Form it 203 Nonresident and Part Year Resident Income Tax Return Tax Year 2023

Understanding the Form IT 203 Nonresident and Part Year Resident Income Tax Return

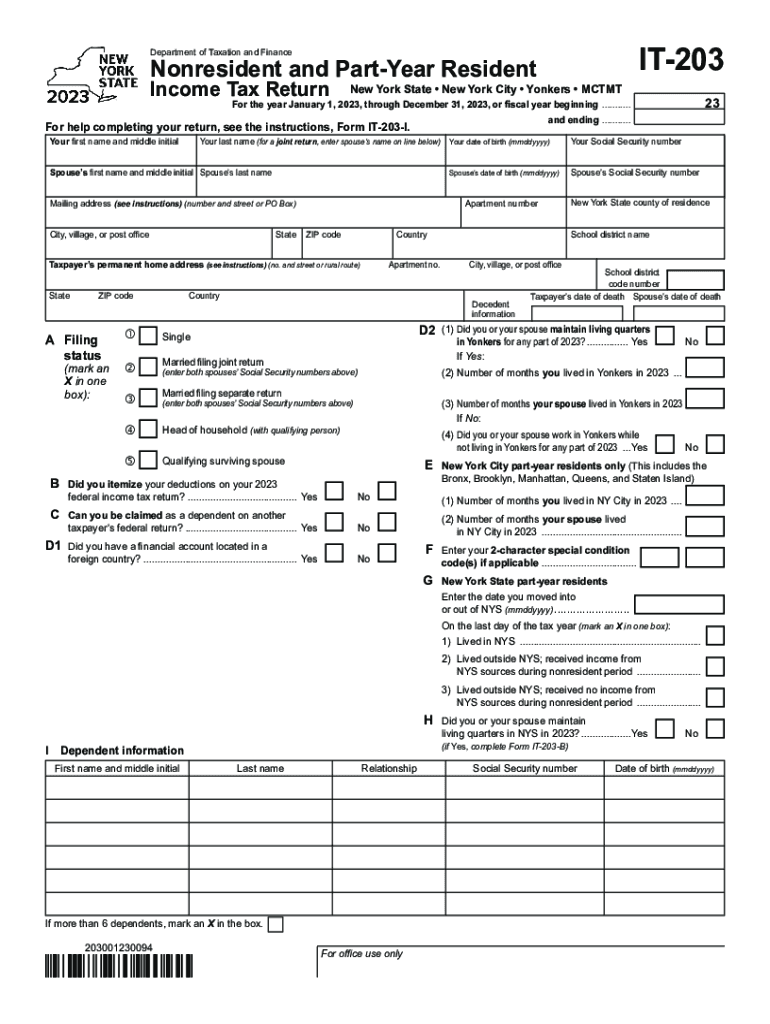

The Form IT 203 is specifically designed for nonresidents and part-year residents of New York State to report their income earned within the state. This form is essential for individuals who do not meet the residency requirements but still have taxable income sourced from New York. It allows these taxpayers to accurately calculate their tax obligations while ensuring compliance with state tax laws.

Steps to Complete the Form IT 203

Completing the Form IT 203 involves several key steps:

- Gather all necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income earned in New York State, ensuring to include only the income sourced from within the state.

- Calculate your total tax liability using the appropriate tax rates for nonresidents.

- Review the form for accuracy before submission.

Obtaining the Form IT 203

The Form IT 203 can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and complete it manually. Additionally, the form may be available at local tax offices or libraries for those who prefer a physical copy.

Filing Deadlines for the Form IT 203

It is crucial to be aware of the filing deadlines associated with the Form IT 203. Typically, the form must be filed by April fifteenth of the year following the tax year being reported. For the 2019 tax year, the deadline would have been April 15, 2020. Taxpayers should ensure timely submission to avoid penalties and interest on any taxes owed.

Key Elements of the Form IT 203

The Form IT 203 includes several important sections that taxpayers must complete:

- Personal Information: This section requires basic identification details.

- Income Reporting: Taxpayers must report all income earned within New York State.

- Tax Calculation: This section helps determine the total tax owed based on reported income.

- Signatures: The form must be signed and dated to validate the information provided.

Legal Use of the Form IT 203

The legal use of Form IT 203 is to ensure compliance with New York State tax laws for those who earn income in the state but do not qualify as residents. Filing this form is a legal requirement for nonresidents to report their income and pay any taxes owed, thereby avoiding potential legal issues or penalties associated with non-compliance.

Quick guide on how to complete form it 203 nonresident and part year resident income tax return tax year

Effortlessly Prepare Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year with Ease

- Locate Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Alter and eSign Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 nonresident and part year resident income tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 nonresident and part year resident income tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for NY nonresident residents?

The airSlate SignNow solution allows NY nonresident residents to easily send and eSign documents online. This platform is designed for efficiency, ensuring that you can get documents signed quickly without the need for physical meetings. The user-friendly interface simplifies the signing process, making it accessible for everyone.

-

What are the pricing options available for NY nonresident residents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of NY nonresident residents. Depending on your business size and requirements, you can choose from various subscription options that fit your budget. Additionally, we frequently provide promotions, so it's worth checking our website for the latest deals.

-

What features does airSlate SignNow provide for NY nonresident residents?

For NY nonresident residents, airSlate SignNow provides a robust set of features that enhance productivity. Key features include document templates, mobile access, advanced security options, and real-time tracking of signatures. These features are designed to streamline the signing process and improve overall efficiency.

-

How can NY nonresident residents benefit from using airSlate SignNow?

NY nonresident residents can benefit from airSlate SignNow by simplifying their document workflows. The platform helps reduce time spent on paperwork while ensuring compliance and security. Moreover, the convenience of remote signing allows businesses to adapt swiftly to changing circumstances.

-

Are there any integrations available for NY nonresident residents with airSlate SignNow?

Yes, airSlate SignNow offers various integrations that benefit NY nonresident residents. You can connect it with popular applications like Google Drive, Dropbox, and CRM systems to consolidate your workflows. These integrations enable a seamless transition between your document management tools and eSigning capabilities.

-

Is airSlate SignNow secure for NY nonresident residents to use?

Absolutely! airSlate SignNow prioritizes the security of its users, including NY nonresident residents. The platform employs top-notch encryption methods and complies with industry standards to protect sensitive information. You can confidently handle your important documents knowing they are secure.

-

How does airSlate SignNow improve collaboration for NY nonresident residents?

airSlate SignNow enhances collaboration for NY nonresident residents by allowing multiple parties to sign documents simultaneously. This feature accelerates the approval process, minimizing delays typically associated with traditional signing methods. With notifications and reminders, all parties stay informed and engaged.

Get more for Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year

- The village bankfull service bank located in the heart of seven form

- National press foundation awards dinnerc spanorg form

- 2019 2020 escc federal direct loan certification form

- Dear patient form

- Covetrus application form

- Written statement for ach stop payment esl federal credit form

- Forms library university of vermont

- Adp client account agreement form

Find out other Form IT 203 Nonresident And Part Year Resident Income Tax Return Tax Year

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe