for the Year January 1, , through December 31, , or Fiscal Year Beginning 2020

What is the For The Year January 1, 2019, Through December 31, 2019, Or Fiscal Year Beginning

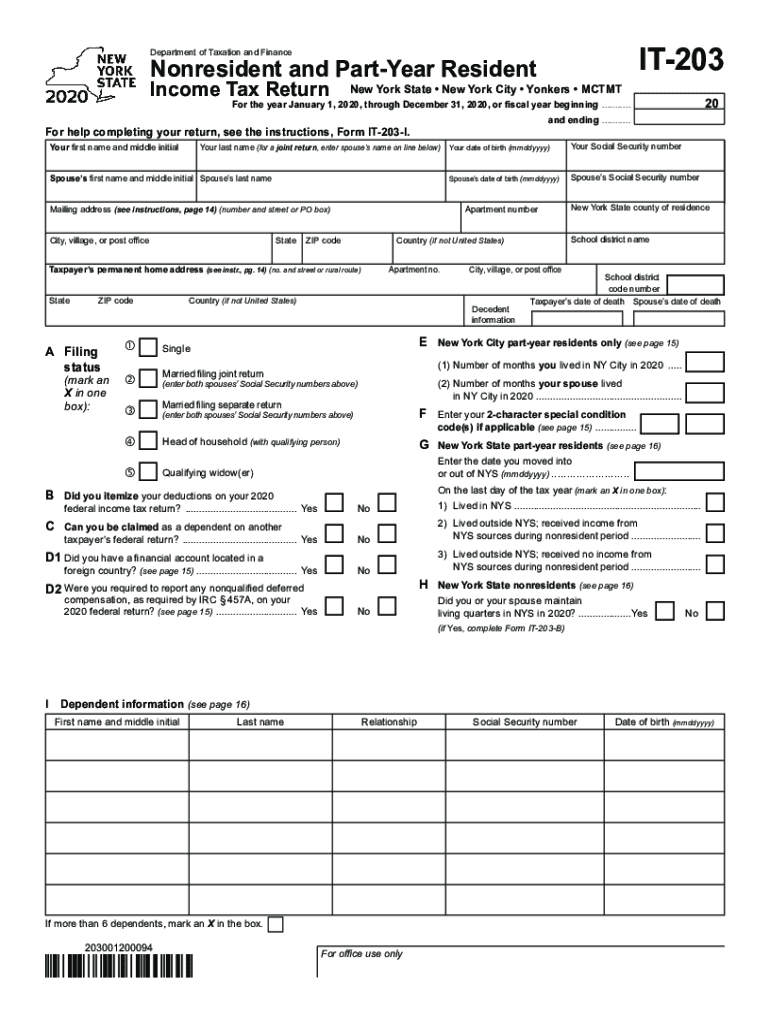

The 2019 NY IT 203 form is designed for New York State taxpayers who need to report their income and calculate their tax liability for the year. This form is applicable for the calendar year starting January 1, 2019, and ending December 31, 2019. Taxpayers may also use this form for a fiscal year if their financial year does not align with the calendar year. Understanding the time frame for which the form is applicable is crucial for accurate reporting and compliance with state tax regulations.

Steps to Complete the For The Year January 1, 2019, Through December 31, 2019, Or Fiscal Year Beginning

Completing the 2019 NY IT 203 form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements, deduction records, and any applicable tax credits. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, self-employment income, and any other taxable income.

- Calculate your deductions and credits, ensuring you have the required documentation to support your claims.

- Complete the tax calculation section to determine your total tax liability.

- Review the form for accuracy before submitting it.

Filing Deadlines / Important Dates

For the 2019 NY IT 203 form, the filing deadline typically aligns with the federal tax deadline, which is April 15, 2020. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to file on time to avoid penalties and interest on any unpaid taxes. Additionally, if you require more time to prepare your return, consider filing for an extension, which may provide an additional six months to submit your form.

Required Documents

To accurately complete the 2019 NY IT 203 form, you will need several key documents, including:

- W-2 forms from employers showing your wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or interest.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any tax credits you plan to claim, supported by relevant paperwork.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that govern the completion and submission of state tax forms, including the 2019 NY IT 203. It is important to refer to IRS publications for information on income reporting, allowable deductions, and tax credits. Ensure that you are familiar with both federal and state tax laws, as they can differ significantly. Following IRS guidelines will help ensure that your form is completed correctly and that you remain in compliance with tax regulations.

Penalties for Non-Compliance

Failure to comply with the requirements set forth in the 2019 NY IT 203 form can result in penalties. Common penalties include:

- Late filing penalties, which may accumulate daily until the form is submitted.

- Interest on any unpaid taxes, which accrues from the original due date until the balance is paid in full.

- Potential legal action for fraudulent reporting or failure to report income.

It is essential to file accurately and on time to avoid these consequences.

Quick guide on how to complete for the year january 1 2020 through december 31 2020 or fiscal year beginning

Manage For The Year January 1, , Through December 31, , Or Fiscal Year Beginning seamlessly on any device

Digital document administration has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without interruptions. Handle For The Year January 1, , Through December 31, , Or Fiscal Year Beginning on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign For The Year January 1, , Through December 31, , Or Fiscal Year Beginning effortlessly

- Find For The Year January 1, , Through December 31, , Or Fiscal Year Beginning and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Identify key sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and eSign For The Year January 1, , Through December 31, , Or Fiscal Year Beginning to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for the year january 1 2020 through december 31 2020 or fiscal year beginning

Create this form in 5 minutes!

How to create an eSignature for the for the year january 1 2020 through december 31 2020 or fiscal year beginning

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What are the NY IT 203 instructions 2019 for e-signatures?

The NY IT 203 instructions 2019 provide guidelines on how to properly use electronic signatures on tax documents. It's vital for businesses to follow these instructions to ensure compliance and validity. By using airSlate SignNow, you can easily adhere to the NY IT 203 instructions 2019, making the signing process seamless and reliable.

-

How can airSlate SignNow help with NY IT 203 instructions 2019 compliance?

airSlate SignNow offers features that align with the NY IT 203 instructions 2019, allowing you to securely sign documents electronically. Our platform ensures that all signatures are legally binding and provide an audit trail for verification. This simplifies compliance for businesses handling taxes and regulatory documents.

-

What pricing plans does airSlate SignNow offer for handling NY IT 203 instructions 2019?

airSlate SignNow provides various pricing plans tailored to meet different business needs, especially for those working with NY IT 203 instructions 2019. Our plans are affordable, enabling businesses of all sizes to implement e-signature solutions without breaking the bank. Explore our plans to find one that suits your requirements.

-

What features does airSlate SignNow provide for the NY IT 203 instructions 2019?

The features of airSlate SignNow include customizable templates, advanced security measures, and easy mobile access, ensuring you adhere to NY IT 203 instructions 2019 without hassle. Our platform streamlines the signing process, helping businesses save time and resources while maintaining compliance. Discover all the features designed to enhance your document workflow.

-

Can airSlate SignNow integrate with other tools for NY IT 203 instructions 2019?

Yes, airSlate SignNow can seamlessly integrate with various tools and applications, which is essential for managing the NY IT 203 instructions 2019 efficiently. By connecting with popular software like CRMs and document management systems, businesses can enhance their workflow and ensure the compliance of all signed documents. Integration helps streamline processes and improve productivity.

-

What are the benefits of using airSlate SignNow for NY IT 203 instructions 2019?

Using airSlate SignNow offers numerous benefits related to the NY IT 203 instructions 2019, including enhanced security and reduced turnaround times. Our platform facilitates quick and easy document signing while maintaining compliance with all guidelines. This ultimately leads to increased efficiency and a better user experience for your clients.

-

Is airSlate SignNow user-friendly for those following NY IT 203 instructions 2019?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing even those unfamiliar with NY IT 203 instructions 2019 to navigate effortlessly. The intuitive interface simplifies the process of sending and signing documents while keeping compliance at the forefront. Our platform is tailored to enhance user experience for everyone.

Get more for For The Year January 1, , Through December 31, , Or Fiscal Year Beginning

Find out other For The Year January 1, , Through December 31, , Or Fiscal Year Beginning

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF