CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates 2020

What is the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates

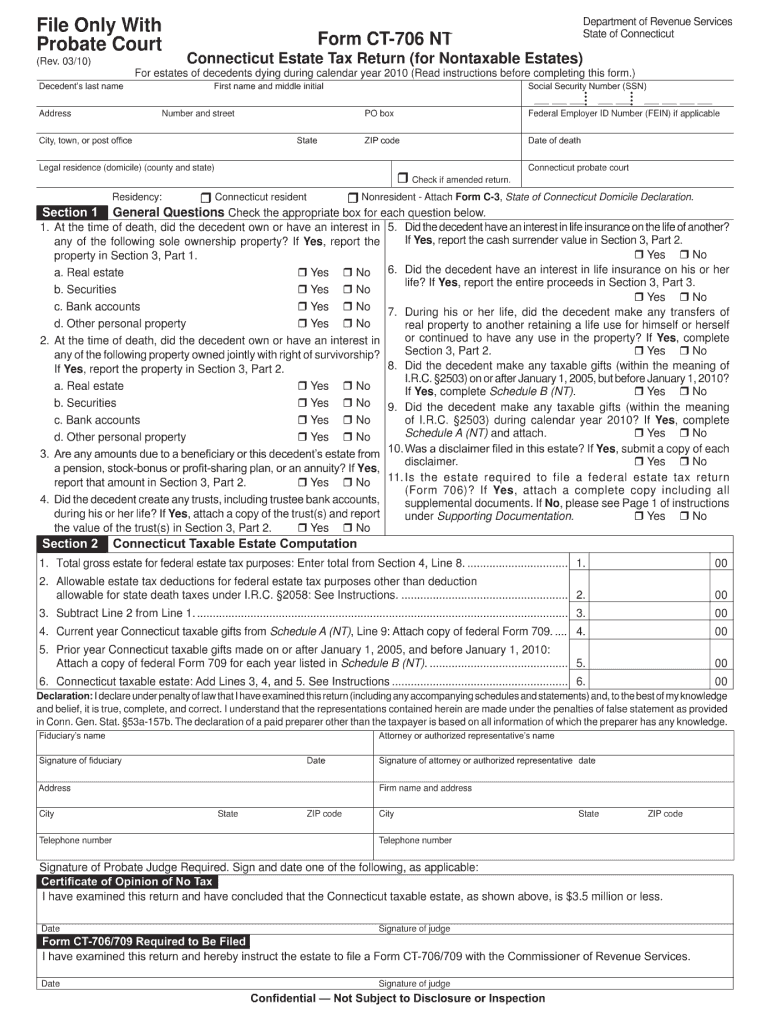

The CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates, is a specific form used to report the estate of a deceased individual in Connecticut when the estate does not exceed the taxable threshold set by the state. This form is crucial for estates that are not subject to Connecticut estate tax but still require formal reporting to the state. It ensures compliance with state laws and provides necessary documentation for the estate's settlement process.

How to use the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates

To effectively use the CT 706 NT, individuals should first determine if the estate qualifies as nontaxable by reviewing the current estate tax thresholds. Once eligibility is confirmed, the form must be completed accurately, providing all required information about the decedent's assets, liabilities, and beneficiaries. After filling out the form, it should be submitted to the Connecticut Department of Revenue Services to fulfill legal obligations.

Steps to complete the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates

Completing the CT 706 NT involves several key steps:

- Gather necessary documentation, including the decedent's will, asset valuations, and any outstanding debts.

- Fill out the form with accurate details regarding the estate's assets, liabilities, and distribution.

- Review the form for completeness and accuracy to avoid delays in processing.

- Submit the completed form to the Connecticut Department of Revenue Services by the specified deadline.

Key elements of the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates

Important elements of the CT 706 NT include:

- Decedent's information, including name, date of birth, and date of death.

- Details of the estate's assets, such as real estate, bank accounts, and investments.

- Liabilities that may affect the net value of the estate.

- Information about beneficiaries and their respective shares of the estate.

Filing Deadlines / Important Dates

Filing deadlines for the CT 706 NT are critical to ensure compliance. The form must typically be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is essential to adhere to the original deadlines to avoid penalties.

Required Documents

When completing the CT 706 NT, several documents are required to support the information provided. These include:

- The decedent's will or trust documents.

- Asset valuations, such as appraisals for real estate and statements for financial accounts.

- Records of any debts or liabilities owed by the estate.

- Identification documents for the executor or personal representative.

Quick guide on how to complete ct 706 nt connecticut estate tax return for nontaxable estates

Complete CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates on any device using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates without effort

- Find CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 706 nt connecticut estate tax return for nontaxable estates

Create this form in 5 minutes!

How to create an eSignature for the ct 706 nt connecticut estate tax return for nontaxable estates

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates?

The CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates, is a form used to report the estate of a decedent who is not subject to Connecticut estate tax. This form allows the estate to be officially recognized without incurring tax liability. Understanding and correctly filing this return can help streamline the settlement of estates.

-

Who needs to file the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates?

Filing the CT 706 NT is required for estates that are claimed to be nontaxable under Connecticut law. If the total value of the estate falls below the taxable threshold set by the state, a return may still need to be submitted. Consult with a tax professional to determine your filing requirements.

-

What information is required to complete the CT 706 NT form?

To complete the CT 706 NT, you will need details such as the decedent's personal information, the value of the estate, and the names of beneficiaries. Additionally, you may need documentation proving why the estate is nontaxable. Accurate documentation is key to a successful filing.

-

How does airSlate SignNow facilitate filing the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates?

airSlate SignNow provides an easy-to-use platform that allows users to prepare, send, and eSign documents, including the CT 706 NT. The streamlined process reduces errors and saves time, making estate management simpler. This user-friendly approach enhances document accuracy and compliance.

-

Are there any costs associated with using airSlate SignNow for the CT 706 NT filing?

The pricing for airSlate SignNow varies based on the subscription plan you choose. While there may be a small fee associated with filing the CT 706 NT, using the platform can be a cost-effective solution compared to traditional methods. Review the pricing plans to select the best fit for your needs.

-

What features does airSlate SignNow offer for managing estate documents?

airSlate SignNow offers features such as document templates, electronic signature capabilities, and secure cloud storage. These tools are designed to facilitate the management of all estate-related documents, including the CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates. This ensures that all documents are organized and accessible when needed.

-

Can airSlate SignNow integrate with other software for estate management?

Yes, airSlate SignNow integrates seamlessly with various business tools and software, enhancing efficiency in estate management. This allows users to connect their existing systems with the CT 706 NT filing process. Integrations can improve workflow and reduce redundancy in data entry.

Get more for CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates

Find out other CT 706 NT, Connecticut Estate Tax Return for Nontaxable Estates

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF