Department of Revenue Services Annual Reports CT Gov 2019

What is the Department Of Revenue Services Annual Reports CT gov

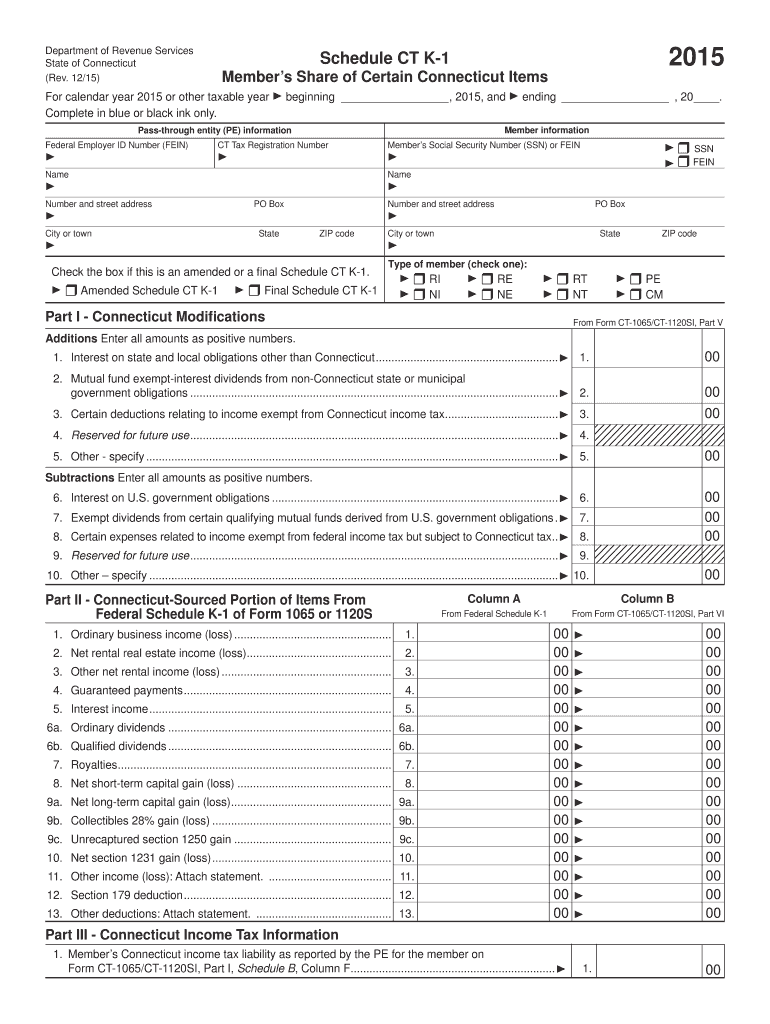

The Department of Revenue Services Annual Reports CT gov is a formal document that provides a comprehensive overview of the financial activities and performance of the Connecticut Department of Revenue Services. This report typically includes details on revenue collections, expenditures, and compliance with state tax laws. It serves as an essential resource for stakeholders, including policymakers, taxpayers, and researchers, to understand the fiscal health of the state and the effectiveness of its revenue collection efforts.

How to use the Department Of Revenue Services Annual Reports CT gov

Utilizing the Department of Revenue Services Annual Reports CT gov involves reviewing the document for insights into state revenue trends and fiscal policies. Users can analyze specific sections such as revenue sources, tax compliance rates, and expenditure patterns. This information can be beneficial for businesses assessing their tax obligations, researchers conducting economic studies, and citizens interested in state financial management. The report can also guide users in understanding how state funds are allocated and spent.

Steps to complete the Department Of Revenue Services Annual Reports CT gov

Completing the Department of Revenue Services Annual Reports CT gov requires specific steps to ensure accuracy and compliance. First, gather all relevant financial data, including revenue sources and expenditures. Next, compile this information into the required format, ensuring that all figures are up-to-date and accurately reflect the financial year in question. After compiling the data, review the report for consistency and clarity before submitting it to the appropriate state authorities.

Legal use of the Department Of Revenue Services Annual Reports CT gov

The legal use of the Department of Revenue Services Annual Reports CT gov is crucial for maintaining transparency and accountability in state financial operations. These reports are often required by law and must adhere to specific guidelines set forth by state regulations. Proper use of these reports ensures compliance with financial reporting standards and can serve as evidence in audits or legal proceedings related to state revenue management.

Filing Deadlines / Important Dates

Filing deadlines for the Department of Revenue Services Annual Reports CT gov are typically established by the Connecticut state government. It is essential for users to be aware of these dates to ensure timely submission and avoid penalties. Important dates may include the deadline for the current fiscal year's report submission, as well as any interim reporting requirements that may be specified by the Department of Revenue Services.

Required Documents

To complete the Department of Revenue Services Annual Reports CT gov, several documents may be required. These can include financial statements, tax revenue data, and compliance reports. Users should also prepare any supporting documentation that validates the figures reported, such as audits or financial reviews. Ensuring that all required documents are accurate and complete is vital for a successful submission.

Penalties for Non-Compliance

Failure to comply with the requirements of the Department of Revenue Services Annual Reports CT gov can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial for individuals and businesses to understand these consequences and ensure that all reporting is completed accurately and on time to avoid any negative repercussions.

Quick guide on how to complete department of revenue services annual reports ctgov

Complete Department Of Revenue Services Annual Reports CT gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your files quickly without delays. Handle Department Of Revenue Services Annual Reports CT gov on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Department Of Revenue Services Annual Reports CT gov with ease

- Obtain Department Of Revenue Services Annual Reports CT gov and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Department Of Revenue Services Annual Reports CT gov and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services annual reports ctgov

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services annual reports ctgov

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What are the Department Of Revenue Services Annual Reports CT gov requirements?

The Department Of Revenue Services Annual Reports CT gov requires businesses to file an annual report that includes essential details such as business structure, officer information, and financial data. This report is crucial for maintaining good standing with state authorities.

-

How can airSlate SignNow help with the Department Of Revenue Services Annual Reports CT gov?

airSlate SignNow simplifies the process of completing and submitting the Department Of Revenue Services Annual Reports CT gov by allowing users to eSign documents online. This ensures that your filings are timely, secure, and compliant with state requirements.

-

What are the pricing options for airSlate SignNow related to the Department Of Revenue Services Annual Reports CT gov?

airSlate SignNow offers various pricing plans tailored to different business needs, enabling organizations to choose a plan that best suits their requirements for handling the Department Of Revenue Services Annual Reports CT gov. All plans provide essential features for document management and eSignature solutions.

-

Are there any specific features in airSlate SignNow for the Department Of Revenue Services Annual Reports CT gov?

Yes, airSlate SignNow includes features specifically designed to streamline the Department Of Revenue Services Annual Reports CT gov process, such as customizable templates, automated reminders for filing deadlines, and secure eSigning capabilities. These features optimize the efficiency of your reporting tasks.

-

Can airSlate SignNow integrate with accounting software for Department Of Revenue Services Annual Reports CT gov?

Absolutely! airSlate SignNow can integrate with various accounting software solutions to facilitate the preparation of the Department Of Revenue Services Annual Reports CT gov. This integration helps centralize your data and simplifies the reporting process, saving you time and effort.

-

What benefits does airSlate SignNow offer for handling Department Of Revenue Services Annual Reports CT gov?

Using airSlate SignNow for the Department Of Revenue Services Annual Reports CT gov can greatly enhance your workflow. Benefits include increased efficiency, reduced processing time, and improved accuracy through digital document management and eSigning.

-

Is training available for using airSlate SignNow for Department Of Revenue Services Annual Reports CT gov?

Yes, airSlate SignNow provides training resources and customer support to assist users in effectively utilizing the platform for the Department Of Revenue Services Annual Reports CT gov. Comprehensive guides and support staff are available to answer any questions.

Get more for Department Of Revenue Services Annual Reports CT gov

Find out other Department Of Revenue Services Annual Reports CT gov

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple