Ny Form it 203 2019

What is the NY Form IT-203?

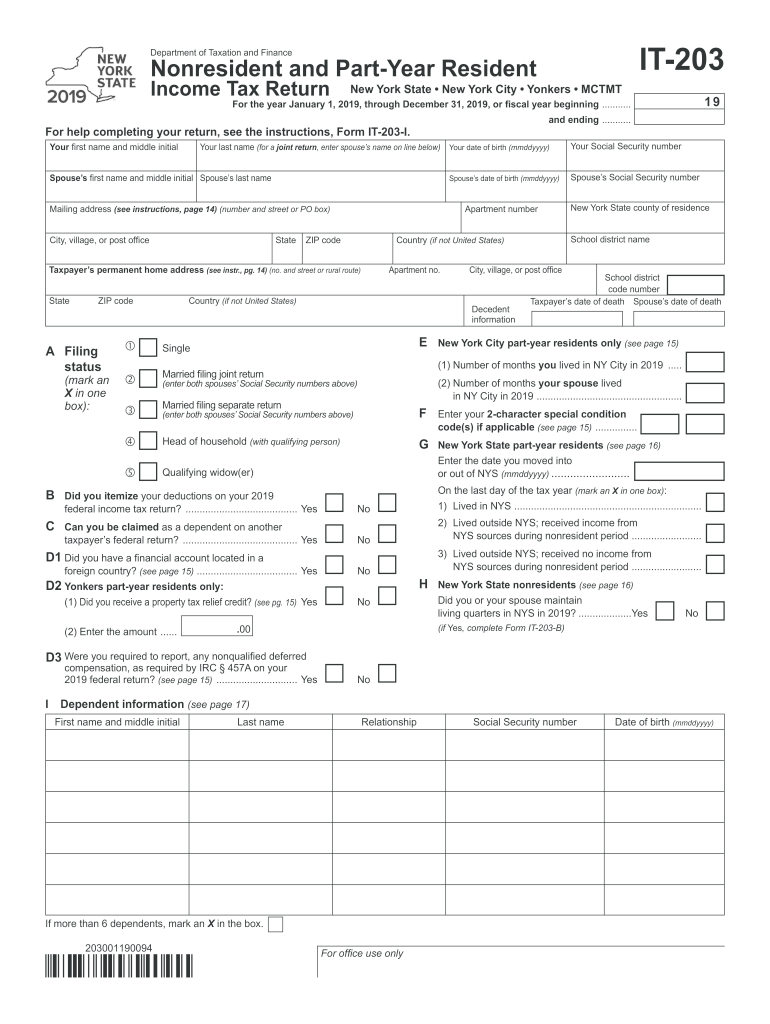

The NY Form IT-203, also known as the Nonresident and Part-Year Resident Income Tax Return, is a tax form used by individuals who do not reside in New York State for the entire year but have earned income from New York sources. This form allows nonresidents to report their income, calculate their tax liability, and claim any applicable credits or deductions. It is essential for ensuring compliance with New York tax laws while accurately reflecting the income earned within the state.

How to Use the NY Form IT-203

Using the NY Form IT-203 involves several steps. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other records of income earned in New York. Next, complete the form by providing personal information, income details, and any deductions or credits you wish to claim. Be sure to follow the instructions carefully to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on your preference and the filing requirements for the tax year.

Steps to Complete the NY Form IT-203

Completing the NY Form IT-203 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income from New York sources, ensuring to include all applicable amounts.

- Claim any deductions or credits available to you as a nonresident.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through approved e-filing services or mail it to the appropriate address.

Legal Use of the NY Form IT-203

The NY Form IT-203 is legally binding when completed accurately and submitted on time. It is crucial to ensure that all information provided is truthful and reflects your actual income and tax situation. Failure to comply with New York tax laws can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of the form is vital for all nonresidents earning income in New York.

Filing Deadlines / Important Dates

Filing deadlines for the NY Form IT-203 typically align with the federal tax filing schedule. For most taxpayers, the deadline is April fifteenth of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to avoid late filing penalties and ensure timely compliance with tax obligations.

Required Documents

To complete the NY Form IT-203, you will need several key documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income received during the tax year.

- Documentation for deductions or credits you plan to claim.

Having these documents ready will streamline the process and help ensure accuracy in your tax return.

Quick guide on how to complete form it 2032019nonresident and part year taxnygov

Effortlessly Prepare Ny Form It 203 on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage Ny Form It 203 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign Ny Form It 203 with Ease

- Obtain Ny Form It 203 and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for these tasks.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Edit and electronically sign Ny Form It 203 to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2032019nonresident and part year taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form it 2032019nonresident and part year taxnygov

How to make an eSignature for the Form It 2032019nonresident And Part Year Taxnygov in the online mode

How to make an eSignature for the Form It 2032019nonresident And Part Year Taxnygov in Google Chrome

How to generate an eSignature for signing the Form It 2032019nonresident And Part Year Taxnygov in Gmail

How to generate an eSignature for the Form It 2032019nonresident And Part Year Taxnygov from your smart phone

How to make an electronic signature for the Form It 2032019nonresident And Part Year Taxnygov on iOS

How to make an electronic signature for the Form It 2032019nonresident And Part Year Taxnygov on Android devices

People also ask

-

What is the NY IT 203 form 2018?

The NY IT 203 form 2018 is a tax form used by nonresidents to report income earned from New York sources. It is essential for individuals who wish to comply with New York State tax laws efficiently. Understanding the details of the NY IT 203 form 2018 can help ensure accurate reporting and compliance.

-

How can airSlate SignNow help with the NY IT 203 form 2018?

AirSlate SignNow allows users to easily eSign and send the NY IT 203 form 2018 securely and efficiently. It streamlines the signing process, saving time and ensuring that all documents are handled with the utmost security. This helps users focus more on their tax filing rather than paperwork hassles.

-

What are the pricing options for using airSlate SignNow features like eSigning the NY IT 203 form 2018?

AirSlate SignNow offers flexible pricing plans that can cater to businesses of all sizes. By using airSlate SignNow, you can access unlimited eSigning features at a cost-effective price. This ensures that regardless of your need to handle the NY IT 203 form 2018, you can do so without breaking your budget.

-

Are there any integrations available for managing the NY IT 203 form 2018?

Yes, airSlate SignNow integrates seamlessly with various platforms to simplify how you manage documents, including the NY IT 203 form 2018. You can connect with CRM systems, cloud storage services, and more to streamline the document workflow. These integrations enhance efficiency and ensure that your eSigning experience is smooth.

-

What features does airSlate SignNow offer for preparing the NY IT 203 form 2018?

AirSlate SignNow provides a variety of features that simplify the preparation of the NY IT 203 form 2018, such as customizable templates and collaborative editing. These tools allow multiple users to work on the document simultaneously, ensuring that all necessary information is included. This ultimately makes filing your taxes much simpler.

-

What are the benefits of using airSlate SignNow for the NY IT 203 form 2018?

Using airSlate SignNow for the NY IT 203 form 2018 offers several benefits, including improved efficiency and enhanced security for all your documents. The ability to eSign quickly means you can submit your tax forms faster. Additionally, airSlate SignNow provides a transparent audit trail for every document sent, ensuring peace of mind.

-

Is training available for using airSlate SignNow with the NY IT 203 form 2018?

Absolutely! AirSlate SignNow offers comprehensive training resources to help users become proficient in using its tools effectively, including for the NY IT 203 form 2018. This training ensures that you are equipped with the knowledge to leverage all features to ease your document management process.

Get more for Ny Form It 203

- Classified application washoe county school district form

- De 2501 rev 78 form

- Change of circumstances form student finance england

- Sbli change form

- Birmingham housing form

- Down payment verification affidavit manufactured housing form down payment verification affidavit manufactured housing form

- What is a dhs shelter verification form

- Barrett residential complex event reservation request form asu

Find out other Ny Form It 203

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later