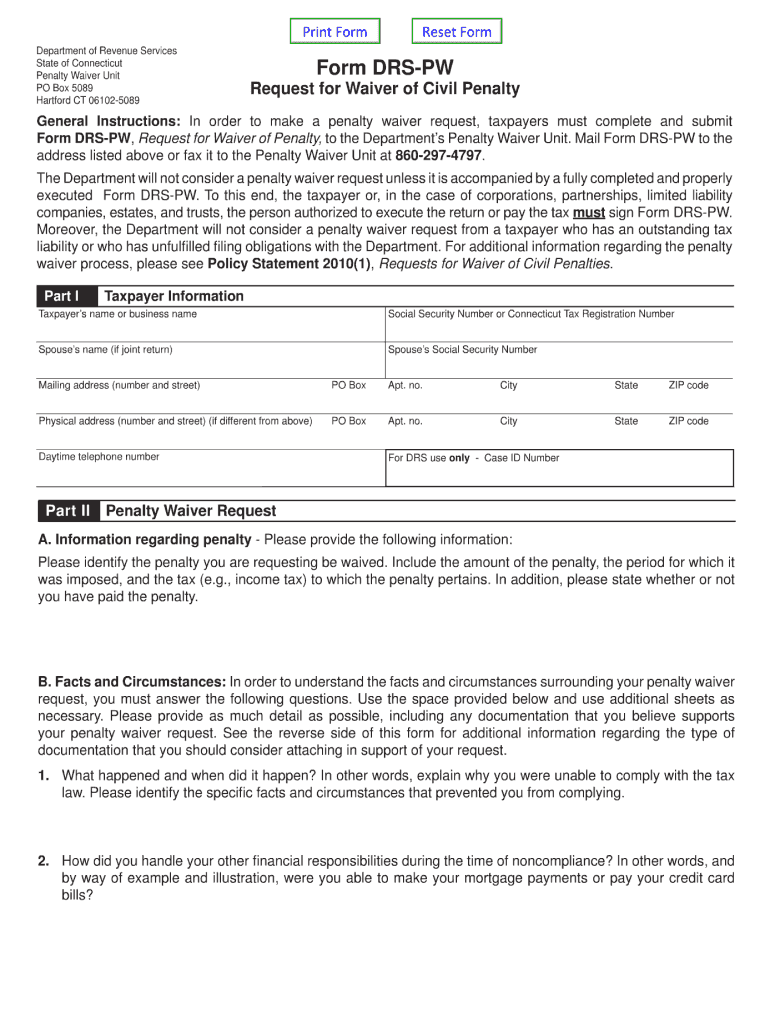

The Ct Form Waiver Penalty is a document used in Connecticut that allows taxpayers to request a waiver of penalties associated with late or incorrect filings. This form is particularly relevant for individuals and businesses that have faced extenuating circumstances affecting their ability to comply with tax obligations. Understanding the purpose and implications of this form is crucial for anyone seeking to mitigate potential penalties imposed by the state.

How to use the Ct Form Waiver Penalty

To effectively use the Ct Form Waiver Penalty, taxpayers must first determine their eligibility for a waiver. This typically involves reviewing the reasons for the late filing or payment. Once eligibility is established, the taxpayer should complete the form, providing necessary details such as identification information and a clear explanation of the circumstances that led to the delay. It is essential to submit the form promptly to ensure consideration by the tax authority.

Steps to complete the Ct Form Waiver Penalty

Completing the Ct Form Waiver Penalty involves several key steps:

- Gather necessary documentation that supports your request, such as tax returns and correspondence with the tax authority.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide a detailed explanation of the circumstances that led to the late filing or payment.

- Review the form for accuracy before submission.

- Submit the completed form to the appropriate tax authority, either online or by mail.

Legal use of the Ct Form Waiver Penalty

The legal use of the Ct Form Waiver Penalty is governed by state tax laws, which outline the circumstances under which penalties may be waived. Taxpayers must ensure that their request complies with these laws, demonstrating valid reasons for their inability to meet deadlines. This form serves as an official request and must be treated with the same seriousness as other tax documents.

Filing Deadlines / Important Dates

Filing deadlines for the Ct Form Waiver Penalty may vary based on specific circumstances, such as the nature of the tax obligation and the penalties being addressed. It is crucial for taxpayers to be aware of these deadlines to ensure timely submission. Generally, forms should be filed as soon as the taxpayer recognizes a potential penalty issue to enhance the chances of approval.

Eligibility Criteria

Eligibility for the Ct Form Waiver Penalty typically includes specific criteria that taxpayers must meet. Common factors include demonstrating reasonable cause for the delay, such as illness, natural disasters, or other unforeseen circumstances. Taxpayers should carefully assess their situation against these criteria before submitting the waiver request to improve their chances of a favorable outcome.

Quick guide on how to complete ct form waiver penalty 2010

Effortlessly Prepare Ct Form Waiver Penalty on Any Device

The management of documents online has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the needed form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Ct Form Waiver Penalty on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The Easiest Way to Modify and eSign Ct Form Waiver Penalty with Ease

- Locate Ct Form Waiver Penalty and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent parts of your documents or obscure confidential details with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow accommodates all your document management requirements in a few clicks from any selected device. Edit and eSign Ct Form Waiver Penalty and guarantee superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct form waiver penalty 2010

Create this form in 5 minutes!

How to create an eSignature for the ct form waiver penalty 2010

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Ct Form Waiver Penalty and how does it work?

The Ct Form Waiver Penalty is a mechanism that allows taxpayers to request a waiver of penalties associated with late or incomplete tax filings. By utilizing airSlate SignNow, users can efficiently submit their waiver requests electronically, reducing delays and ensuring proper documentation.

-

How can airSlate SignNow help with submitting a Ct Form Waiver Penalty?

airSlate SignNow simplifies the process of submitting a Ct Form Waiver Penalty by providing an intuitive platform for eSigning and sending documents. With user-friendly templates, businesses can quickly prepare their waiver requests and ensure they meet all necessary requirements.

-

Is there a cost associated with using airSlate SignNow for Ct Form Waiver Penalty submissions?

Yes, while airSlate SignNow offers competitive pricing plans, there is no hidden fee for submitting a Ct Form Waiver Penalty. Customers can choose from various plans tailored to their needs, ensuring that they have access to the features necessary for smooth document management and signing.

-

What features does airSlate SignNow provide for managing Ct Form Waiver Penalty requests?

With airSlate SignNow, users can take advantage of features such as customizable templates, real-time tracking, and secure document storage, making it ideal for managing Ct Form Waiver Penalty requests. These features help enhance workflow efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other tools for handling Ct Form Waiver Penalty processes?

Absolutely! airSlate SignNow offers integrations with popular business tools, allowing users to streamline their Ct Form Waiver Penalty processes. These integrations enable seamless workflow across various platforms, enhancing productivity and ensuring that all documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the Ct Form Waiver Penalty?

Using airSlate SignNow for the Ct Form Waiver Penalty provides businesses with a reliable, secure, and efficient way to handle their documents. The platform's ease of use and comprehensive features allow users to focus on their core operations while ensuring compliance and timely submissions.

-

How secure is my information when using airSlate SignNow for Ct Form Waiver Penalty?

Security is a top priority for airSlate SignNow. When submitting a Ct Form Waiver Penalty, users can trust that their data is protected with advanced encryption and security protocols, ensuring that sensitive information remains confidential throughout the submission process.

Get more for Ct Form Waiver Penalty

Find out other Ct Form Waiver Penalty

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy