it 203 2018

What is the IT-203?

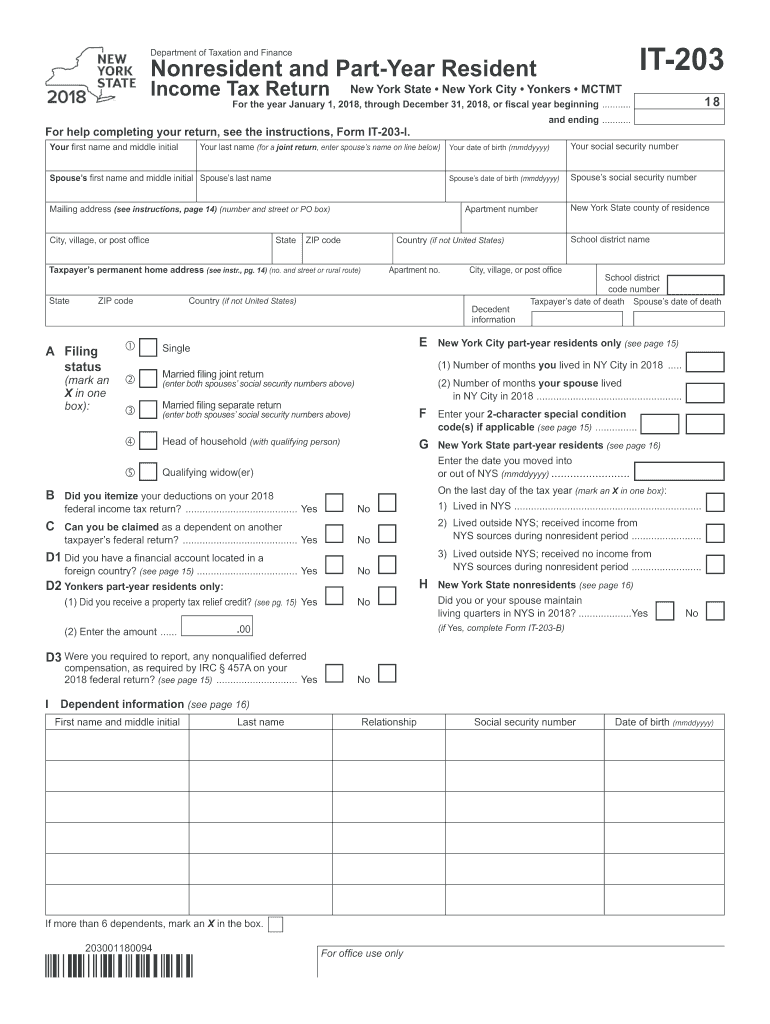

The IT-203 is a New York State tax form specifically designed for non-residents who earn income from New York sources. This form allows individuals to report their income and calculate their tax liability to the state. It is essential for non-residents to accurately complete this form to ensure compliance with state tax laws and to avoid potential penalties. The IT-203 form includes sections for reporting various types of income, deductions, and credits applicable to non-residents.

Steps to Complete the IT-203

Completing the IT-203 involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income earned from New York sources in the appropriate sections of the form.

- Calculate any deductions and credits that apply to your situation.

- Review the completed form for accuracy before submission.

Legal Use of the IT-203

The IT-203 must be used in accordance with New York State tax laws. It is legally binding once signed and submitted. Non-residents must ensure that the information provided is truthful and complete to avoid legal repercussions, including fines or audits. The form is designed to comply with the requirements set forth by the New York State Department of Taxation and Finance, and it is crucial to adhere to these regulations when filing.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the IT-203. Typically, the form must be submitted by April 15 of the year following the tax year in question. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Non-residents should also be aware of any extensions that may be available, which can provide additional time to file without incurring penalties.

Form Submission Methods

The IT-203 can be submitted through various methods, providing flexibility for non-residents. Options include:

- Online Submission: The form can be completed and filed electronically through the New York State Department of Taxation and Finance website.

- Mail: Non-residents can print the completed form and send it via postal mail to the appropriate address provided by the state.

- In-Person: While less common, it is possible to submit the form in person at designated tax offices.

Examples of Using the IT-203

Understanding how to use the IT-203 effectively can be illustrated through various scenarios. For instance:

- A non-resident who works remotely for a New York company must report their income on the IT-203.

- A seasonal worker who earns income in New York during the summer months should file the IT-203 to report that income.

- Individuals who receive rental income from properties located in New York must also utilize the IT-203 to report earnings.

Key Elements of the IT-203

The IT-203 includes several key elements that are crucial for accurate reporting:

- Personal Information: Basic details about the taxpayer, including name and address.

- Income Reporting: Sections to report various types of income from New York sources.

- Deductions and Credits: Areas to claim any applicable deductions or credits that may reduce tax liability.

- Signature: A signature is required to validate the form and confirm that the information provided is accurate.

Quick guide on how to complete new york form it 201 x amended resident income tax return

Your assistance manual on how to prepare your It 203

If you’re interested in learning how to finalize and submit your It 203, here are several quick tips to simplify tax declaration.

Firstly, you just need to sign up for your airSlate SignNow account to revolutionize your management of documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your tax papers effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, and revisit to amend responses as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to finish your It 203 in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through variants and schedules.

- Click Get form to launch your It 203 in our editor.

- Complete the necessary fillable fields with your data (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding electronic signature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in physical form can increase return errors and delay refunds. Certainly, before electronic filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 201 x amended resident income tax return

FAQs

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

According to instructions, if you earn less than $1,500, say $15 in interest, you don't have to fill out a Schedule B--if it's ordinary income, where do you put it on the new forms? (I know the government won't give up a penny in tax.)

If you have less than $1500 in interest income, and do not attach Schedule B, you should report your total taxable interest directly on Form 1040, Line 2b.

Create this form in 5 minutes!

How to create an eSignature for the new york form it 201 x amended resident income tax return

How to create an electronic signature for the New York Form It 201 X Amended Resident Income Tax Return in the online mode

How to create an electronic signature for the New York Form It 201 X Amended Resident Income Tax Return in Google Chrome

How to make an electronic signature for putting it on the New York Form It 201 X Amended Resident Income Tax Return in Gmail

How to make an eSignature for the New York Form It 201 X Amended Resident Income Tax Return right from your mobile device

How to make an electronic signature for the New York Form It 201 X Amended Resident Income Tax Return on iOS devices

How to generate an electronic signature for the New York Form It 201 X Amended Resident Income Tax Return on Android OS

People also ask

-

What pricing options are available for airSlate SignNow for 2018 203?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes looking to leverage the 2018 203 capabilities. These plans range from individual to enterprise levels, providing essential features tailored to your needs. Each option is designed to ensure you maximize value while effectively managing your document signing processes.

-

What are the key features of airSlate SignNow in 2018 203?

The key features of airSlate SignNow include document templates, real-time tracking, and advanced security measures, all integrated into the 2018 203 interface. Users can easily create, send, and eSign documents without hassle. These features ensure a smooth workflow and enhance business productivity.

-

How can airSlate SignNow benefit my business in 2018 203?

By using airSlate SignNow in 2018 203, your business can streamline the document signing process, saving time and resources. This platform empowers you to manage all eSignatures in one place, increasing operational efficiency. Furthermore, it helps improve customer satisfaction through seamless document transactions.

-

Is airSlate SignNow easy to integrate with other tools in 2018 203?

Yes, airSlate SignNow offers seamless integration capabilities with various applications and platforms relevant in 2018 203. Whether you are using CRMs, cloud storage solutions, or team collaboration tools, you can easily connect airSlate SignNow to enhance your document management system. This interoperability ensures a cohesive workflow across your business processes.

-

What security features does airSlate SignNow provide in 2018 203?

In 2018 203, airSlate SignNow prioritizes security with features like data encryption, multi-factor authentication, and compliance with major regulations. These measures protect your sensitive information during the signing process, ensuring that your documents remain confidential and secure. Trust is essential when handling important documents, and airSlate SignNow provides that assurance.

-

Can airSlate SignNow help reduce paper usage in 2018 203?

Absolutely! By utilizing airSlate SignNow in 2018 203, businesses can signNowly reduce paper usage through digital document signing. This not only aids environmental efforts but also decreases printing and storage costs associated with paper documents. Transitioning to a digital solution is an effective way to implement sustainability in your business operations.

-

What kind of customer support does airSlate SignNow offer for 2018 203 users?

airSlate SignNow provides comprehensive customer support for users in 2018 203, ensuring you have assistance when needed. Our support team is available via chat, email, or phone to help resolve any issues promptly. Additionally, we offer a rich knowledge base of tutorials and FAQs for self-help.

Get more for It 203

- New mexico rpd 41290 form

- Pli form pdf

- Madap semi annual verification form

- Friends neighbors privilege pricing application form

- Arizona snowbowl parentalguardian release of liability form

- Employee benefits division eligibility for a waiver of empire form

- Talent ampamp professional growth systems department form

- Michigan application for workers compensation insu form

Find out other It 203

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast