Schedule Ct Si Form 2019

What is the Schedule Ct Si Form

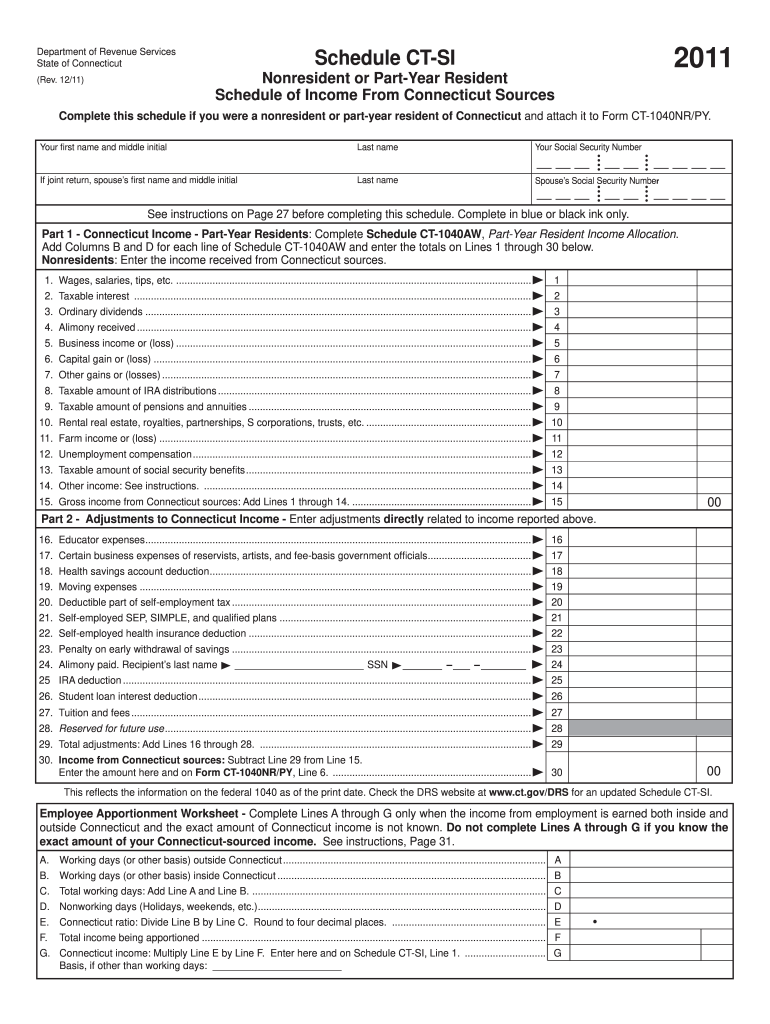

The Schedule Ct Si Form is a tax form used by individuals and businesses in Connecticut to report specific income and calculate the corresponding tax liability. This form is particularly relevant for taxpayers who have earned income that is subject to Connecticut's income tax regulations. It serves as a supplementary document to the main state tax return, allowing for detailed reporting of certain income types, deductions, and credits applicable to Connecticut tax laws.

How to use the Schedule Ct Si Form

To effectively use the Schedule Ct Si Form, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any records of income that need to be reported. The form requires detailed information about income sources, deductions, and credits. After filling out the form, it must be attached to the main state tax return before submission. It is essential to ensure that all calculations are accurate to avoid any discrepancies that may lead to penalties or delays in processing.

Steps to complete the Schedule Ct Si Form

Completing the Schedule Ct Si Form involves several key steps:

- Gather all relevant financial documents, such as W-2 and 1099 forms.

- Fill in personal information, including your name, address, and Social Security number.

- Report all applicable income sources, ensuring to include any deductions or credits.

- Double-check all entries for accuracy, particularly numerical calculations.

- Attach the completed form to your main state tax return.

- Submit your tax return by the designated filing deadline.

Legal use of the Schedule Ct Si Form

The Schedule Ct Si Form is legally recognized as a valid document for reporting income to the state of Connecticut. To ensure its legal standing, taxpayers must adhere to state guidelines and regulations regarding the submission of tax forms. This includes providing accurate information and ensuring that the form is signed and dated appropriately. Failure to comply with these legal requirements may result in penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule Ct Si Form align with the state tax return deadlines. Typically, taxpayers must submit their Connecticut state tax returns, including the Schedule Ct Si Form, by April fifteenth of each year. It is important to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances, but must be officially requested.

Required Documents

When completing the Schedule Ct Si Form, taxpayers will need to provide several key documents, including:

- W-2 forms from employers reporting wages and salaries.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for any deductions or credits being claimed.

Who Issues the Form

The Schedule Ct Si Form is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The DRS provides resources and guidance for completing the form, as well as updates regarding any changes in tax regulations that may affect its use.

Quick guide on how to complete schedule ct si 2011 form

Effortlessly prepare Schedule Ct Si Form on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Schedule Ct Si Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Schedule Ct Si Form with ease

- Find Schedule Ct Si Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule Ct Si Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ct si 2011 form

Create this form in 5 minutes!

How to create an eSignature for the schedule ct si 2011 form

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Schedule Ct Si Form and how can it be utilized?

The Schedule Ct Si Form is a specific document used for Connecticut tax purposes. By utilizing airSlate SignNow, you can easily complete and eSign the Schedule Ct Si Form, ensuring compliance and accuracy in your tax filings.

-

How does airSlate SignNow simplify the process of filling out the Schedule Ct Si Form?

airSlate SignNow offers an intuitive interface that streamlines the process of filling out the Schedule Ct Si Form. With templates and guided steps, you can quickly input your information and finalize the form for eSigning.

-

What features of airSlate SignNow enhance the usability of the Schedule Ct Si Form?

airSlate SignNow includes features like document templates, automated workflows, and real-time tracking, which enhance the usability of the Schedule Ct Si Form. These tools help save time and ensure that your forms are processed efficiently.

-

Is there a free trial available for using airSlate SignNow for the Schedule Ct Si Form?

Yes, airSlate SignNow offers a free trial that allows users to test the platform's capabilities, including eSigning the Schedule Ct Si Form. This trial helps prospective customers evaluate the product before committing to a subscription.

-

How does airSlate SignNow ensure the security of signed Schedule Ct Si Forms?

airSlate SignNow prioritizes security by using encryption and secure server environments to protect your signed Schedule Ct Si Forms. Compliance with industry standards ensures that your sensitive information remains confidential and safe.

-

Can I integrate airSlate SignNow with other software while working on the Schedule Ct Si Form?

Yes, airSlate SignNow offers integrations with various business applications, allowing you to seamlessly manage your documents, including the Schedule Ct Si Form. This interoperability improves your workflow and enhances productivity.

-

What are the pricing options for airSlate SignNow when using it for the Schedule Ct Si Form?

airSlate SignNow provides flexible pricing plans tailored to different business needs, making it cost-effective for handling the Schedule Ct Si Form. Users can choose from various subscription tiers based on their usage and feature requirements.

Get more for Schedule Ct Si Form

- Powergrid vendor portal form

- Atestado de vida form

- C63 form

- University of wisconsin integrative medicine program www form

- Discipline policy daycare example form

- Experience verification form llr

- Petition for conciliation arizona superior court in pima county sc pima form

- Scca 478 south carolina judicial department judicial state sc form

Find out other Schedule Ct Si Form

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template